Claim Itemized Deductions on IRS Form 1040NR 2023

What is the Claim Itemized Deductions on IRS Form 1040NR

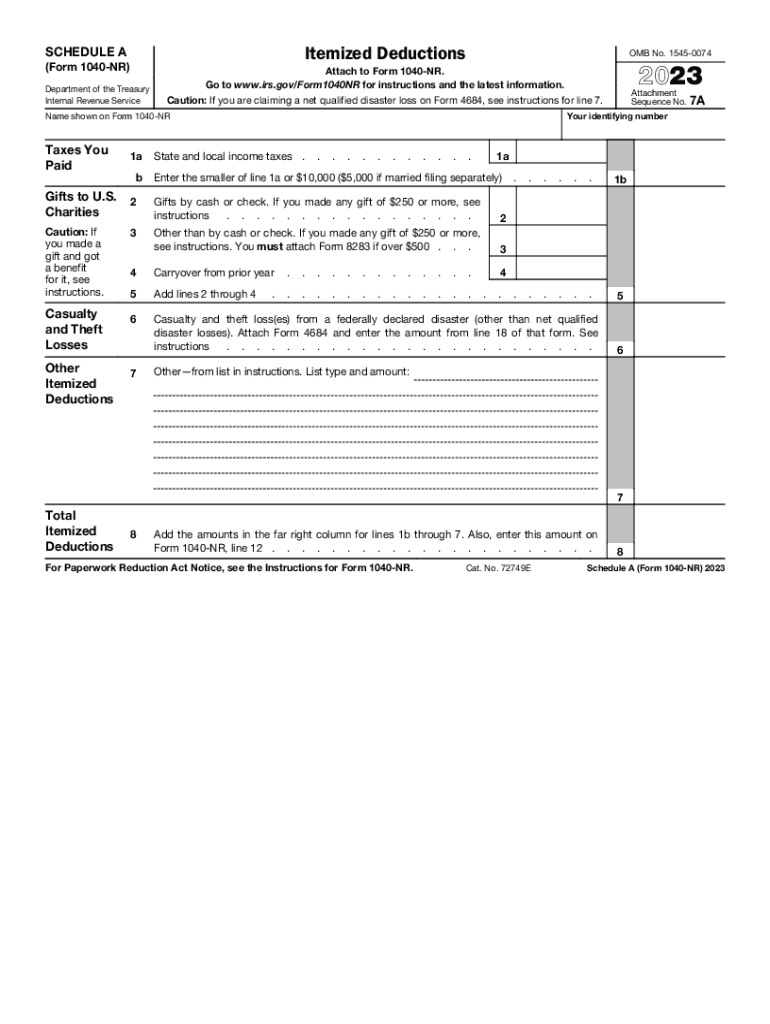

The Claim Itemized Deductions on IRS Form 1040NR allows non-resident aliens to report eligible expenses that can reduce their taxable income. This form is essential for individuals who have specific deductions, such as mortgage interest, state taxes, and certain medical expenses. Understanding how these deductions apply can significantly impact the overall tax liability for non-resident taxpayers.

Steps to Complete the Claim Itemized Deductions on IRS Form 1040NR

Completing the Claim Itemized Deductions on IRS Form 1040NR involves several key steps:

- Gather necessary documents, including receipts and records of deductible expenses.

- Fill out the personal information section of the form accurately.

- List all eligible itemized deductions in the designated section, ensuring compliance with IRS guidelines.

- Calculate the total deductions and ensure they are correctly reflected on the form.

- Review the completed form for accuracy before submission.

IRS Guidelines for Claiming Itemized Deductions

The IRS provides specific guidelines regarding what qualifies as an itemized deduction on Form 1040NR. Generally, taxpayers can deduct expenses related to:

- Medical and dental expenses exceeding a certain percentage of adjusted gross income.

- State and local taxes paid, including property taxes.

- Mortgage interest on a primary residence.

- Charitable contributions to qualified organizations.

It is crucial to adhere to these guidelines to ensure compliance and maximize potential deductions.

Required Documents for Claiming Itemized Deductions

To effectively claim itemized deductions on IRS Form 1040NR, taxpayers should prepare the following documents:

- Receipts for medical expenses, including prescriptions and treatments.

- Property tax statements and records of state taxes paid.

- Mortgage interest statements (Form 1098) from lenders.

- Documentation of charitable contributions, such as receipts or bank statements.

Having these documents ready will facilitate the completion of the form and support the claims made.

Filing Deadlines for IRS Form 1040NR

Taxpayers must be aware of the filing deadlines for IRS Form 1040NR to avoid penalties. Typically, the deadline for filing the form is April 15 of the following year. However, if the taxpayer resides outside the United States, they may qualify for an automatic extension until June 15. It is important to check for any updates or changes to these deadlines each tax year.

Examples of Using the Claim Itemized Deductions on IRS Form 1040NR

Consider a non-resident alien who incurred medical expenses of $5,000, paid $2,000 in state taxes, and donated $1,000 to a charity. By itemizing these deductions on IRS Form 1040NR, they can reduce their taxable income significantly. Each of these expenses must be documented and reported accurately to ensure compliance with IRS regulations.

Quick guide on how to complete claim itemized deductions on irs form 1040nr

Easily Prepare Claim Itemized Deductions On IRS Form 1040NR on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to swiftly create, modify, and electronically sign your documents without delays. Manage Claim Itemized Deductions On IRS Form 1040NR on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to Modify and eSign Claim Itemized Deductions On IRS Form 1040NR Effortlessly

- Locate Claim Itemized Deductions On IRS Form 1040NR and then click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes just a few seconds and holds the same legal validity as a conventional ink signature.

- Review all the details, then click the Done button to save your changes.

- Choose how you would like to send your form—via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Claim Itemized Deductions On IRS Form 1040NR, ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct claim itemized deductions on irs form 1040nr

Create this form in 5 minutes!

How to create an eSignature for the claim itemized deductions on irs form 1040nr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to schedule a itemized deductions pdf using airSlate SignNow?

To schedule a itemized deductions pdf, simply upload your document to airSlate SignNow, add the necessary fields, and then set the scheduling options. The platform allows you to customize the timing for when recipients can access the document for e-signature. This ensures that your tax deductions are processed timely.

-

Can I integrate airSlate SignNow with my accounting software for itemized deductions?

Yes, airSlate SignNow offers seamless integrations with many popular accounting software solutions. By integrating your software with airSlate SignNow, you can streamline the process of creating and scheduling a itemized deductions pdf, ensuring your financial documents are always in sync.

-

What are the pricing options for scheduling a itemized deductions pdf with airSlate SignNow?

airSlate SignNow provides a range of pricing plans to cater to different business needs. You can choose a plan that fits your budget for frequently scheduling a itemized deductions pdf, ensuring you get the most value from the service without overspending.

-

How secure is my data when scheduling a itemized deductions pdf with airSlate SignNow?

Security is a top priority at airSlate SignNow. When you schedule a itemized deductions pdf, your documents are protected by advanced encryption technologies, which help to keep your sensitive financial information safe and private throughout the entire e-signing process.

-

Does airSlate SignNow provide support for scheduling a itemized deductions pdf?

Absolutely! airSlate SignNow offers dedicated customer support to assist you with any questions about scheduling a itemized deductions pdf. Whether you need help with the platform's features or troubleshooting, our support team is here to ensure a smooth experience.

-

Can I edit my scheduled itemized deductions pdf after it's been created?

Yes, airSlate SignNow allows you to edit your scheduled itemized deductions pdf even after creation. You can make necessary changes to the document or the scheduling options, ensuring that everything is accurate before sending it out for signatures.

-

What features does airSlate SignNow offer for scheduling itemized deductions pdf?

airSlate SignNow provides a variety of features designed to enhance your experience when scheduling a itemized deductions pdf. These include customizable templates, automated reminders, and an intuitive drag-and-drop interface, making e-signing and document management easier than ever.

Get more for Claim Itemized Deductions On IRS Form 1040NR

- 2021 form rew 5 maine revenue services incomeestate tax

- Mo 1040v individual income tax payment voucher missouri form

- 21 700 sov mainegov form

- For calendar year tocheck if you led form

- Maine revenue services form 941me 99 2021

- Fillable online note taking process and responsibilities form

- Maine revenue services nonadmitted premiums tax 99 2020 form

- Alaska form 6100 oil and gas corporation net income tax

Find out other Claim Itemized Deductions On IRS Form 1040NR

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement