Form 763S, Virginia Special Nonresident Claim for Individual Income Tax Withheld Virginia Special Nonresident Claim for Individu 2020

What is the Form 763S?

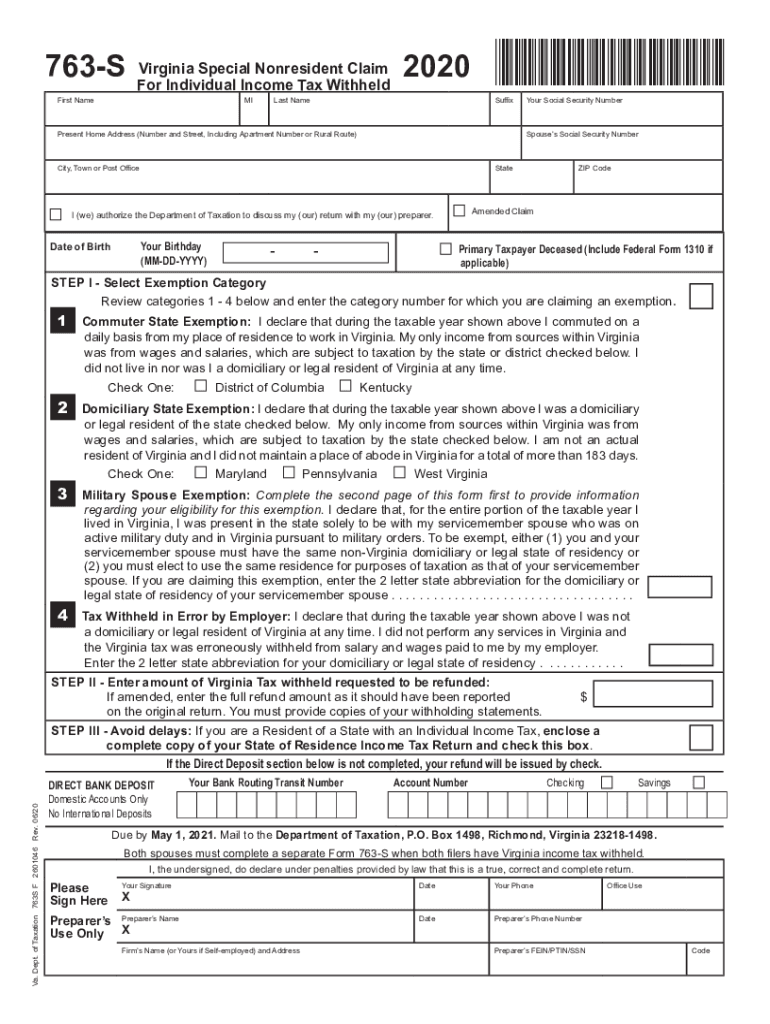

The Form 763S, officially known as the Virginia Special Nonresident Claim for Individual Income Tax Withheld, is a tax form used by nonresidents of Virginia who have had income tax withheld from their wages while working in the state. This form allows individuals to claim a refund for the taxes withheld, provided they meet specific eligibility criteria. It is essential for nonresidents to understand the purpose of this form to ensure they receive any overpaid taxes back from the state.

Steps to Complete the Form 763S

Completing the Form 763S requires careful attention to detail. Here are the steps to follow:

- Gather necessary information: Collect your personal information, including your Social Security number, address, and details about your income earned in Virginia.

- Fill out the form: Enter your income details, the amount of tax withheld, and any other required information on the form.

- Review for accuracy: Double-check all entries for accuracy to avoid delays in processing your claim.

- Sign and date the form: Ensure that you sign and date the form before submission, as an unsigned form may be rejected.

How to Obtain the Form 763S

The Form 763S can be obtained through various means. It is available online on the Virginia Department of Taxation's website, where you can download and print it. Additionally, physical copies may be available at local tax offices or public libraries. It is advisable to ensure you have the most current version of the form to avoid any issues during submission.

Eligibility Criteria for Form 763S

To qualify for filing the Form 763S, individuals must meet specific criteria. You must be a nonresident of Virginia and have had Virginia income tax withheld from your wages. Additionally, you should not be required to file a Virginia resident tax return. Understanding these criteria is crucial to ensure that you are eligible to claim a refund for any taxes withheld.

Form Submission Methods

The completed Form 763S can be submitted through various methods. You can mail the form to the designated address provided in the instructions, ensuring you include any required documentation. Alternatively, some individuals may have the option to submit the form electronically through the Virginia Department of Taxation's online services. It is important to follow the submission guidelines to ensure proper processing of your claim.

Key Elements of the Form 763S

Several key elements are essential to the Form 763S. These include:

- Personal Information: This section requires your name, address, and Social Security number.

- Income Details: You must report the total income earned in Virginia and the amount of tax withheld.

- Signature: A valid signature is required to certify that the information provided is accurate and complete.

Quick guide on how to complete 2020 form 763s virginia special nonresident claim for individual income tax withheld virginia special nonresident claim for

Complete Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld Virginia Special Nonresident Claim For Individu effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents promptly without interruptions. Handle Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld Virginia Special Nonresident Claim For Individu on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld Virginia Special Nonresident Claim For Individu with ease

- Find Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld Virginia Special Nonresident Claim For Individu and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to missing or lost files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets all your requirements in document management in just a few clicks from your chosen device. Modify and eSign Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld Virginia Special Nonresident Claim For Individu and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 763s virginia special nonresident claim for individual income tax withheld virginia special nonresident claim for

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 763s virginia special nonresident claim for individual income tax withheld virginia special nonresident claim for

The way to make an eSignature for a PDF online

The way to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

How to make an eSignature straight from your smartphone

The way to make an eSignature for a PDF on iOS

How to make an eSignature for a PDF document on Android

People also ask

-

What is the state of Virginia Form 763 S?

The state of Virginia Form 763 S is a tax form used for non-residents to report their state income tax obligations. Understanding the state of Virginia Form 763 S instructions is essential for accurate completion and timely submission. This form helps ensure compliance with state tax laws while providing necessary information to the Virginia Department of Taxation.

-

Where can I find the state of Virginia Form 763 S instructions?

You can find the state of Virginia Form 763 S instructions on the Virginia Department of Taxation's official website. The site provides detailed guidance on completing the form, ensuring you have all the essential information. Utilizing airSlate SignNow can streamline the signing and submission process for your documents, including tax forms.

-

How does airSlate SignNow help with the state of Virginia Form 763 S?

airSlate SignNow provides an efficient solution for electronically signing and managing your state of Virginia Form 763 S. By utilizing our platform, users can quickly complete and submit their forms without the hassle of printing and mailing. This saves time and ensures that your documents are securely signed and stored.

-

Are there any fees associated with using airSlate SignNow for my state of Virginia Form 763 S?

Yes, airSlate SignNow offers different pricing plans based on the number of users and the features you need. Our plans are designed to be cost-effective, which is ideal for individuals and businesses needing to handle forms like the state of Virginia Form 763 S. You can choose a plan that fits your budget while enjoying full access to our services.

-

What features does airSlate SignNow offer for managing the state of Virginia Form 763 S?

airSlate SignNow offers a range of features for managing documents, including eSignature capabilities, document routing, and reminders. These features simplify completing the state of Virginia Form 763 S by ensuring all signers receive timely notifications. Additionally, our platform's audit trail provides peace of mind by tracking each step of the document's journey.

-

Can I integrate airSlate SignNow with other applications for the state of Virginia Form 763 S?

Absolutely! airSlate SignNow seamlessly integrates with various applications, making it easy to manage your state of Virginia Form 763 S alongside other documents. Whether you're using cloud storage services or project management tools, our integrations enhance your workflow and simplify document handling.

-

What are the benefits of using airSlate SignNow for my state of Virginia Form 763 S?

By using airSlate SignNow for your state of Virginia Form 763 S, you benefit from automated processes and secure electronic signatures. Our platform also enhances collaboration, allowing multiple signers to complete the form easily. This leads to faster turnaround times and improved overall efficiency for managing your tax obligations.

Get more for Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld Virginia Special Nonresident Claim For Individu

Find out other Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld Virginia Special Nonresident Claim For Individu

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast