Schedule a Itemized Deductions 2021

What is the Schedule A Itemized Deductions

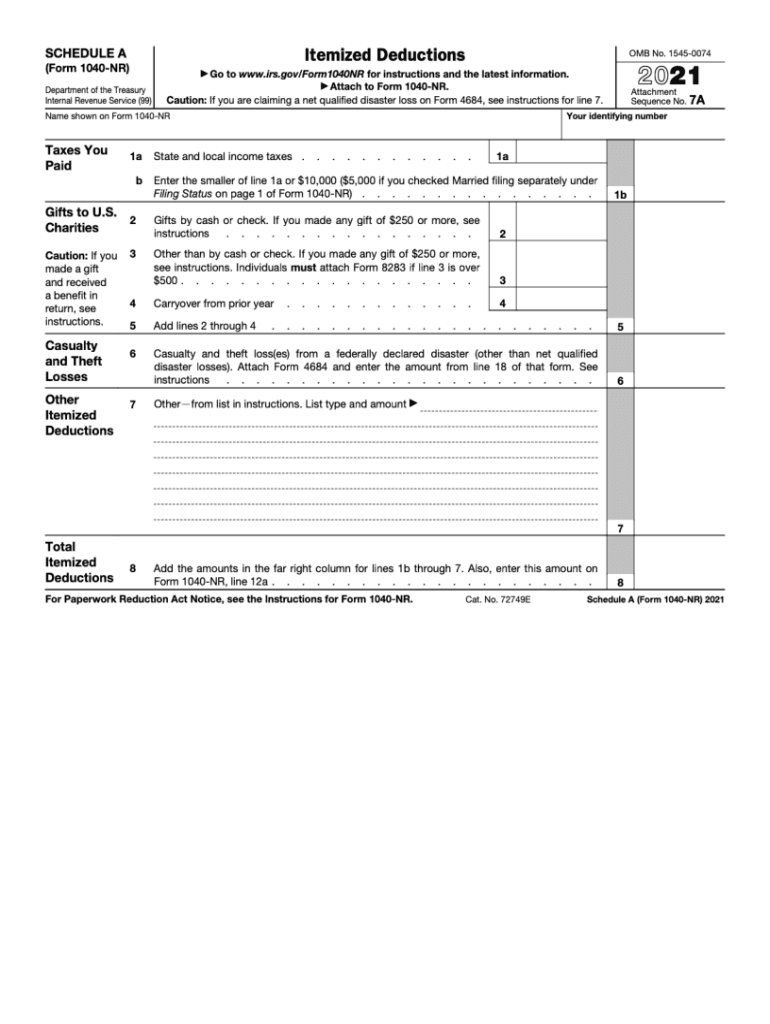

The Schedule A itemized deductions form is a crucial component of the U.S. tax filing process, specifically for taxpayers who choose to itemize their deductions instead of taking the standard deduction. This form allows individuals to detail various eligible expenses that can reduce their taxable income. Common deductions include medical expenses, state and local taxes, mortgage interest, and charitable contributions. By accurately completing the Schedule A, taxpayers can potentially lower their overall tax liability, making it an essential tool for effective tax planning.

How to use the Schedule A Itemized Deductions

Using the Schedule A itemized deductions form involves several steps to ensure accurate reporting of expenses. First, gather all necessary documentation, including receipts and statements related to deductible expenses. Next, fill out the form by categorizing expenses into the appropriate sections, such as medical expenses, taxes paid, and gifts to charity. Each category has specific instructions on what can be included, so it is important to follow IRS guidelines carefully. Once completed, the form should be attached to your IRS Form 1040 when filing your taxes.

Steps to complete the Schedule A Itemized Deductions

Completing the Schedule A itemized deductions form requires attention to detail and organization. Follow these steps:

- Gather all relevant financial documents, including receipts for medical expenses, property tax statements, and records of charitable contributions.

- Review the IRS guidelines to determine which expenses qualify for deductions.

- Fill out the form by entering the total amounts for each category of deductions.

- Double-check all calculations and ensure that the totals are accurate.

- Attach the completed Schedule A to your Form 1040 before submission.

Legal use of the Schedule A Itemized Deductions

The legal use of the Schedule A itemized deductions form is governed by IRS regulations. To ensure compliance, taxpayers must accurately report only those expenses that meet the IRS criteria for deductibility. This includes maintaining proper documentation for each deduction claimed. Failure to adhere to these regulations can result in penalties, including fines or audits. It is advisable to consult with a tax professional if there are uncertainties regarding the legality of specific deductions.

Key elements of the Schedule A Itemized Deductions

Understanding the key elements of the Schedule A itemized deductions form is essential for effective tax filing. The form is divided into several sections, each focusing on different types of deductions:

- Medical and Dental Expenses: This section allows taxpayers to deduct qualifying medical costs that exceed a certain percentage of their adjusted gross income.

- Taxes You Paid: Taxpayers can deduct state and local income taxes, sales taxes, and property taxes.

- Interest You Paid: This includes mortgage interest and points paid on a mortgage.

- Gifts to Charity: Taxpayers can deduct contributions made to qualified charitable organizations.

- Casualty and Theft Losses: This section covers losses due to theft or natural disasters.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule A itemized deductions coincide with the general tax filing deadlines set by the IRS. Typically, individual tax returns are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers requesting an extension can file their returns by October 15, but any taxes owed are still due by the original deadline to avoid penalties. It is important to stay informed about any changes in deadlines or extensions announced by the IRS.

Quick guide on how to complete schedule a itemized deductions

Prepare Schedule A Itemized Deductions seamlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal sustainable alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage Schedule A Itemized Deductions on any platform using airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The simplest way to modify and electronically sign Schedule A Itemized Deductions without hassle

- Obtain Schedule A Itemized Deductions and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes moments and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method for sending your form by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign Schedule A Itemized Deductions and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule a itemized deductions

Create this form in 5 minutes!

People also ask

-

What is the internal revenue service schedule a?

The internal revenue service schedule A is a part of the individual income tax return form 1040, which allows taxpayers to itemize their deductions. Using airSlate SignNow, you can easily prepare and eSign your schedule A forms, ensuring that you capture all eligible deductions for a greater tax refund.

-

How can airSlate SignNow help me manage my internal revenue service schedule A?

airSlate SignNow offers a user-friendly platform to digitize and manage your internal revenue service schedule A. You can quickly fill out, sign, and send your forms securely, minimizing the risk of errors and enhancing the efficiency of your tax filing process.

-

Is airSlate SignNow suitable for small businesses handling internal revenue service schedule A?

Absolutely! airSlate SignNow is an ideal solution for small businesses handling the internal revenue service schedule A. It provides a cost-effective way to manage documents, ensuring compliance and easy access to important tax documents, increasing overall productivity.

-

What are the pricing plans for airSlate SignNow focused on the internal revenue service schedule A?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of individuals and businesses dealing with internal revenue service schedule A forms. With monthly and annual subscription options, you can choose a plan that fits your budget and requirements seamlessly.

-

Can I integrate airSlate SignNow with accounting software for my internal revenue service schedule A?

Yes, airSlate SignNow easily integrates with various accounting software to simplify the management of your internal revenue service schedule A. This integration streamlines your workflow, allowing you to synchronize documents and data effortlessly for accurate tax preparation.

-

What are the benefits of using airSlate SignNow for my internal revenue service schedule A?

Using airSlate SignNow for your internal revenue service schedule A offers numerous benefits, including enhanced security, time-saving eSignatures, and a user-friendly interface. This makes the entire process of preparing and submitting your tax documentation more efficient and less stressful.

-

How secure is airSlate SignNow when handling internal revenue service schedule A documents?

airSlate SignNow prioritizes the security of your data, especially when handling sensitive documents like the internal revenue service schedule A. With advanced encryption and compliance with industry standards, you can trust that your information remains safe throughout the entire signing process.

Get more for Schedule A Itemized Deductions

Find out other Schedule A Itemized Deductions

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template