Virginia Form 502 2023-2026

What is the Virginia Form 502

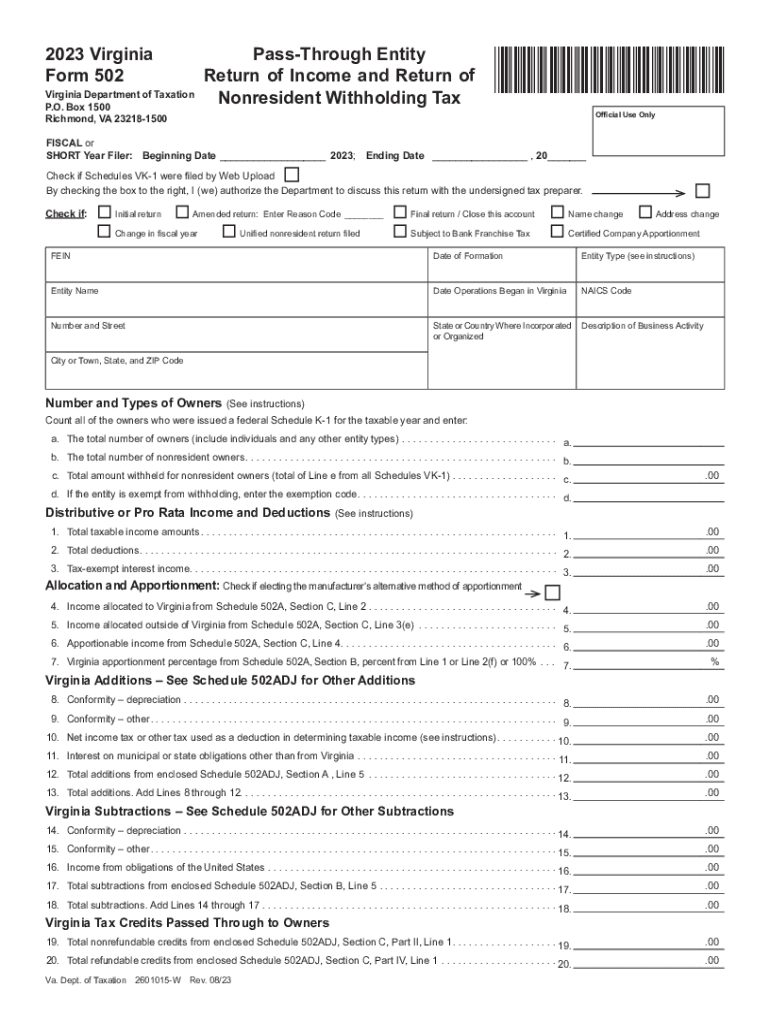

The Virginia Form 502 is the state income tax return form used by individuals and businesses to report their income and calculate their tax liability in Virginia. It is specifically designed for residents and non-residents who earn income within the state. The form collects essential information, including income sources, deductions, and credits, to determine the amount of tax owed or the refund due. Understanding this form is crucial for compliance with Virginia tax laws.

Steps to complete the Virginia Form 502

Completing the Virginia Form 502 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documents, such as W-2s, 1099s, and any other income statements. Next, fill out personal information, including your name, address, and Social Security number. Then, report your total income and applicable deductions. It is important to carefully follow the instructions provided on the form to avoid errors. Finally, calculate your tax owed or refund due before signing and dating the form.

How to obtain the Virginia Form 502

The Virginia Form 502 can be obtained through various channels. It is available for download on the Virginia Department of Taxation's official website, where you can find the most current version for the tax year. Additionally, physical copies of the form can be requested by contacting the Virginia Department of Taxation at their designated phone number. Local libraries and tax preparation offices may also have copies available for public use.

Filing Deadlines / Important Dates

Filing deadlines for the Virginia Form 502 are critical to avoid penalties. Typically, the deadline for filing individual income tax returns is May 1 of the year following the tax year. If May 1 falls on a weekend or holiday, the deadline is extended to the next business day. It is advisable to check for any updates or changes to these deadlines, as they can vary based on specific circumstances or legislative changes.

Form Submission Methods (Online / Mail / In-Person)

The Virginia Form 502 can be submitted through multiple methods, providing flexibility for taxpayers. You can file the form electronically using approved e-filing software, which often allows for faster processing and confirmation of receipt. Alternatively, the form can be printed and mailed to the Virginia Department of Taxation at the address specified in the instructions. In-person submissions may also be possible at designated tax offices, depending on local regulations and availability.

Key elements of the Virginia Form 502

Understanding the key elements of the Virginia Form 502 is essential for accurate completion. The form includes sections for personal information, income reporting, deductions, and credits. It also contains a calculation section to determine the total tax owed or refund due. Each component must be filled out carefully, as errors can lead to delays in processing or potential penalties. Familiarizing yourself with these elements can streamline the filing process.

Legal use of the Virginia Form 502

The Virginia Form 502 is legally required for individuals and entities that meet specific income thresholds or have tax obligations in Virginia. Filing this form accurately and on time is essential for compliance with state tax laws. Failure to file or inaccuracies can result in penalties, interest, or audits. It is important to consult with a tax professional if you have questions about your legal obligations regarding this form.

Quick guide on how to complete virginia form 502

Finish Virginia Form 502 seamlessly on any gadget

Digital document management has become increasingly favored by corporations and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can find the necessary form and safely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Virginia Form 502 on any gadget using airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

How to modify and eSign Virginia Form 502 effortlessly

- Find Virginia Form 502 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight essential parts of the documents or mask sensitive information with tools that airSlate SignNow has designed specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your adjustments.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Alter and eSign Virginia Form 502 and guarantee superior communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct virginia form 502

Create this form in 5 minutes!

How to create an eSignature for the virginia form 502

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2022 Virginia Form 502?

The 2022 Virginia Form 502 is the individual income tax return form used by residents of Virginia. It is crucial for reporting income, claiming deductions, and calculating any taxes owed. Utilizing airSlate SignNow can simplify the process of signing and sending this form securely.

-

How can airSlate SignNow help with the 2022 Virginia Form 502?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the 2022 Virginia Form 502. Our solution ensures document security and compliance, allowing you to streamline the filing process and save valuable time.

-

Is airSlate SignNow cost-effective for eSigning the 2022 Virginia Form 502?

Yes, airSlate SignNow is a cost-effective solution for eSigning the 2022 Virginia Form 502. Our pricing plans are designed to provide value while accommodating various budgeting needs, making it accessible for both individuals and businesses.

-

Can I integrate airSlate SignNow with other software for managing the 2022 Virginia Form 502?

Absolutely! airSlate SignNow offers integration with numerous platforms such as CRM software and cloud storage services, allowing for seamless management of the 2022 Virginia Form 502. This enhances your workflow and ensures all documents are easily accessible.

-

What security features does airSlate SignNow offer for the 2022 Virginia Form 502?

Security is a top priority at airSlate SignNow. When handling the 2022 Virginia Form 502, our platform uses encryption and secure data storage to protect your sensitive information, ensuring that your documents are safe during transactions.

-

Can I track the status of my 2022 Virginia Form 502 with airSlate SignNow?

Yes, airSlate SignNow offers real-time tracking features that allow you to monitor the status of your 2022 Virginia Form 502. This ensures you are updated on when recipients have viewed, signed, or completed the document, leading to a more organized filing process.

-

What are the benefits of using airSlate SignNow for the 2022 Virginia Form 502?

Using airSlate SignNow for the 2022 Virginia Form 502 offers numerous benefits, including enhanced speed, convenience, and reduced paperwork. You can complete your tax filing efficiently while keeping everything organized and secure.

Get more for Virginia Form 502

- Iom prepaid prescription form

- Paycheck protection program loan forgiveness application form 516779569

- Rd108 form

- Virginia concealed carry permit application form

- Publication 1915 rev 2 2021 understanding your irs individual taxpayer identification number itin form

- 2020 publication 4681 canceled debts foreclosures repossessions and abandonments for individuals form

- Miami dade county field trip form

- Important changes to the tax year 2020 form 10a

Find out other Virginia Form 502

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate