Request for Municipal Income Tax Account PART a CONTACT 2017

What is the Request For Municipal Income Tax Account PART A CONTACT

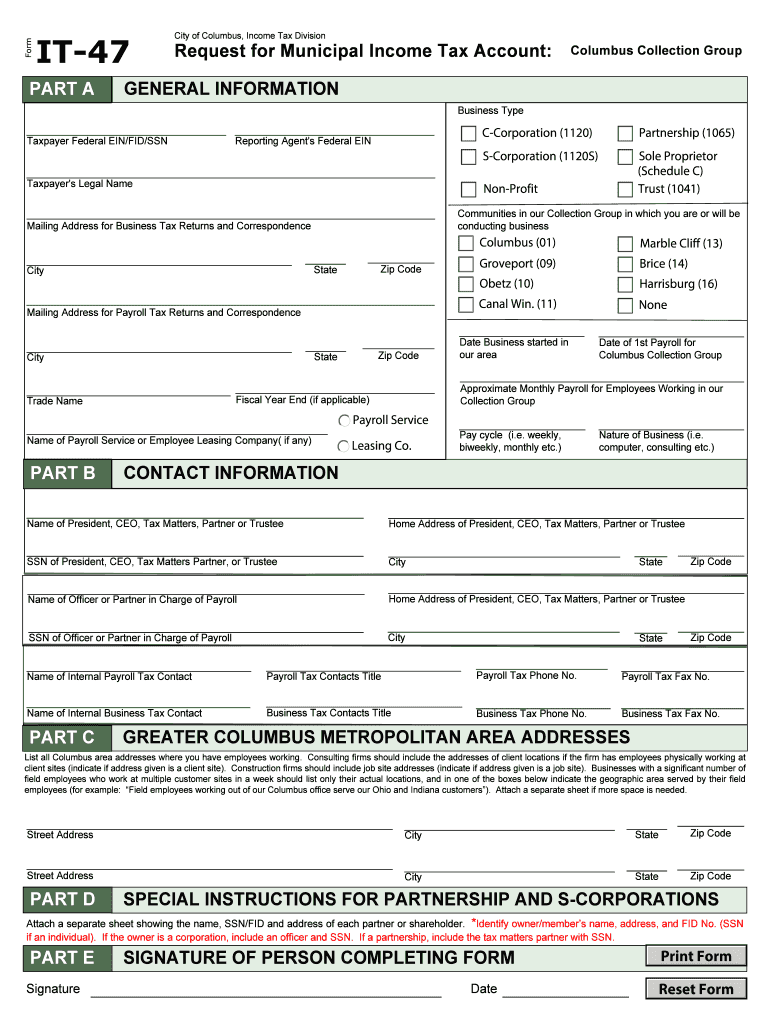

The Request For Municipal Income Tax Account PART A CONTACT is a specific form used to gather essential information for municipal income tax purposes. This form is designed to help individuals and businesses establish or update their municipal income tax accounts. It typically includes sections for personal identification, contact information, and other relevant details required by local tax authorities. Understanding this form is crucial for ensuring compliance with municipal tax regulations.

Steps to complete the Request For Municipal Income Tax Account PART A CONTACT

Completing the Request For Municipal Income Tax Account PART A CONTACT involves several key steps:

- Gather necessary information: Collect all required personal and business information, including your name, address, Social Security number, and any relevant business identification numbers.

- Fill out the form: Carefully complete each section of the form, ensuring that all information is accurate and up to date.

- Review for accuracy: Double-check all entries for correctness to avoid any potential issues with your municipal tax account.

- Sign and date: Ensure you provide your signature and the date on the form, as this is necessary for validation.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person, based on the options provided by your local tax authority.

Legal use of the Request For Municipal Income Tax Account PART A CONTACT

The Request For Municipal Income Tax Account PART A CONTACT is legally recognized as a valid document for establishing or updating municipal income tax accounts. To ensure its legal standing, the form must be completed accurately and submitted according to the guidelines set forth by local tax authorities. Utilizing this form correctly helps taxpayers comply with municipal tax laws and avoid potential penalties.

Required Documents

When completing the Request For Municipal Income Tax Account PART A CONTACT, certain documents may be required to support your application. These documents can include:

- Proof of identity, such as a driver's license or passport.

- Social Security card or Employer Identification Number (EIN) if applicable.

- Any previous tax documents related to municipal income tax.

- Business registration documents if you are applying on behalf of a business.

Form Submission Methods

The Request For Municipal Income Tax Account PART A CONTACT can typically be submitted through various methods, depending on the local tax authority's guidelines. Common submission methods include:

- Online submission: Many municipalities allow for electronic submission through their official websites.

- Mail: You can print the completed form and send it via postal service to the designated tax office.

- In-person: Some individuals may prefer to deliver the form directly to their local tax office.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Request For Municipal Income Tax Account PART A CONTACT. These deadlines can vary by municipality but typically align with the overall tax filing season. Missing these deadlines may result in penalties or delays in account processing. Always check with your local tax authority for the most accurate and up-to-date information regarding important dates.

Quick guide on how to complete request for municipal income tax account part a contact

Your assistance manual on how to set up your Request For Municipal Income Tax Account PART A CONTACT

If you're curious about how to generate and submit your Request For Municipal Income Tax Account PART A CONTACT, here are some brief guidelines on how to simplify tax filing.

To begin, you only need to register your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a very user-friendly and robust document solution that allows you to modify, draft, and finalize your income tax documents effortlessly. With its editor, you can toggle between text, check boxes, and electronic signatures, and return to revise answers as required. Optimize your tax administration with enhanced PDF editing, eSigning, and easy sharing.

Follow the steps below to complete your Request For Municipal Income Tax Account PART A CONTACT in just a few minutes:

- Establish your account and begin working on PDFs in moments.

- Utilize our directory to obtain any IRS tax form; browse through variations and schedules.

- Click Get form to launch your Request For Municipal Income Tax Account PART A CONTACT in our editor.

- Populate the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-recognized eSignature (if required).

- Examine your document and correct any errors.

- Preserve changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper may increase return mistakes and delay refunds. It’s important to check the IRS website for filing regulations in your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct request for municipal income tax account part a contact

FAQs

-

Do I have to fill out a 1099 tax form for my savings account interest?

No, the bank files a 1099 — not you. You’ll get a copy of the 1099-INT that they filed.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

Which form is to be filled out to avoid an income tax deduction from a bank?

Banks have to deduct TDS when interest income is more than Rs.10,000 in a year. The bank includes deposits held in all its branches to calculate this limit. But if your total income is below the taxable limit, you can submit Forms 15G and 15H to the bank requesting them not to deduct any TDS on your interest.Please remember that Form 15H is for senior citizens, those who are 60 years or older; while Form 15G is for everybody else.Form 15G and Form 15H are valid for one financial year. So you have to submit these forms every year if you are eligible. Submitting them as soon as the financial year starts will ensure the bank does not deduct any TDS on your interest income.Conditions you must fulfill to submit Form 15G:Youare an individual or HUFYou must be a Resident IndianYou should be less than 60 years oldTax calculated on your Total Income is nilThe total interest income for the year is less than the minimum exemption limit of that year, which is Rs 2,50,000 for financial year 2016-17Thanks for being here

-

How do I respond to a request for a restraining order? Do I need to fill out a form?

As asked of me specifically;The others are right, you will likely need a lawyer. But to answer your question, there is a response form to respond to a restraining order or order of protection. Worst case the form is available at the courthouse where your hearing is set to be heard in, typically at the appropriate clerk's window, which may vary, so ask any of the clerk's when you get there.You only have so many days to respond, and it will specify in the paperwork.You will also have to appear in court on the date your hearing is scheduled.Most courts have a department that will help you respond to forms at no cost. I figure you are asking because you can't afford an attorney which is completely understandable.The problem is that if you aren't represented and the other person is successful in getting a temporary restraining order made permanent in the hearing you will not be allowed at any of the places the petitioner goes, without risking arrest.I hope this helps.Not given as legal advice-

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

How do I request for Income Tax refund if it's failed due to closure of account?

Login to Income Tax efiling website.Go to ‘My Account’. In the drop down click on ‘Service Request’ In the ‘Request Type’ click on ‘New Request’, And select ‘Request Category’ as ‘Refund Reissue’Fill in the ‘Bank Account Number’, ‘Account Type’. ‘IFSC Code’ and ‘Bank Name’ and click on ‘Submit’

Create this form in 5 minutes!

How to create an eSignature for the request for municipal income tax account part a contact

How to make an electronic signature for the Request For Municipal Income Tax Account Part A Contact online

How to generate an electronic signature for the Request For Municipal Income Tax Account Part A Contact in Google Chrome

How to create an electronic signature for signing the Request For Municipal Income Tax Account Part A Contact in Gmail

How to make an eSignature for the Request For Municipal Income Tax Account Part A Contact straight from your mobile device

How to create an electronic signature for the Request For Municipal Income Tax Account Part A Contact on iOS devices

How to generate an electronic signature for the Request For Municipal Income Tax Account Part A Contact on Android OS

People also ask

-

What is the process for completing a Request For Municipal Income Tax Account PART A CONTACT?

To complete the Request For Municipal Income Tax Account PART A CONTACT, simply access our user-friendly platform, where you can fill in the required fields. After filling out the necessary information, you can electronically sign the document and submit it easily. Our easy-to-use solution streamlines the process for businesses handling municipal tax accounts.

-

How much does it cost to use airSlate SignNow for the Request For Municipal Income Tax Account PART A CONTACT?

airSlate SignNow offers competitive pricing plans to suit businesses of all sizes. The cost of using our platform for the Request For Municipal Income Tax Account PART A CONTACT starts at a low monthly fee, providing signNow savings compared to traditional methods. Our packages are designed to deliver maximum value while maintaining affordability.

-

What features does airSlate SignNow offer for managing the Request For Municipal Income Tax Account PART A CONTACT?

Our platform includes features such as document templates, real-time tracking, and robust eSignature capabilities specifically for the Request For Municipal Income Tax Account PART A CONTACT. Additionally, users can automate workflows to ensure timely responses and submissions, enhancing organization and efficiency. These features simplify the entire process and reduce the potential for errors.

-

Can I integrate airSlate SignNow with other tools while processing my Request For Municipal Income Tax Account PART A CONTACT?

Yes, airSlate SignNow offers seamless integrations with various tools, such as CRM systems and cloud storage services, to streamline your workflow. This means you can connect the Request For Municipal Income Tax Account PART A CONTACT process with your existing software ecosystem, enhancing overall productivity. Our integration capabilities ensure that your documents and workflows are interconnected.

-

What benefits does airSlate SignNow provide for businesses handling the Request For Municipal Income Tax Account PART A CONTACT?

By using airSlate SignNow for the Request For Municipal Income Tax Account PART A CONTACT, businesses can achieve signNow time savings and reduced operational costs. Our platform allows for quick document handling, eSigning, and tracking, all in one location. This efficiency can lead to improved compliance and accuracy in your municipal tax dealings.

-

Is airSlate SignNow secure for handling my Request For Municipal Income Tax Account PART A CONTACT information?

Absolutely, airSlate SignNow prioritizes security and compliance, ensuring that your Request For Municipal Income Tax Account PART A CONTACT information is protected. We utilize advanced encryption methods and comply with leading security standards to safeguard your data. You can trust that your sensitive information remains confidential and secure.

-

How does airSlate SignNow simplify the workflow for the Request For Municipal Income Tax Account PART A CONTACT?

airSlate SignNow simplifies the workflow for the Request For Municipal Income Tax Account PART A CONTACT by automating key steps, enabling quick document access and signature collection. The platform allows users to create templates for repetitive tasks and reduces manual data entry. This means faster processing times and fewer bottlenecks in obtaining necessary approvals.

Get more for Request For Municipal Income Tax Account PART A CONTACT

- The long term care treatment authorization request tar form 20 1 on a following page is used to request prior authorization

- Wayne state financial affidavit of support form

- Ameritas dental claim address form

- Lhs grad lawn signs order form

- Permanent change of station pcs orders form

- Revocable license agreement template form

- Graphic design project contract template form

- Graphic design service contract template form

Find out other Request For Municipal Income Tax Account PART A CONTACT

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free