Form 706 Rev April Internal Revenue Service

What is the Form 706 Rev April Internal Revenue Service

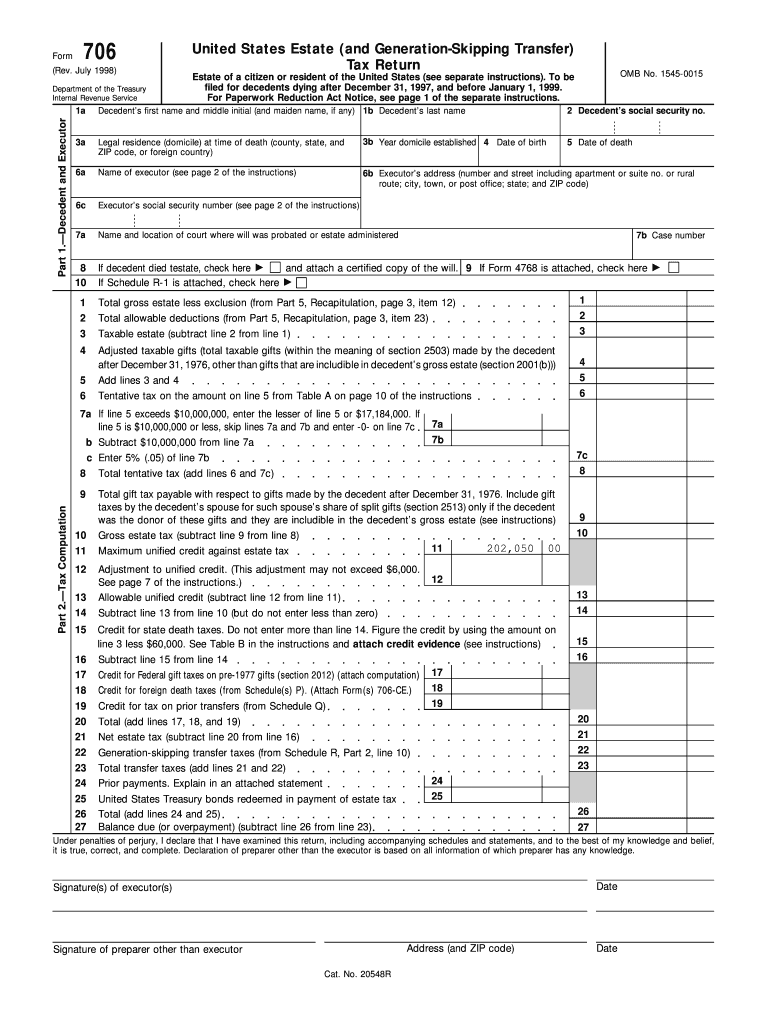

The Form 706 Rev April is a United States federal tax form used to report the estate tax. This form is required by the Internal Revenue Service (IRS) for estates that exceed a certain value threshold, which is adjusted periodically. The form captures essential information about the deceased's assets, liabilities, and the overall value of the estate. It is crucial for ensuring compliance with federal tax laws and for calculating any estate taxes owed.

How to use the Form 706 Rev April Internal Revenue Service

To effectively use the Form 706 Rev April, individuals must first determine if the estate's gross value exceeds the filing threshold set by the IRS. If it does, the executor or administrator of the estate should gather all necessary documentation, including asset valuations, debts, and any prior gift taxes paid. The form must be filled out accurately, reflecting all relevant information, and submitted to the IRS by the designated deadline. Proper completion ensures that the estate tax calculation is correct and minimizes the risk of penalties.

Steps to complete the Form 706 Rev April Internal Revenue Service

Completing the Form 706 Rev April involves several key steps:

- Gather all necessary financial documents related to the estate, including bank statements, property appraisals, and outstanding debts.

- Calculate the gross estate value, which includes all assets owned by the deceased at the time of death.

- Complete each section of the form, providing detailed information about assets, liabilities, and deductions.

- Review the form for accuracy and completeness before submission.

- File the form with the IRS by the due date, along with any required payments for estate taxes.

Filing Deadlines / Important Dates

The filing deadline for Form 706 Rev April is typically nine months after the date of the decedent's death. However, an extension may be requested, allowing for an additional six months to file the form. It is essential to adhere to these deadlines to avoid penalties and interest on any unpaid estate taxes. Executors should mark these dates on their calendars and ensure all necessary documentation is prepared in advance.

Required Documents

When filing the Form 706 Rev April, several documents are essential to support the information provided on the form. These documents include:

- Death certificate of the decedent.

- Appraisals of real estate and other significant assets.

- Records of debts and liabilities owed by the decedent.

- Previous gift tax returns if applicable.

- Financial statements from banks and investment accounts.

Penalties for Non-Compliance

Failure to file Form 706 Rev April on time or providing inaccurate information can result in significant penalties. The IRS may impose fines based on the amount of tax owed, and interest may accrue on any unpaid taxes. Additionally, non-compliance can lead to audits or further scrutiny of the estate's financial affairs. It is crucial for executors to ensure timely and accurate filing to avoid these repercussions.

Quick guide on how to complete form 706 rev april internal revenue service

Prepare [SKS] effortlessly on any device

Online document management has gained traction among organizations and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents swiftly without any delays. Manage [SKS] on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to modify and electronically sign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Select important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] to ensure smooth communication during any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 706 Rev April Internal Revenue Service

Create this form in 5 minutes!

How to create an eSignature for the form 706 rev april internal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 706 Rev April Internal Revenue Service?

Form 706 Rev April Internal Revenue Service is a tax form used to report the estate tax liability of a decedent's estate. It is important for executors to understand how to properly complete this form, as it can impact the overall tax obligations of the estate.

-

How can airSlate SignNow assist with completing Form 706 Rev April Internal Revenue Service?

airSlate SignNow offers a streamlined eSigning solution that allows users to easily fill out and sign the Form 706 Rev April Internal Revenue Service digitally. Our platform provides templates and guidance to ensure that all required information is included for compliance.

-

What are the pricing options for airSlate SignNow when utilizing Form 706 Rev April Internal Revenue Service?

We offer competitive pricing plans for airSlate SignNow that cater to businesses of all sizes. Each plan provides access to features that support the eSigning process, including customization options for important documents like Form 706 Rev April Internal Revenue Service.

-

What features does airSlate SignNow provide for managing Form 706 Rev April Internal Revenue Service documents?

Our platform includes features such as document templates, automated workflows, and secure cloud storage, ensuring that your Form 706 Rev April Internal Revenue Service is managed efficiently. Additionally, you can track document status and receive real-time notifications.

-

Can I integrate airSlate SignNow with other software to handle Form 706 Rev April Internal Revenue Service?

Yes, airSlate SignNow supports integration with various business applications, allowing for seamless management of Form 706 Rev April Internal Revenue Service and other documents. This integration enhances productivity by connecting your eSigning process with your existing workflows.

-

What are the benefits of using airSlate SignNow for Form 706 Rev April Internal Revenue Service?

Using airSlate SignNow to handle Form 706 Rev April Internal Revenue Service provides substantial benefits, including reduced paperwork, faster turnaround times, and enhanced security for sensitive information. Our platform also improves collaboration among all parties involved in the signing process.

-

Is airSlate SignNow compliant with IRS regulations for Form 706 Rev April Internal Revenue Service?

Yes, airSlate SignNow is designed to comply with IRS regulations for Form 706 Rev April Internal Revenue Service. Our eSigning process meets legal standards, ensuring that your electronically signed documents are valid and enforceable.

Get more for Form 706 Rev April Internal Revenue Service

- Dental clinic medical consultation request nnoha form

- Agreement to maintain records outside of canada form

- Hdfc redemption form

- Scholastic news edition 5 6 answer key form

- Form 029 registration application civil aviation safety authority casa gov

- Gmu ferpa form

- Elimu ya watu wazima pdf form

- Njdoc disabled visitor procedure form

Find out other Form 706 Rev April Internal Revenue Service

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe