This Form Can Be Filed on Our Website Www 2020-2026

Understanding the IT47 Form

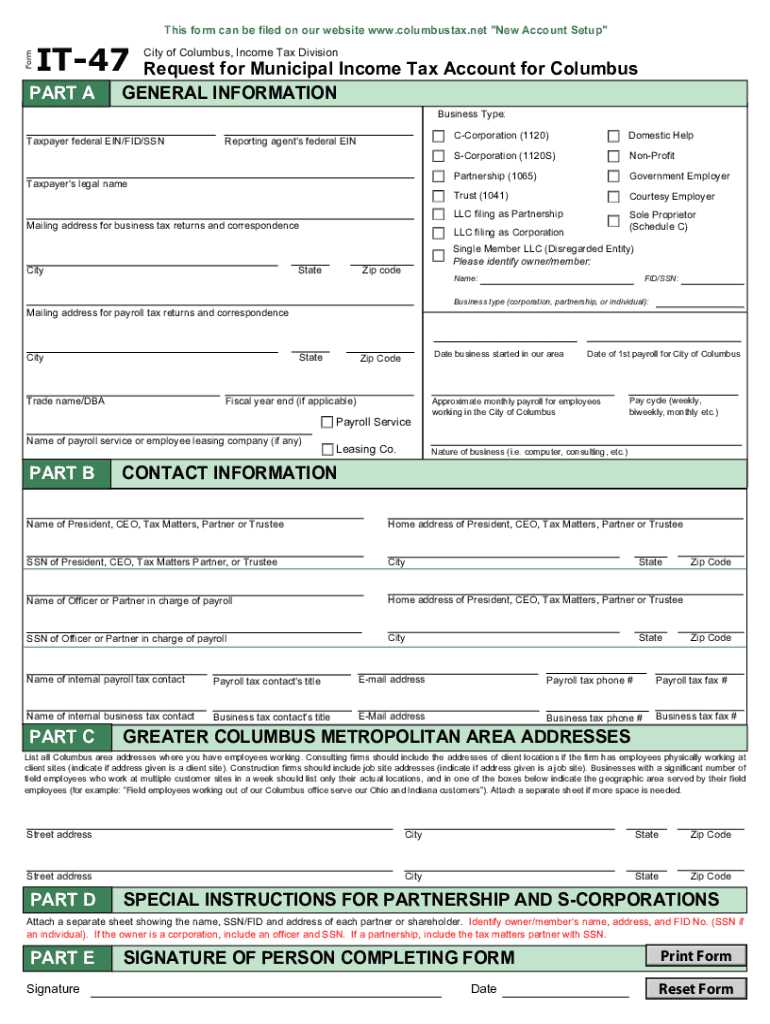

The IT47 form, also known as the Columbus city tax form, is essential for individuals and businesses who need to report municipal income tax in Columbus, Ohio. This form is specifically designed for residents and non-residents who earn income within the city. It captures various income types and helps determine the appropriate tax liability. Understanding its purpose and requirements is crucial for compliance with local tax regulations.

Steps to Complete the IT47 Form

Completing the IT47 form involves several key steps to ensure accuracy and compliance:

- Gather necessary documents, including W-2s and 1099s, that report your income.

- Access the IT47 form through the official website, ensuring you have the latest version.

- Fill out personal information, including your name, address, and Social Security number.

- Report all applicable income sources, ensuring to include any income earned in Columbus.

- Calculate your municipal tax liability based on the provided tax rates.

- Review the completed form for accuracy before submission.

Legal Use of the IT47 Form

The IT47 form is legally binding when filled out correctly and submitted in accordance with local tax laws. It must be signed and dated by the taxpayer to validate the information provided. The form's compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act ensures that electronic submissions are recognized legally, provided that the necessary security measures are in place.

Filing Deadlines for the IT47 Form

It is important to be aware of the filing deadlines associated with the IT47 form to avoid penalties. Typically, the form must be filed by April fifteenth of the following year for income earned during the previous calendar year. Extensions may be available, but it is crucial to check with local tax authorities for specific guidelines and any potential late fees.

Form Submission Methods

The IT47 form can be submitted through various methods to accommodate different preferences:

- Online Submission: The form can be filled out and submitted electronically via the official website, providing a quick and efficient option.

- Mail: Completed forms can be printed and mailed to the appropriate tax authority address.

- In-Person: Taxpayers may also choose to deliver the form in person at designated tax offices in Columbus.

Required Documents for the IT47 Form

To complete the IT47 form accurately, several documents are typically required:

- W-2 forms from employers, detailing annual earnings.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as rental income or investments.

- Proof of residency or non-residency status, if applicable.

Quick guide on how to complete this form can be filed on our website www

Effortlessly Prepare This Form Can Be Filed On Our Website Www on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow provides all the necessary tools to create, adjust, and eSign your documents swiftly without any delays. Manage This Form Can Be Filed On Our Website Www on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Way to Edit and eSign This Form Can Be Filed On Our Website Www Without Hassle

- Retrieve This Form Can Be Filed On Our Website Www and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign This Form Can Be Filed On Our Website Www and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct this form can be filed on our website www

Create this form in 5 minutes!

How to create an eSignature for the this form can be filed on our website www

How to make an electronic signature for a PDF document in the online mode

How to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to make an electronic signature straight from your mobile device

The best way to generate an eSignature for a PDF document on iOS devices

How to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the it47 pricing structure for airSlate SignNow?

The it47 pricing for airSlate SignNow is designed to be cost-effective, offering various plans to fit different business needs. You can choose from monthly or annual subscriptions, with discounts available for long-term commitments. Each plan includes essential features to help you streamline document management efficiently.

-

What features does airSlate SignNow offer under the it47 plan?

The it47 plan includes a comprehensive suite of features such as customizable templates, advanced eSigning capabilities, and mobile access. Additionally, users can track document statuses in real-time and automate repetitive tasks, enhancing productivity and collaboration. These features are crucial for modern businesses looking to optimize their document workflows.

-

How can airSlate SignNow help businesses improve efficiency?

By using airSlate SignNow under the it47 plan, businesses can signNowly enhance operational efficiency. The platform allows for quick document preparation and eSigning, reducing turnaround times. With automated reminders and easy tracking, your team can focus more on core activities rather than paperwork.

-

What are the integration options available with it47?

airSlate SignNow offers seamless integrations with various applications under the it47 plan, including popular CRM and cloud storage platforms. Integrating your existing tools helps create a more cohesive workflow, allowing for data to flow seamlessly between systems. This level of integration is essential for companies looking to maximize their productivity.

-

Is airSlate SignNow compliant with industry standards under the it47 plan?

Yes, airSlate SignNow is compliant with major industry standards such as GDPR and HIPAA under the it47 plan. This commitment to compliance ensures that your sensitive documents are handled securely and with integrity. You can confidently use airSlate SignNow knowing that your business meets the required regulatory standards.

-

Can airSlate SignNow handle bulk document sending?

Absolutely! The it47 plan allows users to send bulk documents easily, making it perfect for businesses that need to manage large volumes of paperwork. You can customize each signing process for recipients, ensuring an efficient and personalized experience for all parties involved. This feature is especially beneficial during large campaigns or events.

-

What customer support options are available for it47 users?

Users of the it47 plan benefit from a variety of customer support options, including live chat, email support, and a comprehensive knowledge base. Whether you need immediate assistance or prefer to troubleshoot on your own, we provide resources to help you maximize your airSlate SignNow experience. Our dedicated support team is also available for tailored assistance.

Get more for This Form Can Be Filed On Our Website Www

Find out other This Form Can Be Filed On Our Website Www

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure