DO HOTMAIL!Classmate of Georgia Department of Reve 2015

Understanding the Georgia Form G-7 Quarterly Return

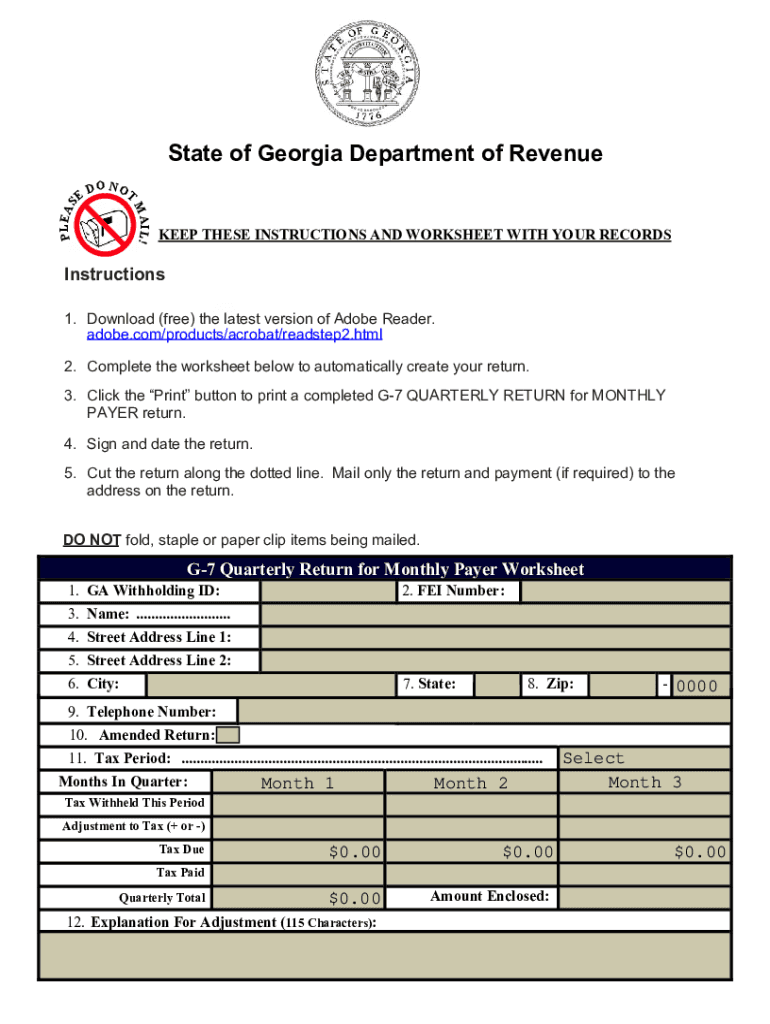

The Georgia Form G-7, also known as the G-7 quarterly return, is a crucial document for businesses operating in Georgia. This form is used to report and remit sales and use tax collected during the quarter. It is essential for ensuring compliance with state tax regulations and for maintaining good standing with the Georgia Department of Revenue. The form must be filed by businesses that have collected sales tax from customers, and it is typically due on a quarterly basis.

Steps to Complete the Georgia Form G-7

Completing the Georgia Form G-7 requires careful attention to detail. Here are the steps to follow:

- Gather all sales records for the quarter, including receipts and invoices.

- Calculate the total sales tax collected during the quarter.

- Fill out the form with the required information, including your business details and the total amount of sales tax due.

- Double-check all entries for accuracy to avoid penalties.

- Submit the form by the due date, either online or by mail.

Filing Deadlines for the Georgia Form G-7

It is important to be aware of the filing deadlines for the Georgia Form G-7. The form is due on the 20th day of the month following the end of the quarter. For example, the deadlines are:

- First Quarter: April 20

- Second Quarter: July 20

- Third Quarter: October 20

- Fourth Quarter: January 20

Required Documents for Filing

When preparing to file the Georgia Form G-7, certain documents are necessary to ensure accurate reporting. These include:

- Sales records for the reporting period.

- Invoices and receipts that detail sales transactions.

- Any previous tax filings that may be relevant for comparison.

Penalties for Non-Compliance

Failure to file the Georgia Form G-7 on time can result in significant penalties. Businesses may face fines, interest on unpaid taxes, and potential legal action from the Georgia Department of Revenue. It is essential to file on time and accurately to avoid these repercussions.

Form Submission Methods

The Georgia Form G-7 can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission through the Georgia Department of Revenue website.

- Mailing a paper copy of the form to the appropriate address.

- In-person submission at local Department of Revenue offices.

Eligibility Criteria for Filing the Georgia Form G-7

To be eligible to file the Georgia Form G-7, businesses must be registered with the Georgia Department of Revenue and have a sales tax account. This includes various business entity types such as LLCs, corporations, and partnerships that engage in taxable sales within the state.

Quick guide on how to complete do hotmailclassmate of georgia department of reve

Complete DO HOTMAIL!Classmate Of Georgia Department Of Reve effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage DO HOTMAIL!Classmate Of Georgia Department Of Reve on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign DO HOTMAIL!Classmate Of Georgia Department Of Reve with ease

- Locate DO HOTMAIL!Classmate Of Georgia Department Of Reve and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal standing as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign DO HOTMAIL!Classmate Of Georgia Department Of Reve and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct do hotmailclassmate of georgia department of reve

Create this form in 5 minutes!

How to create an eSignature for the do hotmailclassmate of georgia department of reve

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'ga form quarterly' and how can it benefit my business?

The 'ga form quarterly' is a streamlined document that allows businesses to gather essential information and insights on a quarterly basis. Utilizing airSlate SignNow for this process enables you to electronically sign, share, and receive documents quickly and efficiently. This can save time, reduce errors, and ultimately enhance your reporting capability.

-

How much does airSlate SignNow cost for companies using the 'ga form quarterly'?

airSlate SignNow offers various pricing plans to accommodate businesses of all sizes. Pricing may vary depending on the specific features and number of users required for efficiently managing the 'ga form quarterly.' It's recommended to check the official website for the most recent pricing information and any available promotions.

-

Can I customize the 'ga form quarterly' template in airSlate SignNow?

Yes, airSlate SignNow offers customizable templates, including the 'ga form quarterly.' You can modify the fields, layout, and design to suit your business needs, ensuring that the template meets all necessary compliance and operational standards.

-

What features does airSlate SignNow provide for managing the 'ga form quarterly'?

airSlate SignNow provides a range of features to effectively manage the 'ga form quarterly,' including eSigning, template creation, and automated workflows. These features ensure you can streamline the entire documentation process, making it quick and hassle-free. Additionally, you can track the status of documents sent for signatures in real-time.

-

Is it easy to integrate airSlate SignNow with other tools for the 'ga form quarterly'?

Absolutely! airSlate SignNow integrates seamlessly with numerous third-party applications, enhancing your workflow for the 'ga form quarterly.' This allows you to connect the platform with CRM systems, cloud storage solutions, and other essential tools used in your business operations.

-

How secure is the 'ga form quarterly' when using airSlate SignNow?

airSlate SignNow prioritizes security and employs advanced encryption protocols to protect your 'ga form quarterly' and all documents shared through the platform. With secure access controls and compliance with major regulations, you can rest assured that your sensitive information is safe.

-

Can I track changes made to the 'ga form quarterly' in airSlate SignNow?

Yes, airSlate SignNow includes version tracking features for documents like the 'ga form quarterly.' This means you can easily monitor changes, view document history, and ensure that all updates are accurately logged, enhancing accountability in your business processes.

Get more for DO HOTMAIL!Classmate Of Georgia Department Of Reve

- Do not resuscitate form edit fill create download appco

- Make sure you display this form as visibly as possible for first

- Hs309 form

- Medication destruction log form

- Lic 604a form

- Wage and insurance verification child support services form

- Calpers tax withholding election blank form

- Imperial county health department in el centro ca form

Find out other DO HOTMAIL!Classmate Of Georgia Department Of Reve

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter