SCHEDULE a Form 1040 NR Itemized Deductions 2024-2026

Understanding the Schedule A Form 1040 NR Itemized Deductions

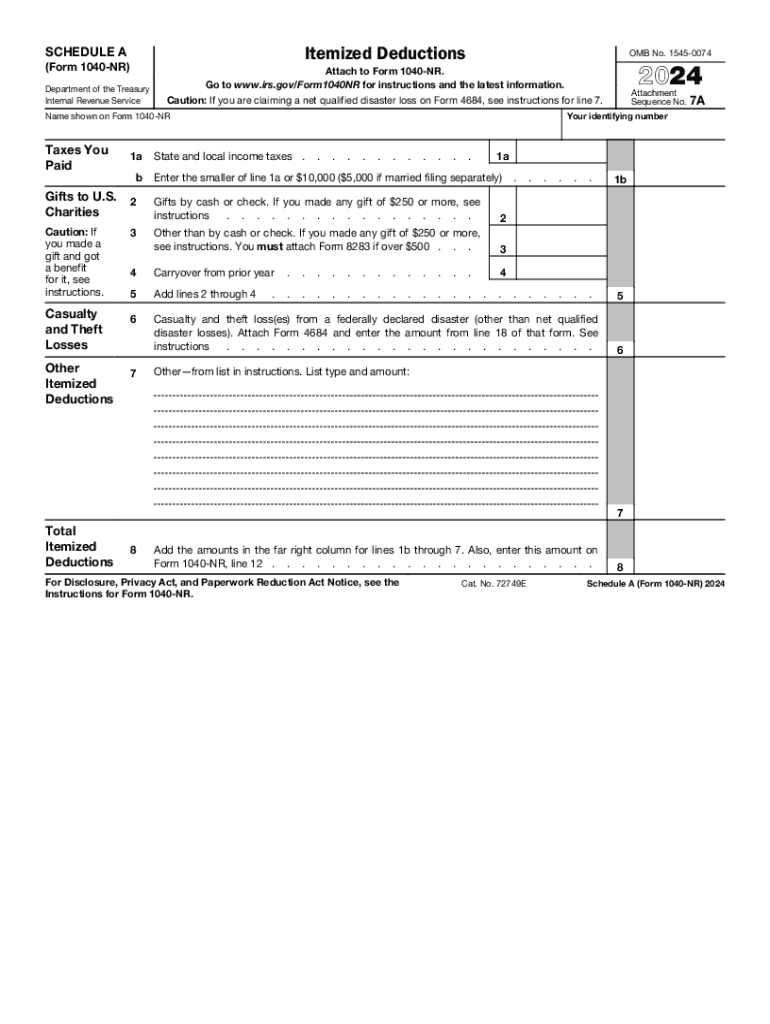

The Schedule A Form 1040 NR is specifically designed for non-resident aliens who are required to file a U.S. tax return. This form allows taxpayers to itemize deductions instead of taking the standard deduction. By itemizing, individuals may reduce their taxable income based on eligible expenses incurred during the tax year. Common deductions include medical expenses, state and local taxes, mortgage interest, and charitable contributions. Understanding the specific deductions available can significantly impact the overall tax liability for non-resident aliens.

How to Complete the Schedule A Form 1040 NR Itemized Deductions

Filling out the Schedule A Form 1040 NR involves several steps. First, gather all necessary documentation, including receipts and statements for deductible expenses. Next, follow the form's sections carefully:

- Medical and Dental Expenses: Report qualifying medical expenses that exceed a certain percentage of your adjusted gross income.

- Taxes You Paid: Include state and local taxes, as well as foreign taxes if applicable.

- Interest You Paid: Document mortgage interest and any other interest payments that qualify.

- Charitable Contributions: List donations made to qualified organizations.

Ensure that all entries are accurate and supported by documentation. Once completed, the form should be attached to your main tax return.

Obtaining the Schedule A Form 1040 NR Itemized Deductions

The Schedule A Form 1040 NR can be obtained directly from the IRS website or through tax preparation software that supports non-resident alien filings. It is important to ensure that you are using the most current version of the form for the tax year you are filing. Additionally, tax professionals can provide assistance in obtaining and completing this form.

IRS Guidelines for Schedule A Form 1040 NR Itemized Deductions

The IRS provides specific guidelines regarding what qualifies as an itemized deduction on the Schedule A Form 1040 NR. Familiarizing yourself with these guidelines is crucial to ensure compliance and maximize potential deductions. The IRS outlines eligibility criteria for each type of deduction, including limits and documentation requirements. Taxpayers should review these guidelines annually, as they may change from year to year.

Filing Deadlines for Schedule A Form 1040 NR Itemized Deductions

Filing deadlines for the Schedule A Form 1040 NR align with the general tax return deadlines for non-resident aliens. Typically, this is due on April 15 for most taxpayers, but extensions may be available. It is essential to check the IRS website for any updates or changes to deadlines, especially for the 2024 tax year, to avoid penalties.

Required Documents for Schedule A Form 1040 NR Itemized Deductions

When preparing to file the Schedule A Form 1040 NR, certain documents are necessary to substantiate your claims. These include:

- Receipts for medical expenses and insurance premiums.

- Proof of state and local taxes paid, such as W-2 forms or 1099s.

- Mortgage statements showing interest paid.

- Documentation for charitable contributions, including receipts and acknowledgment letters.

Having these documents ready will facilitate a smoother filing process and help ensure that all deductions claimed are valid.

Create this form in 5 minutes or less

Find and fill out the correct schedule a form 1040 nr itemized deductions

Create this form in 5 minutes!

How to create an eSignature for the schedule a form 1040 nr itemized deductions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow related to 2024 IRS deductions?

airSlate SignNow offers features that streamline document management, making it easier to track and organize your 2024 IRS deductions. With eSignature capabilities, you can quickly sign and send tax-related documents, ensuring compliance and efficiency. This helps businesses save time and reduce errors when preparing for tax season.

-

How can airSlate SignNow help me maximize my 2024 IRS deductions?

By using airSlate SignNow, you can efficiently manage and store all documents related to your 2024 IRS deductions. The platform allows for easy collaboration and sharing of documents with your accountant or tax advisor, ensuring that you don’t miss any potential deductions. This can ultimately lead to signNow savings on your tax return.

-

Is airSlate SignNow cost-effective for managing 2024 IRS deductions?

Yes, airSlate SignNow is a cost-effective solution for managing your 2024 IRS deductions. With various pricing plans available, you can choose one that fits your budget while still accessing powerful features. This affordability makes it an ideal choice for small businesses and freelancers looking to optimize their tax processes.

-

What integrations does airSlate SignNow offer for handling 2024 IRS deductions?

airSlate SignNow integrates seamlessly with popular accounting software, which is essential for managing your 2024 IRS deductions. These integrations allow for automatic syncing of documents and data, reducing manual entry and the risk of errors. This ensures that all your financial information is up-to-date and easily accessible.

-

Can I use airSlate SignNow on mobile devices for my 2024 IRS deductions?

Absolutely! airSlate SignNow is fully optimized for mobile devices, allowing you to manage your 2024 IRS deductions on the go. Whether you need to sign documents or access important files, the mobile app provides the flexibility to handle your tax-related tasks anytime, anywhere.

-

How secure is airSlate SignNow for storing documents related to 2024 IRS deductions?

Security is a top priority for airSlate SignNow, especially when it comes to sensitive documents related to your 2024 IRS deductions. The platform employs advanced encryption and security protocols to protect your data. You can confidently store and share your tax documents, knowing they are safe from unauthorized access.

-

What support options are available for airSlate SignNow users managing 2024 IRS deductions?

airSlate SignNow provides comprehensive support options for users managing their 2024 IRS deductions. You can access a knowledge base, live chat, and email support to get assistance whenever you need it. This ensures that you have the help necessary to navigate any challenges related to your tax documents.

Get more for SCHEDULE A Form 1040 NR Itemized Deductions

Find out other SCHEDULE A Form 1040 NR Itemized Deductions

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile