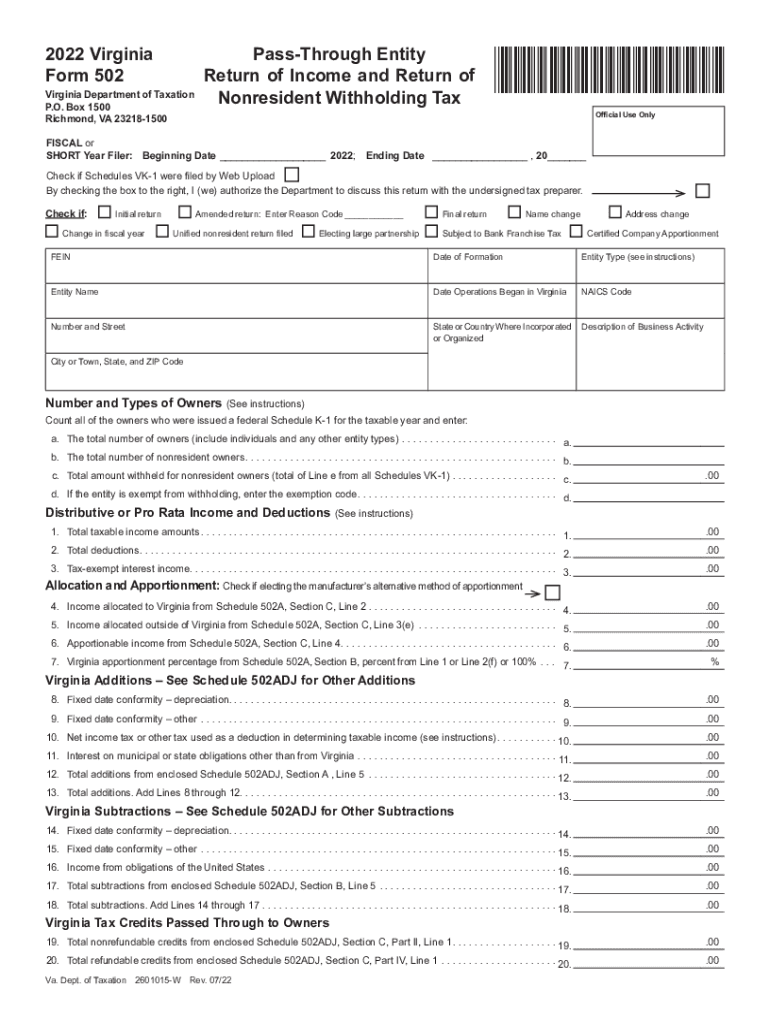

Virginia Department of Taxation Income Tax Return P O Box 1500 2022

Understanding the Virginia Department of Taxation Income Tax Return

The Virginia Department of Taxation Income Tax Return is a crucial document for individuals and businesses in Virginia. It serves as the official form for reporting income, calculating tax liabilities, and claiming any applicable credits. This form is essential for ensuring compliance with state tax laws and regulations. By accurately completing this form, taxpayers can avoid penalties and ensure they fulfill their tax obligations.

Steps to Complete the Virginia Department of Taxation Income Tax Return

Completing the Virginia Department of Taxation Income Tax Return involves several key steps:

- Gather necessary documentation, including W-2s, 1099s, and any other relevant income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, ensuring that all figures match your documentation.

- Calculate your total tax liability using the provided tax tables or software tools.

- Claim any deductions or credits you are eligible for, such as the standard deduction or specific tax credits.

- Review your completed form for accuracy before submission.

Legal Use of the Virginia Department of Taxation Income Tax Return

The Virginia Department of Taxation Income Tax Return must be used in accordance with state tax laws. This form is legally binding and must be completed truthfully. Any inaccuracies or omissions can lead to penalties, including fines or additional taxes owed. It is important to keep a copy of the submitted form and any supporting documents for your records, as they may be needed for future reference or in the event of an audit.

Form Submission Methods

Taxpayers have several options for submitting the Virginia Department of Taxation Income Tax Return:

- Online: Many taxpayers choose to file electronically through the Virginia Department of Taxation's website or approved e-filing software.

- Mail: Completed forms can be printed and mailed to the appropriate address provided by the Virginia Department of Taxation.

- In-Person: Some taxpayers may prefer to deliver their forms in person at local tax offices, where assistance may also be available.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the Virginia Department of Taxation Income Tax Return. Typically, the deadline for individual income tax returns is May 1 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions that may apply and the implications of late submissions.

Required Documents

To complete the Virginia Department of Taxation Income Tax Return, taxpayers must gather several documents:

- W-2 forms from employers, which report annual wages and withheld taxes.

- 1099 forms for any freelance or contract work, detailing additional income.

- Records of any deductions or credits being claimed, such as receipts or statements.

- Previous year's tax returns, which can provide useful reference points.

Eligibility Criteria

Eligibility to file the Virginia Department of Taxation Income Tax Return generally includes being a resident of Virginia or earning income sourced from Virginia. Specific criteria may vary based on individual circumstances, such as age or filing status. It is advisable to review the eligibility requirements outlined by the Virginia Department of Taxation to ensure compliance.

Quick guide on how to complete virginia department of taxation income tax return po box 1500

Complete Virginia Department Of Taxation Income Tax Return P O Box 1500 seamlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly and without delays. Manage Virginia Department Of Taxation Income Tax Return P O Box 1500 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The easiest way to modify and eSign Virginia Department Of Taxation Income Tax Return P O Box 1500 effortlessly

- Find Virginia Department Of Taxation Income Tax Return P O Box 1500 and click Get Form to begin.

- Utilize the tools we offer to finish your form.

- Emphasize important parts of your documents or redact sensitive information with tools specifically designed for that function by airSlate SignNow.

- Produce your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred delivery method for the form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or mislaid files, time-consuming form searching, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Virginia Department Of Taxation Income Tax Return P O Box 1500 to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct virginia department of taxation income tax return po box 1500

Create this form in 5 minutes!

People also ask

-

What is the VA Form 502 and how can airSlate SignNow help with it?

The VA Form 502 is a critical document used for various administrative purposes. airSlate SignNow simplifies the process of filling out, signing, and sending the VA Form 502 electronically, ensuring a streamlined workflow and secure signatures.

-

Is there a cost associated with using airSlate SignNow for VA Form 502?

Yes, airSlate SignNow offers various pricing plans, including options that cater to individual users as well as businesses. You can choose a plan that suits your needs while effectively managing the costs associated with handling VA Form 502.

-

What features does airSlate SignNow provide for managing VA Form 502?

airSlate SignNow provides an intuitive platform for creating, editing, and securely eSigning VA Form 502. Features include templates, document tracking, and automated reminders, ensuring a smooth process from initiation to completion.

-

Can airSlate SignNow integrate with other tools I use for VA Form 502?

Absolutely! airSlate SignNow seamlessly integrates with popular applications like Google Drive, Salesforce, and more. This allows for easy management of VA Form 502 along with other essential documents in your existing workflow.

-

How does airSlate SignNow enhance the security of VA Form 502?

airSlate SignNow prioritizes security with advanced encryption protocols and data protection measures, ensuring that your VA Form 502 remains confidential and secure throughout the signing process.

-

Can I access my VA Form 502 from multiple devices with airSlate SignNow?

Yes, airSlate SignNow is a cloud-based solution that allows you to access and manage your VA Form 502 from any device, whether it's a smartphone, tablet, or computer, making it convenient and flexible for users.

-

What benefits can I expect from using airSlate SignNow for VA Form 502?

Using airSlate SignNow for VA Form 502 offers numerous benefits including reduced processing time, increased efficiency, and enhanced collaboration. The ease of use and accessibility make it an ideal choice for individuals and organizations handling important documents.

Get more for Virginia Department Of Taxation Income Tax Return P O Box 1500

- Notice of assignment to living trust ohio form

- Revocation of living trust ohio form

- Letter to lienholder to notify of trust ohio form

- Ohio deed 497322459 form

- Ohio timber sale contract ohio form

- Ohio forest products timber sale contract ohio form

- Easement scenic form

- Grant of conservation easement from husband and wife ohio form

Find out other Virginia Department Of Taxation Income Tax Return P O Box 1500

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract