Form 502 Pass through Entity Return of Income and Return of Nonresident Withholding Tax 2020

Understanding the Virginia Tax Form 502

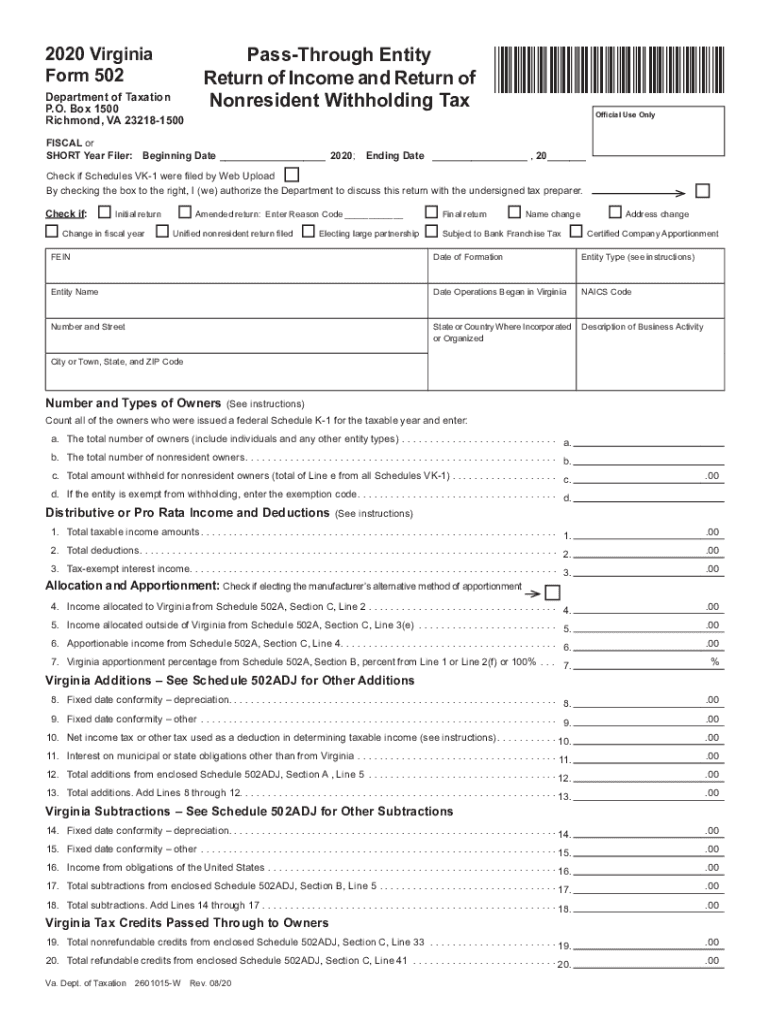

The Virginia Tax Form 502 is a crucial document for pass-through entities, such as partnerships, S corporations, and limited liability companies (LLCs). This form serves as the Pass Through Entity Return of Income and Return of Nonresident Withholding Tax. It is essential for reporting income earned by the entity and for withholding tax obligations for nonresident members. Properly completing this form ensures compliance with Virginia tax regulations and helps avoid potential penalties.

Steps to Complete the Virginia Tax Form 502

Filling out the Virginia Tax Form 502 involves several key steps:

- Gather necessary information about the entity, including its federal employer identification number (EIN), and the names and addresses of all members.

- Calculate the total income earned by the entity, including any deductions and credits applicable to the business.

- Determine the withholding tax amount for nonresident members based on their share of the income.

- Complete each section of the form accurately, ensuring that all calculations are correct.

- Review the completed form for accuracy and ensure all required signatures are included.

Obtaining the Virginia Tax Form 502

The Virginia Tax Form 502 can be easily obtained through the Virginia Department of Taxation’s official website. It is available as a downloadable PDF, allowing for easy access and printing. Additionally, tax professionals and accountants may have copies of this form available for their clients. If you prefer, you can also request a physical copy by contacting the Virginia Department of Taxation directly.

Key Elements of the Virginia Tax Form 502

Understanding the key elements of the Virginia Tax Form 502 is vital for accurate completion:

- Entity Information: This section requires details about the pass-through entity, including its name, address, and EIN.

- Income Calculation: Report all income earned by the entity, including any applicable deductions or credits.

- Nonresident Withholding Tax: Calculate the withholding tax for nonresident members based on their share of the income.

- Signatures: Ensure that the form is signed by an authorized representative of the entity.

Filing Deadlines for the Virginia Tax Form 502

Timely filing of the Virginia Tax Form 502 is essential to avoid penalties. The form is typically due on the fifteenth day of the fourth month following the end of the entity's tax year. For most entities operating on a calendar year basis, this means the form is due by April 15. It is important to stay informed about any changes to deadlines or requirements that may occur annually.

Legal Use of the Virginia Tax Form 502

The Virginia Tax Form 502 must be filed in accordance with state tax laws. It is legally binding and must be completed accurately to reflect the entity's income and withholding obligations. Failure to comply with filing requirements can result in penalties, including fines and interest on unpaid taxes. Using a reliable digital platform for e-signatures can enhance the security and legitimacy of the completed form.

Quick guide on how to complete 2020 form 502 pass through entity return of income and return of nonresident withholding tax

Complete Form 502 Pass Through Entity Return Of Income And Return Of Nonresident Withholding Tax effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-conscious alternative to traditional printed and signed documents, as you can access the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Form 502 Pass Through Entity Return Of Income And Return Of Nonresident Withholding Tax on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest method to modify and eSign Form 502 Pass Through Entity Return Of Income And Return Of Nonresident Withholding Tax with ease

- Locate Form 502 Pass Through Entity Return Of Income And Return Of Nonresident Withholding Tax and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, frustrating form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Form 502 Pass Through Entity Return Of Income And Return Of Nonresident Withholding Tax and ensure outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 502 pass through entity return of income and return of nonresident withholding tax

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 502 pass through entity return of income and return of nonresident withholding tax

The way to generate an eSignature for a PDF online

The way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

How to generate an eSignature for a PDF on Android

People also ask

-

What is the Virginia tax form 502 2019, and why is it important?

The Virginia tax form 502 2019 is a state tax return form used by partnerships and limited liability companies (LLCs) to report income and calculate tax liability. It is important for ensuring compliance with Virginia tax regulations and for submitting accurate financial information to the state.

-

How can airSlate SignNow help me with the Virginia tax form 502 2019?

airSlate SignNow provides businesses with an efficient platform to prepare, send, and eSign the Virginia tax form 502 2019. With its user-friendly interface, you can easily manage your documents without the hassle of printing or mailing, keeping your tax filing process streamlined.

-

Is there a cost associated with using airSlate SignNow for the Virginia tax form 502 2019?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Each plan includes features that can help you manage documents like the Virginia tax form 502 2019 effectively and cost-effectively, making it a valuable investment for businesses.

-

What features does airSlate SignNow provide for managing the Virginia tax form 502 2019?

airSlate SignNow offers features such as eSigning, document templates, and automated workflows that help simplify the process of handling the Virginia tax form 502 2019. These tools enable you to collaborate easily with team members and ensure timely submissions.

-

Can I integrate airSlate SignNow with other software for the Virginia tax form 502 2019?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions, allowing you to streamline your workflow for the Virginia tax form 502 2019. This integration helps to enhance productivity and ensures all your documentation processes are centralized.

-

What are the benefits of using airSlate SignNow for my Virginia tax form 502 2019 submissions?

Using airSlate SignNow for your Virginia tax form 502 2019 submissions allows for faster processing times, increased security, and reduced paperwork. The platform makes it simple to obtain signatures electronically, saving you time and ensuring compliance.

-

Is airSlate SignNow secure for handling sensitive information like the Virginia tax form 502 2019?

Yes, airSlate SignNow prioritizes security and uses advanced encryption technologies to protect your sensitive data, including information related to the Virginia tax form 502 2019. You can trust that your documents remain confidential and secure throughout the process.

Get more for Form 502 Pass Through Entity Return Of Income And Return Of Nonresident Withholding Tax

- Wpf ps 010450 residential schedule proposed rsp temporary rst final order rs washington form

- Order child support sample form

- Wpf ps 100800 motion and declaration for order appointing guardian ad litem mtapgl washington form

- Order appointing guardian ad form

- Wpf ps 020200 motion and declaration for order to require genetic tests mtaf washington form

- Washington ps form

- Wpf ps 020300 order requiring genetic tests orbt washington form

- Chain custody form

Find out other Form 502 Pass Through Entity Return Of Income And Return Of Nonresident Withholding Tax

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast