Va Dept of Taxation 763S F 2601046 Rev 0622 ST 2024-2026

Understanding the Virginia Department of Taxation Form 763S

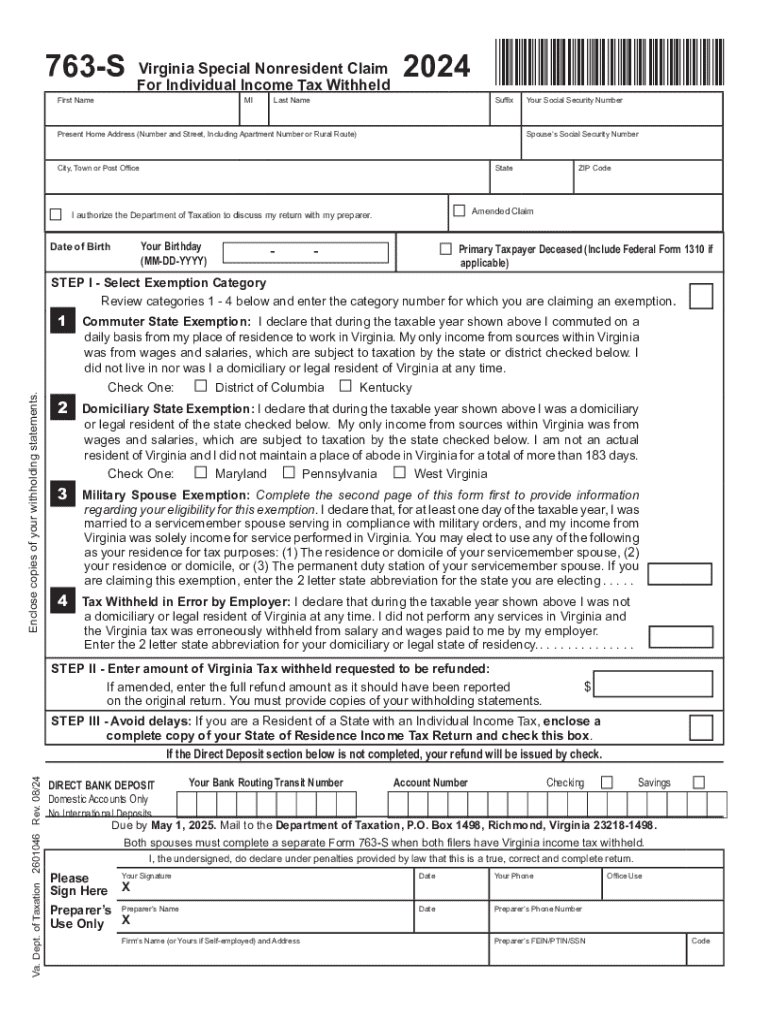

The Virginia Department of Taxation Form 763S is a specific tax form used primarily by non-residents who need to report their income earned in Virginia. This form is essential for individuals who do not reside in Virginia but have income sourced from the state. It is crucial for ensuring compliance with state tax laws and accurately reporting income to avoid potential penalties.

Step-by-Step Instructions for Completing Form 763S

Completing the Form 763S involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and social security number.

- Report all income earned in Virginia, ensuring that you include any deductions or credits applicable to your situation.

- Double-check your calculations for accuracy before submitting the form.

Following these steps will help ensure that your form is completed correctly and submitted on time.

Eligibility Criteria for Using Form 763S

To be eligible to use Form 763S, you must meet specific criteria:

- You must be a non-resident of Virginia.

- You must have earned income from Virginia sources during the tax year.

- Your total Virginia income must exceed the filing threshold set by the Virginia Department of Taxation.

Understanding these criteria is vital for ensuring that you file the correct form and comply with state tax regulations.

Required Documents for Filing Form 763S

When filing Form 763S, certain documents are necessary to support your income claims:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Any other documentation that verifies your income and deductions.

Having these documents ready will streamline the filing process and help avoid delays.

Filing Deadlines for Form 763S

It is essential to be aware of the filing deadlines for Form 763S to avoid penalties:

- The standard filing deadline is typically May 1 of the year following the tax year.

- If you require an extension, you must file for an extension before the original deadline.

Staying informed about these dates ensures timely submissions and compliance with Virginia tax laws.

Form Submission Methods for 763S

Form 763S can be submitted in various ways, providing flexibility for taxpayers:

- Online through the Virginia Department of Taxation's e-filing system.

- By mail, using the address specified in the form instructions.

- In-person at designated tax offices, if needed.

Choosing the right submission method can enhance the efficiency of your filing process.

Create this form in 5 minutes or less

Find and fill out the correct va dept of taxation 763s f 2601046 rev 0622 st

Create this form in 5 minutes!

How to create an eSignature for the va dept of taxation 763s f 2601046 rev 0622 st

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is va763 and how does it benefit my business?

va763 is a powerful feature within airSlate SignNow that allows businesses to streamline their document signing process. By utilizing va763, you can enhance efficiency, reduce turnaround times, and ensure secure transactions. This feature is designed to empower your team to focus on what matters most while simplifying document management.

-

How much does airSlate SignNow with va763 cost?

The pricing for airSlate SignNow with va763 is competitive and designed to fit various business needs. We offer flexible plans that cater to different sizes of organizations, ensuring you get the best value for your investment. For detailed pricing information, please visit our pricing page.

-

What features are included with va763?

va763 includes a range of features such as customizable templates, real-time tracking, and secure cloud storage. These features are designed to enhance your document workflow and provide a seamless eSigning experience. With va763, you can also integrate with other tools to further streamline your processes.

-

Can I integrate va763 with other software?

Yes, va763 is designed to integrate seamlessly with various software applications, including CRM and project management tools. This integration capability allows you to enhance your workflow and improve productivity. By connecting va763 with your existing systems, you can create a more cohesive document management process.

-

Is va763 secure for sensitive documents?

Absolutely, va763 prioritizes security and compliance, ensuring that your sensitive documents are protected. We utilize advanced encryption and authentication methods to safeguard your data. With va763, you can confidently send and sign documents without worrying about unauthorized access.

-

How can va763 improve my team's productivity?

va763 can signNowly enhance your team's productivity by automating the document signing process. With features like bulk sending and reminders, your team can focus on core tasks rather than getting bogged down by paperwork. This efficiency leads to faster decision-making and improved overall performance.

-

What types of documents can I sign using va763?

You can sign a wide variety of documents using va763, including contracts, agreements, and forms. The flexibility of va763 allows you to customize your document templates to suit your specific needs. This versatility makes it an ideal solution for businesses across different industries.

Get more for Va Dept Of Taxation 763S F 2601046 Rev 0622 ST

Find out other Va Dept Of Taxation 763S F 2601046 Rev 0622 ST

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation