Form 763S, Virginia Special Nonresident Claim for Individual Income Tax Withheld Virginia Special Nonresident Claim for Individu 2019

Understanding the Form 763S

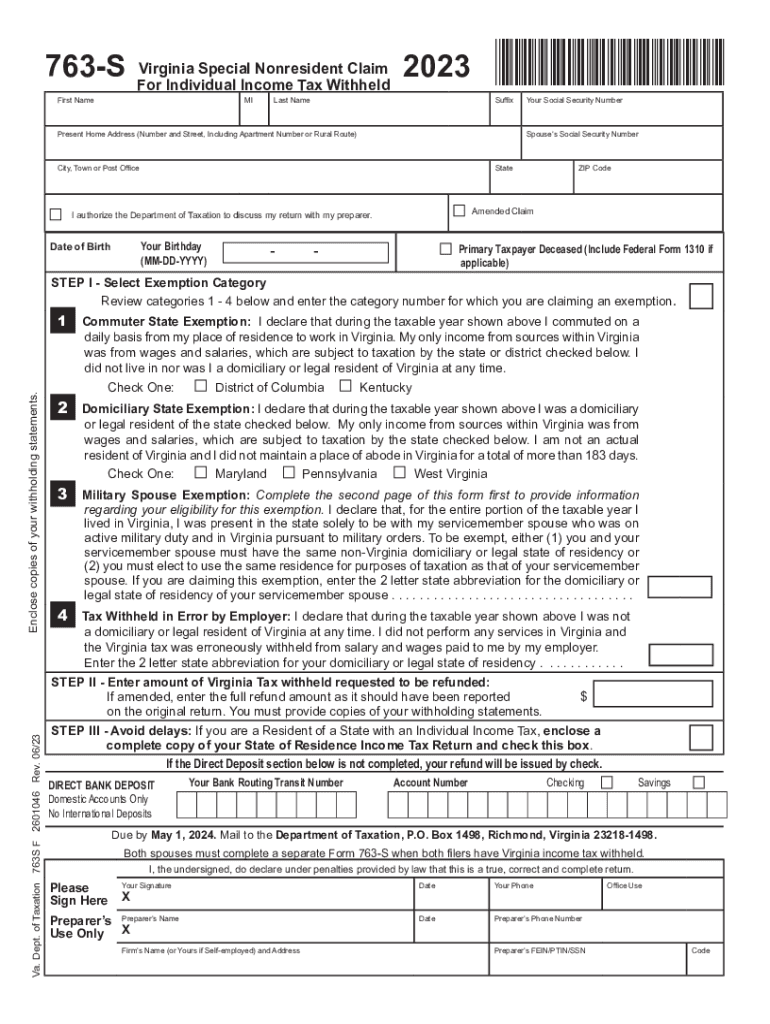

The Form 763S, known as the Virginia Special Nonresident Claim for Individual Income Tax Withheld, is designed for nonresidents who have had Virginia income tax withheld from their earnings. This form allows individuals to claim a refund for the taxes withheld, ensuring that they are not taxed unfairly on income earned while working in Virginia. The form is specifically tailored for those who do not reside in Virginia but have income sourced from the state.

Steps to Complete the Form 763S

Completing the Form 763S involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including W-2 forms and any other income statements that reflect Virginia tax withholdings. Next, fill out the personal information section, ensuring that your name, address, and Social Security number are correct. Then, report your total income earned in Virginia and the amount of tax withheld. Finally, review the form for any errors before submission.

Obtaining the Form 763S

The Form 763S can be easily obtained from the Virginia Department of Taxation's website. It is available for download in PDF format, allowing users to print and fill it out manually. Additionally, individuals can request a physical copy by contacting the Virginia Department of Taxation directly. Ensure that you have the most current version of the form to avoid any issues during the filing process.

Key Elements of the Form 763S

Several key elements are crucial when filling out the Form 763S. These include your personal identification details, the total amount of income earned in Virginia, and the specific amount of tax that was withheld. It is also important to include any relevant tax credits or deductions that may apply to your situation. Providing accurate information in these sections is essential for a successful claim.

Eligibility Criteria for the Form 763S

To qualify for filing the Form 763S, you must meet certain eligibility criteria. You should be a nonresident of Virginia who has had Virginia income tax withheld. This typically applies to individuals who work in Virginia but reside in another state. Additionally, you must have earned income that is subject to Virginia state tax laws. Ensuring that you meet these criteria will help streamline the filing process.

Legal Use of the Form 763S

The Form 763S is legally recognized for claiming refunds on taxes withheld from nonresidents. It is essential to use this form correctly to comply with Virginia tax laws. Misuse or incorrect information can lead to delays in processing your claim or potential penalties. Understanding the legal framework surrounding this form will help ensure that you are following the appropriate guidelines.

Quick guide on how to complete form 763s virginia special nonresident claim for individual income tax withheld virginia special nonresident claim for

Easily prepare Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld Virginia Special Nonresident Claim For Individu on any device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and without delays. Handle Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld Virginia Special Nonresident Claim For Individu on any device using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to edit and eSign Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld Virginia Special Nonresident Claim For Individu effortlessly

- Locate Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld Virginia Special Nonresident Claim For Individu and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with functionalities that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose your preferred method for sending your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, monotonous form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Edit and eSign Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld Virginia Special Nonresident Claim For Individu and ensure effective communication at any point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 763s virginia special nonresident claim for individual income tax withheld virginia special nonresident claim for

Create this form in 5 minutes!

How to create an eSignature for the form 763s virginia special nonresident claim for individual income tax withheld virginia special nonresident claim for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Virginia special nonresident claim withheld?

The Virginia special nonresident claim withheld is a tax form used by nonresidents who have had Virginia taxes withheld from their income. This claim allows nonresidents to recover some or all of the withheld tax amounts. Understanding this claim is crucial for nonresidents who want to ensure they receive their rightful refunds.

-

How can airSlate SignNow help with the Virginia special nonresident claim withheld?

airSlate SignNow provides a streamlined process to electronically sign and send your Virginia special nonresident claim withheld documents. Our platform simplifies document management, ensuring compliance with state requirements. This allows for a faster, more efficient submission of your tax forms.

-

Is there a cost associated with using airSlate SignNow for Virginia special nonresident claims?

Yes, airSlate SignNow offers competitive pricing plans that cater to different business needs. Our cost-effective solutions are designed to maximize your ROI while efficiently managing your Virginia special nonresident claim withheld forms. We provide various subscription options, including pay-per-use.

-

What features are available when using airSlate SignNow for tax claims?

airSlate SignNow offers features like document templates, collaboration tools, and secure eSigning. These features ensure that you can efficiently manage your Virginia special nonresident claim withheld documents with ease. Additionally, our platform enables real-time notifications to keep you updated on the status of your claims.

-

Are there integrations available with airSlate SignNow for tax management?

Yes, airSlate SignNow integrates with various tax and accounting software, allowing seamless management of your Virginia special nonresident claim withheld documents. These integrations simplify your workflow, letting you easily transfer data and documents between platforms. This helps ensure all information is accurate and up-to-date.

-

How does eSigning enhance the submission of Virginia special nonresident claims?

eSigning not only expedites the submission process for Virginia special nonresident claims but also enhances security and compliance. When you eSign through airSlate SignNow, you receive a tamper-proof document with a detailed audit trail. This ensures that your claims are submitted correctly and securely.

-

Can I track the status of my Virginia special nonresident claim withheld submissions?

Absolutely! airSlate SignNow provides tracking tools that allow you to monitor the status of your Virginia special nonresident claim withheld submissions. With real-time updates, you can stay informed about when your documents are received, viewed, and signed, ensuring peace of mind throughout the process.

Get more for Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld Virginia Special Nonresident Claim For Individu

- Incompetency ampamp adult guardianship hearings for clerks of form

- Request formright to review north carolina state

- State of louisiana jefferson parish juvenile court form

- Michigan self proving affidavit form

- My name address city state zip i am the petitioner form

- Order changing minors name form

- Order changing minors name utah courts form

- The state of utah to form

Find out other Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld Virginia Special Nonresident Claim For Individu

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form