State of Oklahoma 320a Form 2016

What is the State Of Oklahoma 320a Form

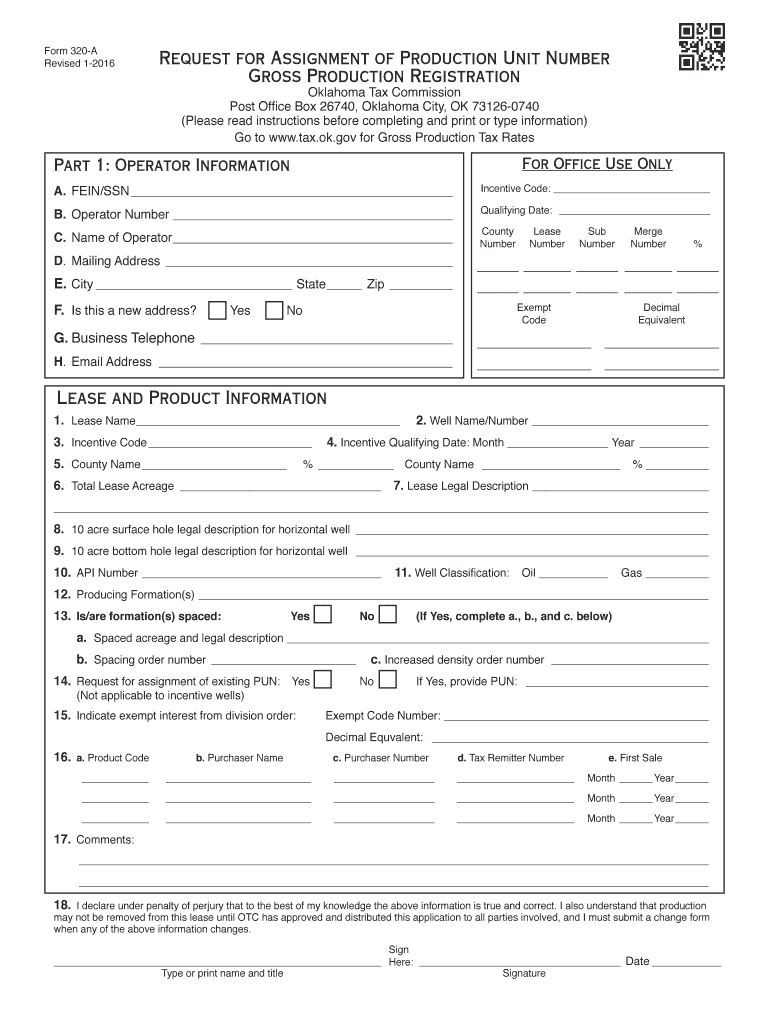

The State Of Oklahoma 320a Form is a tax document specifically designed for reporting income tax for individuals and businesses in Oklahoma. This form is essential for taxpayers to accurately report their earnings, deductions, and credits to the Oklahoma Tax Commission. The 320a form is part of the state’s efforts to streamline tax reporting and ensure compliance with state tax laws. It includes sections for personal information, income details, and any applicable deductions or credits.

How to use the State Of Oklahoma 320a Form

Using the State Of Oklahoma 320a Form involves several steps to ensure accurate completion and submission. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, fill out the form with your personal information, including your name, address, and Social Security number. Report your total income and apply any deductions or credits you qualify for. After completing the form, review it for accuracy before signing and submitting it to the Oklahoma Tax Commission.

Steps to complete the State Of Oklahoma 320a Form

Completing the State Of Oklahoma 320a Form requires careful attention to detail. Follow these steps for a smooth process:

- Gather all relevant tax documents, such as income statements and receipts for deductions.

- Begin filling out the form with your personal information, ensuring accuracy.

- Report your total income in the designated sections.

- Apply any deductions or credits you are eligible for, following the guidelines provided with the form.

- Review the completed form for any errors or omissions.

- Sign and date the form before submission.

Legal use of the State Of Oklahoma 320a Form

The legal use of the State Of Oklahoma 320a Form is mandated by state tax laws. It is critical for taxpayers to understand that submitting this form is a legal requirement for reporting income and calculating tax liabilities. Failure to file the form can result in penalties, interest, and potential legal action by the Oklahoma Tax Commission. Therefore, it is essential to ensure that the form is completed accurately and submitted on time to comply with state regulations.

Form Submission Methods

The State Of Oklahoma 320a Form can be submitted through various methods to accommodate taxpayers' preferences. Options include:

- Online Submission: Taxpayers can file the form electronically through the Oklahoma Tax Commission’s online portal.

- Mail: The completed form can be printed and mailed to the appropriate address provided by the Oklahoma Tax Commission.

- In-Person: Taxpayers may also choose to submit the form in person at designated Oklahoma Tax Commission offices.

Filing Deadlines / Important Dates

Filing deadlines for the State Of Oklahoma 320a Form are crucial for taxpayers to observe. Typically, the deadline for submitting the form aligns with the federal tax deadline, which is usually April fifteenth. However, taxpayers should verify specific dates each tax year, as they may vary. Additionally, extensions may be available, but it is important to file the form or an extension request by the original deadline to avoid penalties.

