State of Oklahoma 320a Form 2011

What is the State Of Oklahoma 320a Form

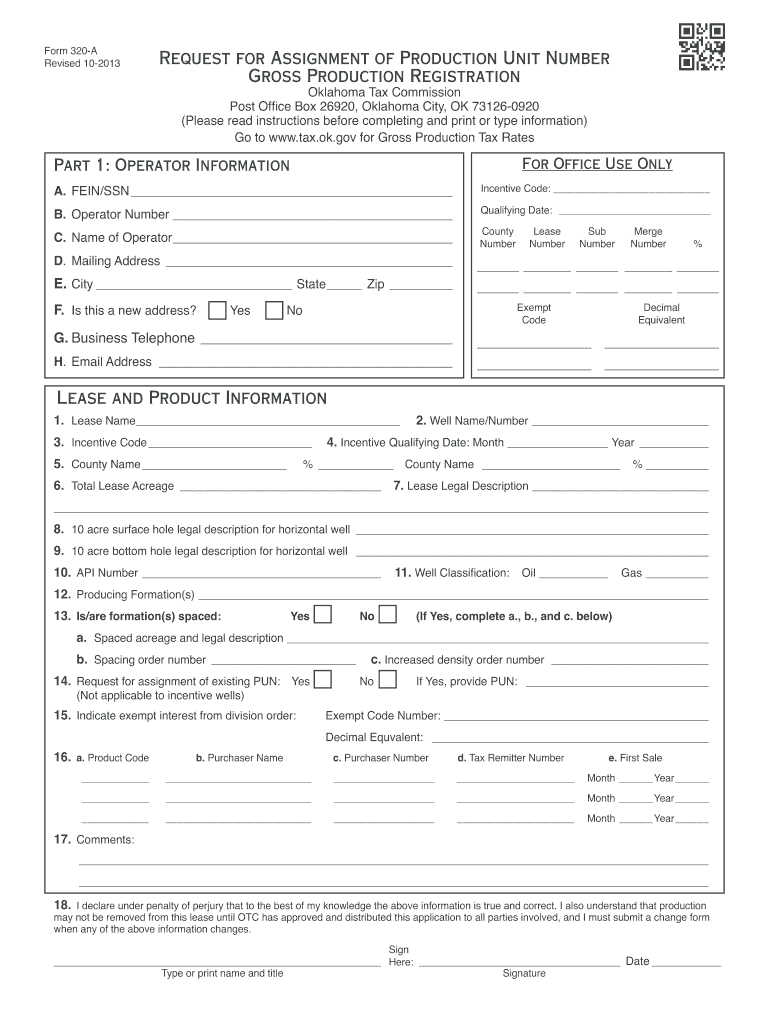

The State Of Oklahoma 320a Form is a tax form used by individuals and businesses to report specific income and tax information to the Oklahoma Tax Commission. This form is essential for ensuring compliance with state tax regulations and allows taxpayers to accurately report their earnings, deductions, and credits. Understanding the purpose of this form is crucial for anyone required to file taxes in Oklahoma, as it helps in determining the amount of tax owed or the refund due.

How to use the State Of Oklahoma 320a Form

Using the State Of Oklahoma 320a Form involves several straightforward steps. First, gather all necessary financial documents, including income statements and deduction records. Next, access the form online or obtain a physical copy from the Oklahoma Tax Commission. Fill out the form by entering the required information accurately, ensuring that all fields are completed. Once the form is filled, review it for any errors before signing and submitting it. This form can be submitted electronically or via mail, depending on your preference.

Steps to complete the State Of Oklahoma 320a Form

Completing the State Of Oklahoma 320a Form requires careful attention to detail. Follow these steps for an accurate submission:

- Collect all relevant financial documents, including W-2s, 1099s, and receipts for deductions.

- Download the form from the Oklahoma Tax Commission website or use a digital platform for completion.

- Fill in personal information, including your name, address, and Social Security number.

- Report your total income, making sure to include all sources of earnings.

- List any deductions or credits you are eligible for, as this can reduce your taxable income.

- Review the completed form for accuracy and completeness.

- Sign the form and submit it according to the guidelines provided.

Legal use of the State Of Oklahoma 320a Form

The legal use of the State Of Oklahoma 320a Form is governed by state tax laws and regulations. It is essential for taxpayers to use this form correctly to avoid penalties or legal issues. The form must be completed truthfully and submitted by the designated deadlines to ensure compliance with Oklahoma tax obligations. Failure to adhere to these requirements can result in fines or audits by the Oklahoma Tax Commission.

Form Submission Methods

The State Of Oklahoma 320a Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers prefer to file electronically, which is often faster and more efficient.

- Mail: Completed forms can be printed and sent to the Oklahoma Tax Commission via postal service.

- In-Person: Taxpayers may also submit their forms directly at designated state tax offices.

Filing Deadlines / Important Dates

Being aware of filing deadlines for the State Of Oklahoma 320a Form is crucial for timely submissions. Typically, the deadline aligns with the federal tax filing deadline, which is usually April 15. However, it is advisable to check for any state-specific extensions or changes, especially during tax season. Missing the deadline can lead to penalties and interest on any taxes owed.

Quick guide on how to complete state of oklahoma 320a 2011 form

Your assistance manual for preparing your State Of Oklahoma 320a Form

If you’re curious about how to finalize and submit your State Of Oklahoma 320a Form, here are some concise instructions to simplify your tax processing.

To begin, simply establish your airSlate SignNow profile to revolutionize your online document management. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to edit, draft, and finalize your tax documents smoothly. With its editor, you can toggle between text, check boxes, and eSignatures, and return to modify answers as necessary. Streamline your tax administration with enhanced PDF editing, eSigning, and simple sharing.

Follow the instructions below to complete your State Of Oklahoma 320a Form in just a few minutes:

- Create your account and start working on PDFs shortly.

- Utilize our directory to locate any IRS tax form; browse through variations and schedules.

- Click Get form to access your State Of Oklahoma 320a Form in our editor.

- Populate the required fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to insert your legally-binding eSignature (if necessary).

- Review your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to submit your taxes electronically with airSlate SignNow. Be aware that submitting in paper form may increase the chances of return errors and delay refunds. Before e-filing your taxes, be sure to check the IRS website for the filing regulations applicable in your state.

Create this form in 5 minutes or less

Find and fill out the correct state of oklahoma 320a 2011 form

FAQs

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

Do you have to fill out a separate form to avail state quota in NEET?

No..you dont have to fill form..But you have to register yourself in directorate of medical education/DME of your state for state quota counselling process..DME Will issue notice regarding process, date, of 1st round of counsellingCounselling schedule have info regarding date for registration , process of counselling etc.You will have to pay some amount of fee at the time of registration as registration fee..As soon as neet result is out..check for notification regarding counselling on DmE site..Hope this helpBest wishes dear.

Create this form in 5 minutes!

How to create an eSignature for the state of oklahoma 320a 2011 form

How to make an eSignature for the State Of Oklahoma 320a 2011 Form in the online mode

How to make an eSignature for your State Of Oklahoma 320a 2011 Form in Google Chrome

How to make an eSignature for putting it on the State Of Oklahoma 320a 2011 Form in Gmail

How to generate an eSignature for the State Of Oklahoma 320a 2011 Form straight from your smartphone

How to create an eSignature for the State Of Oklahoma 320a 2011 Form on iOS devices

How to make an eSignature for the State Of Oklahoma 320a 2011 Form on Android

People also ask

-

What is the State Of Oklahoma 320a Form?

The State Of Oklahoma 320a Form is a document used for specific tax reporting purposes in Oklahoma. It is essential for individuals and businesses to accurately fill out this form to comply with state tax regulations. Using airSlate SignNow simplifies the process of completing and submitting your State Of Oklahoma 320a Form.

-

How can airSlate SignNow assist with the State Of Oklahoma 320a Form?

airSlate SignNow offers a user-friendly platform that allows you to electronically sign and manage your documents, including the State Of Oklahoma 320a Form. With our integration features, you can easily upload and share your forms for efficient collaboration. This streamlines the preparation process, ensuring you submit accurate forms on time.

-

Is there a cost to use airSlate SignNow for the State Of Oklahoma 320a Form?

airSlate SignNow offers competitive pricing plans that provide access to various features, including eSigning the State Of Oklahoma 320a Form. You can choose a plan that fits your budget, ensuring you have a cost-effective electronic signing solution without compromising on functionality. We also offer a free trial to help you get started.

-

What features does airSlate SignNow provide for filling out the State Of Oklahoma 320a Form?

With airSlate SignNow, you can easily fill out the State Of Oklahoma 320a Form online with form fields and customizable templates. Our platform allows you to add text, dates, and signatures directly to the document. Additionally, you can save and reuse templates for future filings, optimizing your workflow.

-

Are there any benefits to using airSlate SignNow for the State Of Oklahoma 320a Form?

Using airSlate SignNow for the State Of Oklahoma 320a Form offers increased efficiency and accuracy. You can reduce the time spent on manual processes, decrease the chance of errors, and ensure timely submissions. The ability to track document status also enhances accountability within your organization.

-

Can I integrate airSlate SignNow with other software for the State Of Oklahoma 320a Form?

Yes, airSlate SignNow offers various integrations with popular business applications, making it easier to manage the State Of Oklahoma 320a Form. You can connect it with CRMs, cloud storage, and project management tools to enhance your document workflow. This flexibility allows you to maintain continuity across your business operations.

-

How secure is airSlate SignNow when handling the State Of Oklahoma 320a Form?

Security is a top priority at airSlate SignNow. We use advanced encryption protocols to protect your data, including the State Of Oklahoma 320a Form. Our compliance with industry-standard security measures ensures that your documents remain confidential and secure throughout the signing process.

Get more for State Of Oklahoma 320a Form

- Temporary authorization for kinship care a form

- Speech language screening form

- Mcps form 336 21 classroom observation mcps k12 md

- Electronic ps 74 prince georgeamp39s county public school system form

- School administration form 46846678

- Electronic navmc 10359 form

- Ontario residential application form

- Credit card payment authorization form ielts vancouver

Find out other State Of Oklahoma 320a Form

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe