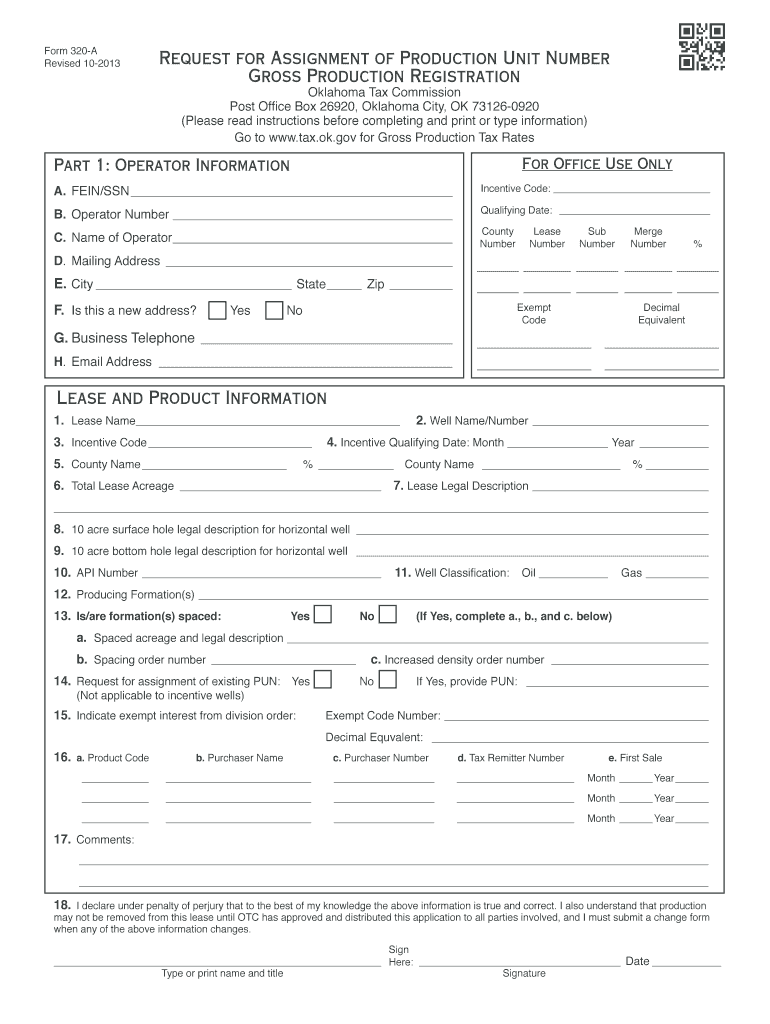

State of Oklahoma 320a Form 2013

What is the State Of Oklahoma 320a Form

The State Of Oklahoma 320a Form is a tax document used by individuals and businesses to report income and calculate tax liabilities. This form is essential for ensuring compliance with state tax regulations and is typically required for various tax filings. Understanding the purpose and requirements of this form is crucial for accurate tax reporting in Oklahoma.

How to use the State Of Oklahoma 320a Form

Using the State Of Oklahoma 320a Form involves several steps. First, gather all necessary financial documents, including income statements and deductions. Next, access the form online or obtain a physical copy. Fill out the form with accurate information, ensuring all fields are completed as required. Once completed, review the form for accuracy before submitting it to the appropriate tax authority.

Steps to complete the State Of Oklahoma 320a Form

Completing the State Of Oklahoma 320a Form requires careful attention to detail. Follow these steps:

- Download the form from the official state website or access it through a tax preparation service.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income accurately, including wages, self-employment income, and any other sources of income.

- Claim eligible deductions and credits to reduce your taxable income.

- Review all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the State Of Oklahoma 320a Form

The legal use of the State Of Oklahoma 320a Form is governed by state tax laws. It is important to ensure that the form is used for its intended purpose, which is to report income and calculate tax obligations. Misuse of the form, such as providing false information, can result in penalties or legal consequences.

Filing Deadlines / Important Dates

Filing deadlines for the State Of Oklahoma 320a Form typically align with federal tax deadlines. Generally, individual taxpayers must file their forms by April fifteenth of each year. However, extensions may be available under certain circumstances. It is essential to stay informed about specific deadlines to avoid late fees or penalties.

Form Submission Methods (Online / Mail / In-Person)

The State Of Oklahoma 320a Form can be submitted through various methods. Taxpayers may choose to file online using state-approved e-filing services, which often streamline the process. Alternatively, the form can be mailed to the appropriate tax office. In-person submissions may also be possible at designated locations, providing flexibility for taxpayers.

Quick guide on how to complete state of oklahoma 320a 2013 form

Your assistance manual on how to prepare your State Of Oklahoma 320a Form

If you’re wondering how to finalize and submit your State Of Oklahoma 320a Form, here are some concise instructions to simplify tax processing.

To start, you just need to sign up for your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a user-friendly and robust document solution that enables you to modify, create, and complete your income tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, returning to amend information as necessary. Enhance your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow the steps below to finalize your State Of Oklahoma 320a Form in just a few minutes:

- Create your account and begin working on PDFs in no time.

- Utilize our directory to access any IRS tax form; explore various versions and schedules.

- Click Obtain form to open your State Of Oklahoma 320a Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Utilize the Signature Tool to add your legally-binding eSignature (if required).

- Examine your document and correct any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to submit your taxes electronically using airSlate SignNow. Please be aware that submitting on paper can lead to return errors and delay refunds. Naturally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct state of oklahoma 320a 2013 form

FAQs

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

Create this form in 5 minutes!

How to create an eSignature for the state of oklahoma 320a 2013 form

How to make an eSignature for the State Of Oklahoma 320a 2013 Form in the online mode

How to generate an eSignature for the State Of Oklahoma 320a 2013 Form in Google Chrome

How to create an electronic signature for putting it on the State Of Oklahoma 320a 2013 Form in Gmail

How to create an electronic signature for the State Of Oklahoma 320a 2013 Form from your mobile device

How to make an electronic signature for the State Of Oklahoma 320a 2013 Form on iOS

How to create an electronic signature for the State Of Oklahoma 320a 2013 Form on Android devices

People also ask

-

What is the State Of Oklahoma 320a Form?

The State Of Oklahoma 320a Form is a crucial document used for reporting income and taxes within the state. It serves to help taxpayers accurately disclose their earnings to the Oklahoma tax authorities, ensuring compliance with state tax regulations.

-

How can airSlate SignNow assist with the State Of Oklahoma 320a Form?

airSlate SignNow provides an efficient platform to electronically sign and submit your State Of Oklahoma 320a Form. With its user-friendly interface, you can easily complete your document and ensure it's submitted securely and on time.

-

What are the pricing options for airSlate SignNow when filing the State Of Oklahoma 320a Form?

airSlate SignNow offers a variety of pricing plans that cater to different business needs when filing the State Of Oklahoma 320a Form. The cost-effective solutions ensure you have access to essential features without breaking your budget.

-

What features does airSlate SignNow provide for the State Of Oklahoma 320a Form?

The airSlate SignNow platform includes features like electronic signatures, document templates, and real-time tracking for the State Of Oklahoma 320a Form. These tools simplify your filing process and enhance productivity, making document management seamless.

-

Are there any benefits to using airSlate SignNow for the State Of Oklahoma 320a Form?

Yes, using airSlate SignNow for the State Of Oklahoma 320a Form means faster processing times and reduced paperwork. Additionally, the platform increases compliance and reduces the risk of errors associated with manual submissions.

-

Can I integrate airSlate SignNow with other software for my State Of Oklahoma 320a Form needs?

Absolutely! airSlate SignNow seamlessly integrates with many popular software applications, enhancing your workflow when managing the State Of Oklahoma 320a Form. This allows for better data management and more efficient document handling.

-

Is it safe to submit the State Of Oklahoma 320a Form through airSlate SignNow?

Yes, airSlate SignNow prioritizes security, employing advanced encryption methods to protect your State Of Oklahoma 320a Form and personal information. You can confidently submit your documents knowing they are handled with the highest level of security.

Get more for State Of Oklahoma 320a Form

Find out other State Of Oklahoma 320a Form

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word