Quick guide on how to complete state of oklahoma 320a 2016 form

Your assistance manual on how to prepare your State Of Oklahoma 320a Form

If you’re wondering how to create and submit your State Of Oklahoma 320a Form, here are some quick guidelines on how to simplify tax filing.

Initially, you simply need to register your airSlate SignNow profile to modify your document management online. airSlate SignNow is a user-friendly and robust document solution that enables you to edit, create, and complete your tax documents effortlessly. Utilizing its editor, you can alternate between text, check boxes, and eSignatures and return to amend responses as necessary. Enhance your tax administration with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the steps below to achieve your State Of Oklahoma 320a Form in minutes:

- Establish your account and begin working on PDFs in just a few minutes.

- Utilize our directory to locate any IRS tax form; browse through versions and schedules.

- Click Get form to access your State Of Oklahoma 320a Form in our editor.

- Complete the required fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to append your legally-binding eSignature (if necessary).

- Review your document and correct any errors.

- Save adjustments, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please keep in mind that submitting in hard copy can increase return errors and delay reimbursements. Certainly, before e-filing your taxes, check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct state of oklahoma 320a 2016 form

FAQs

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

How should I fill this contract form "Signed this... day of..., 2016"?

I agree that you need to have the document translated to your native language or read to you by an interpreter.

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

How do I give state wise preference in filling SBI Clerk 2016 form?

If you want to stay in your hometown or nearby area than gave them preferences. Else fill the preference randomly if you didn't have any problem to work anywhere in India.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

Create this form in 5 minutes!

How to create an eSignature for the state of oklahoma 320a 2016 form

How to generate an electronic signature for your State Of Oklahoma 320a 2016 Form in the online mode

How to make an eSignature for the State Of Oklahoma 320a 2016 Form in Chrome

How to generate an eSignature for signing the State Of Oklahoma 320a 2016 Form in Gmail

How to make an electronic signature for the State Of Oklahoma 320a 2016 Form straight from your smartphone

How to create an eSignature for the State Of Oklahoma 320a 2016 Form on iOS

How to make an eSignature for the State Of Oklahoma 320a 2016 Form on Android devices

People also ask

-

What is the State Of Oklahoma 320a Form and why is it important?

The State Of Oklahoma 320a Form is a vital document used for specific legal and financial purposes within Oklahoma. It ensures compliance with state regulations and helps streamline processes related to various transactions. Understanding its importance can help businesses and individuals avoid potential legal issues.

-

How does airSlate SignNow simplify the process of completing the State Of Oklahoma 320a Form?

airSlate SignNow provides an intuitive platform that allows you to fill out and eSign the State Of Oklahoma 320a Form easily. With templates and a user-friendly interface, you can complete your documents quickly, saving time and reducing hassle. This streamlining is crucial for busy professionals and businesses.

-

What are the pricing options for using airSlate SignNow to manage the State Of Oklahoma 320a Form?

airSlate SignNow offers competitive pricing plans suited to various needs, starting from basic to advanced functionalities. All plans include the ability to eSign and manage the State Of Oklahoma 320a Form without hidden fees. You can choose a plan that fits your budget and business requirements.

-

Can I integrate airSlate SignNow with other software for handling the State Of Oklahoma 320a Form?

Yes, airSlate SignNow seamlessly integrates with a variety of popular applications and platforms, allowing you to manage the State Of Oklahoma 320a Form alongside your other business tools. These integrations enhance productivity and streamline workflow by connecting essential systems. This flexibility makes it a preferred choice for many users.

-

What features does airSlate SignNow offer for the State Of Oklahoma 320a Form?

airSlate SignNow includes features such as customizable templates, advanced eSigning options, and secure document storage, especially for the State Of Oklahoma 320a Form. These features ensure you have all the tools needed to efficiently complete and manage your documents. Additionally, users can track document status in real-time, enhancing transparency.

-

Is the State Of Oklahoma 320a Form legally binding when signed with airSlate SignNow?

Absolutely, the State Of Oklahoma 320a Form signed through airSlate SignNow is legally binding, as it complies with federal and state eSign laws. This means your electronically signed document holds the same legal weight as its traditional paper counterpart. Thus, you can sign with confidence using our platform.

-

What benefits can businesses expect when using airSlate SignNow for the State Of Oklahoma 320a Form?

Businesses using airSlate SignNow for the State Of Oklahoma 320a Form enjoy enhanced efficiency, reduced paperwork, and improved document security. By automating the signing process, you can save valuable time and reduce errors. Moreover, the ease of access to documents ensures that you can manage them from anywhere, benefiting remote work setups.

Get more for State Of Oklahoma 320a Form

- Repossessed motor vehicle affidavit form

- M1c republic of the philippines philippine health insurance corporation city state centre building 709 shaw boulevard pasig form

- The impact of event scale revised adapted for cancer care psycho oncology form

- Certificate of appointment for estate trustee form

- Concomitant medication log form

- Rubric for email writing form

- Best of the best qxd asse form

- The demand for homeowners insurance with bundled catastrophe aria form

Find out other State Of Oklahoma 320a Form

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer