Ok Gov Tax Bt 115 C W 2012-2026

What is the Ok Gov Tax Bt 115 C W

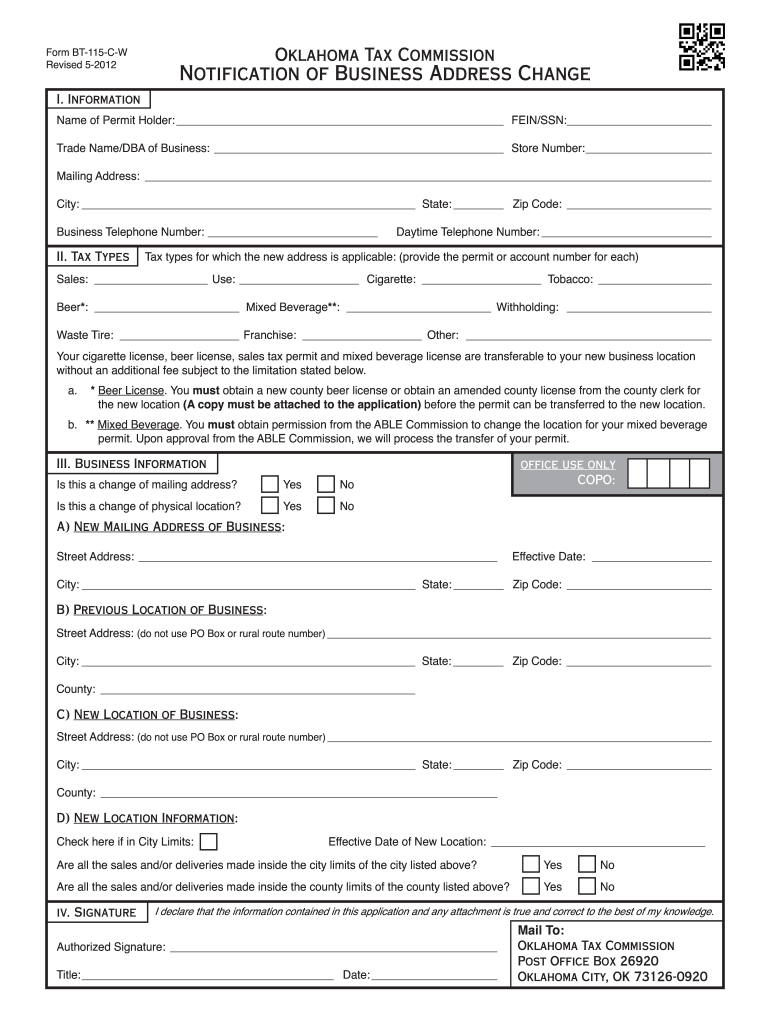

The Ok Gov Tax Bt 115 C W is a specific form used in Oklahoma for notifying the state of a change in business address. This form is essential for maintaining accurate records with the Oklahoma Tax Commission, ensuring that all correspondence and tax-related documents are sent to the correct location. Businesses must complete this form to comply with state regulations and avoid potential penalties related to miscommunication or misfiling.

How to use the Ok Gov Tax Bt 115 C W

Using the Ok Gov Tax Bt 115 C W involves several straightforward steps. First, download the form from the Oklahoma Tax Commission's website or access it through a digital platform that supports e-signatures. Next, fill in the required fields, including your business name, old address, new address, and any other pertinent information. After completing the form, review it for accuracy before submitting it online or via mail. Utilizing an e-signature solution like signNow can streamline this process, allowing for secure and efficient submission.

Steps to complete the Ok Gov Tax Bt 115 C W

Completing the Ok Gov Tax Bt 115 C W requires careful attention to detail. Follow these steps:

- Obtain the form from the Oklahoma Tax Commission's website.

- Fill in your business name and old address accurately.

- Provide the new address where you want correspondence directed.

- Include any additional information requested on the form.

- Review the completed form for any errors or omissions.

- Submit the form electronically or by mail, ensuring that you retain a copy for your records.

Legal use of the Ok Gov Tax Bt 115 C W

The legal use of the Ok Gov Tax Bt 115 C W is crucial for businesses operating in Oklahoma. This form serves as the official notification to the state regarding changes in business address. Filing this form ensures compliance with state laws and regulations, helping to avoid potential legal issues or penalties. It is important to submit the form promptly to prevent any disruption in communication with state agencies.

Required Documents

When completing the Ok Gov Tax Bt 115 C W, certain documents may be required for reference or verification. Typically, you will need:

- Your business's current tax identification number.

- Proof of your previous business address, such as a utility bill or lease agreement.

- Any relevant business licenses or permits that may be affected by the address change.

Form Submission Methods (Online / Mail / In-Person)

The Ok Gov Tax Bt 115 C W can be submitted through various methods, providing flexibility for businesses. You can choose to submit the form online via the Oklahoma Tax Commission's website, ensuring a quick and efficient process. Alternatively, you may print the form and mail it to the appropriate address. Some businesses may prefer to deliver the form in person, which can be useful for immediate confirmation of receipt. Regardless of the method chosen, ensure that you keep a copy of the submitted form for your records.

Quick guide on how to complete bt 115 c w 2012 2019 form

Your assistance manual on how to prepare your Ok Gov Tax Bt 115 C W

If you are curious about how to complete and submit your Ok Gov Tax Bt 115 C W, here are a few brief guidelines to simplify tax submission.

First, you just need to create your airSlate SignNow account to transform your document management online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, generate, and finalize your income tax documents with ease. With its editor, you can alternate between text, check boxes, and eSignatures and revisit to adjust responses when necessary. Streamline your tax oversight with enhanced PDF editing, eSigning, and intuitive sharing.

Follow the instructions below to complete your Ok Gov Tax Bt 115 C W in minutes:

- Create your account and start handling PDFs within moments.

- Utilize our directory to find any IRS tax form; explore various versions and schedules.

- Click Get form to access your Ok Gov Tax Bt 115 C W in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to include your legally-binding eSignature (if needed).

- Review your file and rectify any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Be aware that submitting on paper can lead to return errors and delay refunds. Additionally, before e-filing your taxes, verify the IRS website for declaration regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct bt 115 c w 2012 2019 form

FAQs

-

How many forms are filled out in the JEE Main 2019 to date?

You should wait till last date to get these type of statistics .NTA will release how much application is received by them.

-

When do I have to learn how to fill out a W-2 form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

I received my late husband's W-9 form to fill out for what I believe were our stocks. How am I supposed to fill this out or am I even supposed to?

You do not sound as a person who handles intricasies of finances on daily basis, this is why you should redirect the qustion to your family’s tax professional who does hte filings for you.The form itself, W-9 form, is a form created and approved by the IRS, if that’s your only inquiry.Whether the form applies to you or to your husband’s estate - that’s something only a person familiar with the situation would tell you about; there is no generic answer to this.

-

How a Non-US residence company owner (has EIN) should fill the W-7 ITIN form out? Which option is needed to be chosen in the first part?

Depends on the nature of your business and how it is structured.If you own an LLC taxed as a passthrough entity, then you probably will check option b and submit the W7 along with your US non-resident tax return. If your LLC’s income is not subject to US tax, then you will check option a.If the business is a C Corp, then you probably don’t need an ITIN, unless you are receiving taxable compensation from the corporation and then we are back to option b.

Create this form in 5 minutes!

How to create an eSignature for the bt 115 c w 2012 2019 form

How to make an eSignature for the Bt 115 C W 2012 2019 Form in the online mode

How to create an electronic signature for the Bt 115 C W 2012 2019 Form in Google Chrome

How to create an electronic signature for putting it on the Bt 115 C W 2012 2019 Form in Gmail

How to create an electronic signature for the Bt 115 C W 2012 2019 Form straight from your smart phone

How to create an eSignature for the Bt 115 C W 2012 2019 Form on iOS

How to create an eSignature for the Bt 115 C W 2012 2019 Form on Android

People also ask

-

What is an OK business address?

An OK business address is a legitimate location that can be used for business operations, such as registration, correspondence, and maintaining credibility. It helps businesses establish a professional presence without the need for a physical office, making it a popular choice for remote workers and startups.

-

How can airSlate SignNow utilize my OK business address?

With airSlate SignNow, you can easily incorporate your OK business address into documents that require official addresses. This allows you to maintain a professional image while using electronic signatures on contracts and agreements that reference your business location.

-

Is there a pricing plan for airSlate SignNow with an OK business address feature?

Yes, airSlate SignNow offers various pricing plans that include features to manage your OK business address efficiently. Each plan is designed to cater to different business needs, ensuring you get the best value for using your OK business address in all your eSigning and document workflows.

-

What are the benefits of using an OK business address with airSlate SignNow?

Utilizing an OK business address with airSlate SignNow comes with several benefits, including enhanced professionalism and privacy. You can operate your business from anywhere while ensuring that important documents are securely signed, creating a seamless and efficient workflow.

-

Can I integrate airSlate SignNow with other tools while using my OK business address?

Yes, airSlate SignNow offers multiple integrations with popular applications and tools that can support your OK business address needs. Whether you're using CRM software, accounting tools, or project management systems, you can streamline your processes and keep everything connected.

-

Is it legal to use an OK business address for my company?

Yes, you can legally use an OK business address for your company, provided it complies with local regulations. This address can serve as your registered business address for correspondence, making it a practical option for many businesses that operate remotely.

-

How does airSlate SignNow ensure the security of documents related to my OK business address?

airSlate SignNow employs top-notch security measures, including encryption and secure access controls, to protect your documents linked to your OK business address. This ensures that your sensitive information remains confidential while you eSign and manage important business documents.

Get more for Ok Gov Tax Bt 115 C W

- Tsp 65 form

- Rago brothers form

- Dopl california form

- Stavros fiscal intermediary 100474189 form

- Form 101 crsng nserc crsng gc

- Application for transfer of federally forfeited property form

- Middle school musical audition form photo schechterwestchester

- Medical clearance for dental treatment drs allison amp hulihan form

Find out other Ok Gov Tax Bt 115 C W

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online