Form 1040 NR Schedule a 2022

What is the Form 1040 NR Schedule A

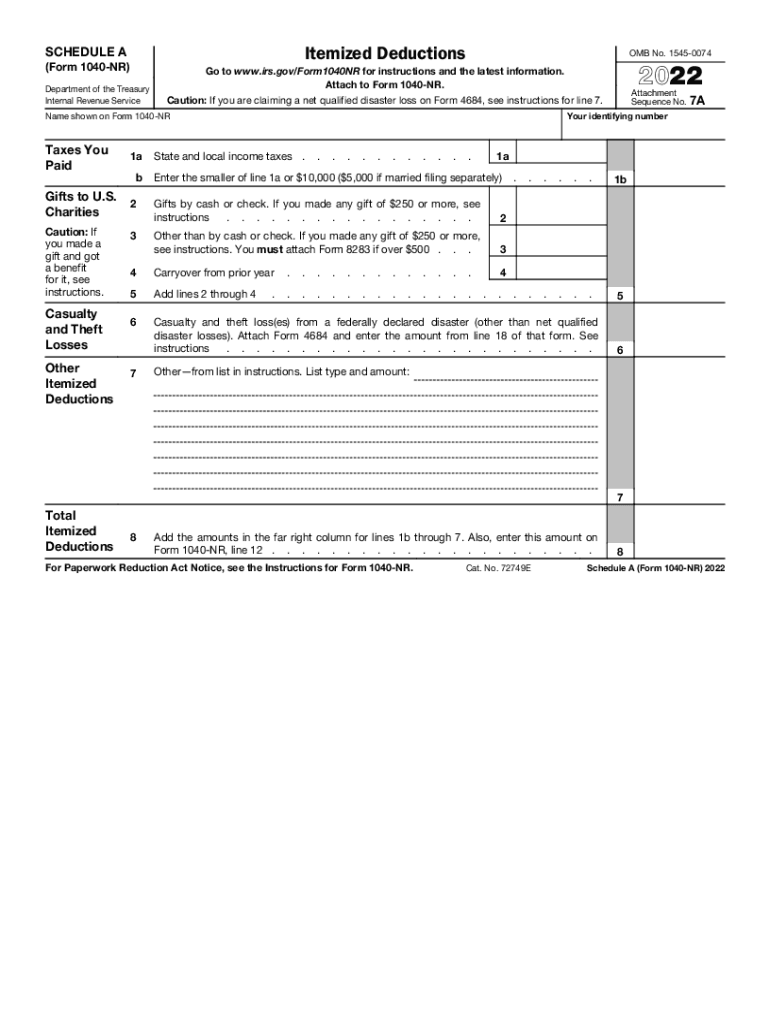

The Form 1040 NR Schedule A is a critical document used by non-resident aliens in the United States to report itemized deductions. This form allows taxpayers to detail eligible expenses that can reduce their taxable income. Common deductions include medical expenses, state and local taxes, mortgage interest, and charitable contributions. Understanding the purpose of this form is essential for non-residents seeking to maximize their tax benefits while complying with U.S. tax laws.

How to use the Form 1040 NR Schedule A

Using the Form 1040 NR Schedule A involves several steps to ensure accurate reporting of itemized deductions. Taxpayers should first gather all relevant financial documents, such as receipts and statements for deductible expenses. Next, they will need to complete the form by entering the amounts for each category of deduction. It is important to follow the instructions carefully to avoid errors that could lead to delays or audits. After completing the form, it should be attached to the main Form 1040 NR when filing.

Steps to complete the Form 1040 NR Schedule A

Completing the Form 1040 NR Schedule A requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documentation for itemized deductions, including receipts and invoices.

- Fill in personal information at the top of the form, including name and identification number.

- Enter amounts for each category of deductions, ensuring they are supported by documentation.

- Calculate the total deductions and transfer this amount to the main Form 1040 NR.

- Review the form for accuracy and completeness before submission.

Legal use of the Form 1040 NR Schedule A

The legal use of the Form 1040 NR Schedule A is governed by IRS regulations. To be considered valid, the form must be filled out truthfully and accurately, reflecting all eligible deductions. Taxpayers should retain copies of all documentation supporting the deductions claimed, as the IRS may request this information during audits. Compliance with tax laws is essential to avoid penalties and ensure that the deductions are recognized by the Internal Revenue Service.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 1040 NR Schedule A. Taxpayers should refer to the IRS instructions for the form, which detail the types of deductions allowed and the necessary documentation. It is also important to stay updated on any changes in tax laws that may affect the eligibility of certain deductions. Adhering to these guidelines helps ensure accurate filing and minimizes the risk of issues with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 NR Schedule A align with the general tax filing deadlines for non-resident aliens. Typically, the due date for filing is April 15 for most taxpayers, but non-residents may have different deadlines based on their specific circumstances. It is crucial to be aware of these dates to avoid late fees and penalties. Taxpayers should also consider any extensions that may be available if they need additional time to file.

Quick guide on how to complete form 1040 nr schedule a

Complete Form 1040 NR Schedule A seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and eSign your documents swiftly without delays. Manage Form 1040 NR Schedule A on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to adjust and eSign Form 1040 NR Schedule A effortlessly

- Locate Form 1040 NR Schedule A and click on Get Form to begin.

- Take advantage of the tools we provide to complete your form.

- Emphasize important sections of the documents or conceal sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Alter and eSign Form 1040 NR Schedule A to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 nr schedule a

Create this form in 5 minutes!

People also ask

-

What steps do I need to follow to schedule a itemized deductions form with airSlate SignNow?

To schedule a itemized deductions form using airSlate SignNow, you first need to create an account with us. Once you’re logged in, you can easily upload your itemized deductions form, set the necessary fields for signing, and then schedule the document for signature. Just follow the prompts to complete the scheduling process seamlessly.

-

Is there a cost associated with scheduling a itemized deductions form on your platform?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. For a monthly or yearly subscription, you can schedule a itemized deductions form along with other features designed to enhance document management. We also offer a free trial, so you can explore our services without any commitment.

-

What features does airSlate SignNow provide for scheduling itemized deductions forms?

airSlate SignNow includes numerous features that simplify the process of scheduling a itemized deductions form. These features include customizable templates, integrated eSigning, document tracking, and automated reminders to ensure your items are signed on time. Our platform makes document management efficient and straightforward.

-

How secure is the process of scheduling a itemized deductions form with airSlate SignNow?

Security is our top priority at airSlate SignNow. When you schedule a itemized deductions form, you can rest assured that your data is protected with industry-standard encryption and stringent security protocols. This ensures that your documents remain confidential and secure throughout the signing process.

-

Can I integrate airSlate SignNow with other business software when scheduling a itemized deductions form?

Absolutely! airSlate SignNow offers integrations with various business applications, allowing you to streamline your workflow. You can easily connect our platform with your CRM, accounting software, or other tools, making it convenient to schedule a itemized deductions form within your existing systems.

-

What benefits can I expect when I schedule a itemized deductions form using airSlate SignNow?

When you schedule a itemized deductions form with airSlate SignNow, you benefit from increased efficiency and time savings. Our user-friendly interface helps you seamlessly manage your documents, while automated workflows eliminate the need for manual handling. You'll also enjoy faster turnaround times with our eSigning capabilities.

-

Is there customer support available if I have issues scheduling a itemized deductions form?

Yes, airSlate SignNow provides dedicated customer support to assist you with any issues you may encounter while scheduling a itemized deductions form. Our support team is available through various channels, including email and live chat, to ensure your concerns are addressed promptly and effectively.

Get more for Form 1040 NR Schedule A

- Verification of creditors matrix indiana 497307019 form

- Correction statement and agreement indiana form

- Indiana closing form

- Flood zone statement and authorization indiana form

- Name affidavit of buyer indiana form

- Name affidavit of seller indiana form

- Non foreign affidavit under irc 1445 indiana form

- Owners or sellers affidavit of no liens indiana form

Find out other Form 1040 NR Schedule A

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure