Ia 1065 Instructions 2007

Understanding the Iowa 1065 Instructions

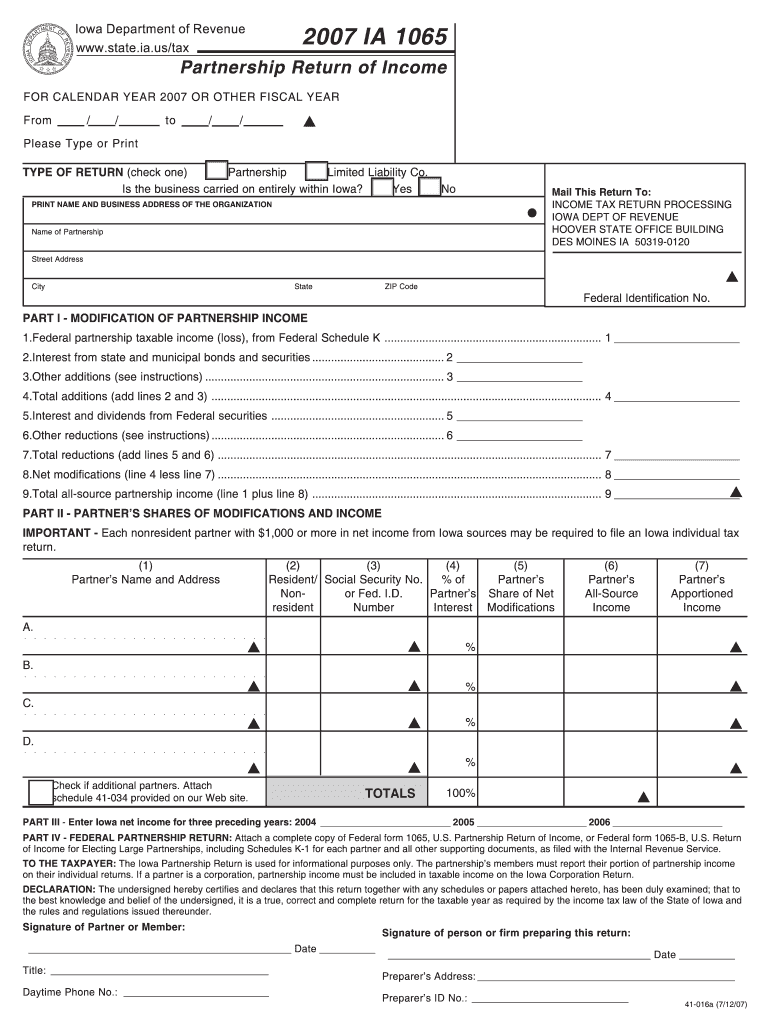

The Iowa 1065 form, also known as the Iowa Form 1065, is used for reporting income, deductions, and credits for partnerships operating in Iowa. This form is essential for partnerships to fulfill their tax obligations in the state. The instructions accompanying the Iowa 1065 provide detailed guidance on how to accurately complete the form, including information on required fields, specific calculations, and any additional documentation that may be necessary. Understanding these instructions is crucial for ensuring compliance and avoiding potential penalties.

Steps to Complete the Iowa 1065 Instructions

Completing the Iowa 1065 involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Review the Iowa 1065 instructions to understand the required information and calculations.

- Fill out the form accurately, ensuring all income and deductions are reported correctly.

- Double-check the form for any errors or omissions before submission.

- Submit the completed Iowa 1065 form by the designated deadline, either electronically or via mail.

Legal Use of the Iowa 1065 Instructions

The Iowa 1065 instructions are legally binding and must be adhered to when filing the form. Compliance with these instructions ensures that the partnership meets its legal obligations under Iowa tax law. Failure to follow the instructions may result in penalties, including fines or additional taxes owed. It is important for partnerships to maintain accurate records and to consult with a tax professional if there are uncertainties regarding the completion of the form.

Filing Deadlines for the Iowa 1065

Partnerships must be aware of the filing deadlines for the Iowa 1065 form to avoid late fees and penalties. Generally, the form is due on the 15th day of the fourth month following the end of the partnership's tax year. For partnerships operating on a calendar year basis, this means the form is typically due by April 15. Extensions may be available, but it is crucial to file for an extension before the original deadline to ensure compliance.

Required Documents for the Iowa 1065

When completing the Iowa 1065 form, several documents are required to support the information reported. These may include:

- Income statements for the partnership

- Expense records, including receipts and invoices

- Schedules detailing each partner's share of income and deductions

- Any relevant tax documents from previous years

Having these documents organized and readily available will facilitate a smoother filing process.

Form Submission Methods for the Iowa 1065

The Iowa 1065 form can be submitted through various methods, providing flexibility for partnerships. Options include:

- Electronic filing through the Iowa Department of Revenue's online portal

- Mailing a paper copy of the completed form to the appropriate state office

- In-person submission at designated state tax offices

Choosing the right submission method can help ensure timely processing and compliance with state regulations.

Examples of Using the Iowa 1065 Instructions

Utilizing the Iowa 1065 instructions effectively can lead to accurate reporting and compliance. For instance, a partnership with multiple income streams must ensure that all sources are reported correctly. By following the instructions, the partnership can allocate income and deductions accurately among partners, thereby minimizing the risk of errors. Additionally, understanding the instructions can help in identifying eligible deductions that may reduce the overall tax liability.

Quick guide on how to complete ia 1065 instructions

Complete Ia 1065 Instructions effortlessly on any device

Web-based document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage Ia 1065 Instructions on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign Ia 1065 Instructions effortlessly

- Locate Ia 1065 Instructions and click on Get Form to begin.

- Utilize the tools we offer to finish your document.

- Highlight important sections of your documents or obscure sensitive content with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Edit and eSign Ia 1065 Instructions and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ia 1065 instructions

Create this form in 5 minutes!

How to create an eSignature for the ia 1065 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Iowa 1065 form?

The Iowa 1065 form is a tax return used for partnerships operating in Iowa. This form reports income, deductions, and credits that partners can claim on their individual returns. Understanding the intricacies of the Iowa 1065 is essential for partnerships to ensure compliance with state tax laws.

-

How does airSlate SignNow simplify the filing of the Iowa 1065?

airSlate SignNow streamlines the process of completing and submitting the Iowa 1065 by allowing users to easily fill out, sign, and send documents electronically. This not only saves time but also reduces errors commonly associated with manual filing. With SignNow, completing your Iowa 1065 becomes a hassle-free online experience.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, starting from a competitive monthly rate. Each plan includes access to all essential features, including eSignature capabilities for forms like the Iowa 1065. By choosing SignNow, businesses can invest in a cost-effective solution that simplifies document management.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features designed to enhance document management, including customizable templates, secure eSignatures, and automated workflows. These capabilities allow you to manage your Iowa 1065 and other important documents efficiently. With these tools, businesses can optimize their processes and improve accuracy.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers integrations with several popular software applications, facilitating seamless document management. Whether you're using accounting software or project management tools, integrating SignNow with your existing systems can enhance workflow efficiency, especially for managing forms like the Iowa 1065.

-

What are the benefits of using airSlate SignNow for the Iowa 1065?

Using airSlate SignNow for the Iowa 1065 offers numerous benefits including reduced processing time, improved accuracy, and enhanced security for sensitive information. The ability to eSign documents remotely makes it convenient for partners to collaborate on their tax returns. This leads to a smoother filing experience and better compliance.

-

How secure is airSlate SignNow for sensitive documents like the Iowa 1065?

airSlate SignNow prioritizes the security of your documents with advanced encryption and authentication protocols. When handling forms like the Iowa 1065, your data is protected against unauthorized access. Robust security features ensure that you can eSign and manage sensitive documents with confidence.

Get more for Ia 1065 Instructions

- Continuity form for brazer nitc

- Claimants statement of wages form

- Complete and send this form together with the applicable fee

- Form i 589 application for asylum and for withholding of removal instruction for application for asylumand for withholding of

- Epa form 5700 52a approval expires 043021 mbewbe utilization under fedeal grants and cooperative agreements

- Form trs6 application for refund form trs6 application for refund

- Land and water conservation fundfpr department of forests form

- Application for annual clothing allowance va form

Find out other Ia 1065 Instructions

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple