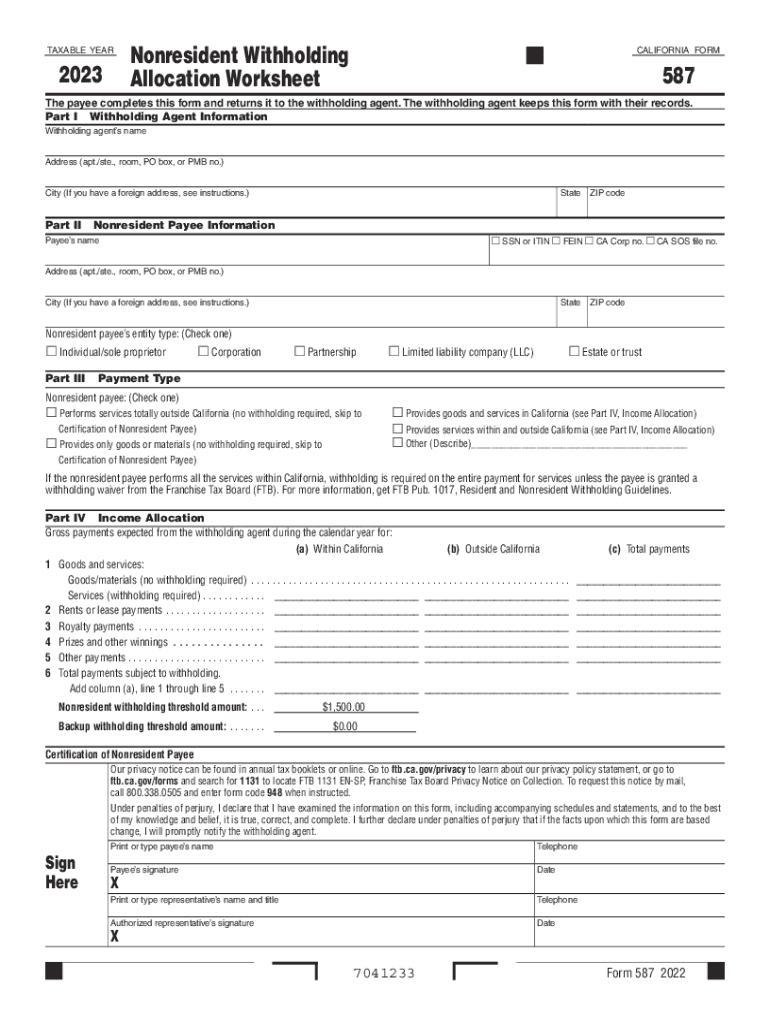

FORM 587 Nonresident Withholding Allocation Worksheet CALIFORNIA 2022

What is the California Form 587 Nonresident Withholding Allocation Worksheet?

The California Form 587 is a tax document known as the Nonresident Withholding Allocation Worksheet. It is used by nonresident individuals and entities to allocate California source income and determine the amount of withholding tax required. This form is particularly important for nonresidents who receive income from California sources, as it helps ensure compliance with state tax regulations. By accurately completing the form, taxpayers can avoid over-withholding or under-withholding, which can lead to penalties or delayed refunds.

Steps to Complete the California Form 587

Completing the California Form 587 involves several key steps:

- Begin by providing your personal information, including your name, address, and taxpayer identification number.

- Identify the type of income you are receiving from California sources, such as rental income or wages.

- Allocate the income by specifying the amount earned in California versus other states.

- Calculate the withholding amount based on the allocated California income and the applicable tax rate.

- Review the completed form for accuracy before submission.

How to Obtain the California Form 587

The California Form 587 can be obtained through the California Franchise Tax Board (FTB) website. It is available as a fillable PDF, allowing users to complete the form electronically. Additionally, physical copies can often be found at tax preparation offices or local government offices. It is advisable to ensure that you are using the correct version of the form for the tax year in question, as forms may change from year to year.

Key Elements of the California Form 587

Several key elements must be included when filling out the California Form 587:

- Taxpayer Information: Accurate identification details of the taxpayer.

- Income Allocation: Clear breakdown of California source income versus total income.

- Withholding Calculation: Specific calculations that determine the withholding amount based on allocated income.

- Signature: Required signature of the taxpayer or authorized representative to validate the form.

Legal Use of the California Form 587

The California Form 587 is legally required for nonresidents who earn income from California sources. It ensures that appropriate withholding taxes are collected and reported to the state. Failure to submit this form when required can lead to penalties, including fines and interest on unpaid taxes. It is important for taxpayers to understand their obligations under California tax law and to use this form correctly to maintain compliance.

Filing Deadlines for the California Form 587

Filing deadlines for the California Form 587 typically align with the tax year deadlines. Nonresidents must submit the form along with any withholding payments by the due date of their tax return. For most individuals, this is April fifteenth of the following year. However, if the taxpayer is a business entity, different deadlines may apply based on the entity type. It is essential to check the California Franchise Tax Board's guidelines for specific dates related to your situation.

Quick guide on how to complete form 587 nonresident withholding allocation worksheet california

Complete FORM 587 Nonresident Withholding Allocation Worksheet CALIFORNIA effortlessly on any device

Internet document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage FORM 587 Nonresident Withholding Allocation Worksheet CALIFORNIA on any platform using airSlate SignNow Android or iOS applications and enhance any document-related operation today.

The simplest method to modify and eSign FORM 587 Nonresident Withholding Allocation Worksheet CALIFORNIA seamlessly

- Find FORM 587 Nonresident Withholding Allocation Worksheet CALIFORNIA and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that function.

- Create your signature using the Sign tool, which takes moments and carries the same legal significance as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced files, cumbersome form searches, or errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign FORM 587 Nonresident Withholding Allocation Worksheet CALIFORNIA and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 587 nonresident withholding allocation worksheet california

Create this form in 5 minutes!

How to create an eSignature for the form 587 nonresident withholding allocation worksheet california

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the California Form 587 2019 Fillable used for?

The California Form 587 2019 Fillable is utilized for reporting an individual's income from California sources. By filling out this form, taxpayers ensure they comply with state tax regulations, ultimately making the filing process easier and more efficient.

-

How can I access the California Form 587 2019 Fillable?

You can access the California Form 587 2019 Fillable directly from the airSlate SignNow platform. Our easy-to-navigate interface allows you to find and fill out this form quickly, streamlining your document signing process.

-

Is there a cost associated with using the California Form 587 2019 Fillable on airSlate SignNow?

airSlate SignNow offers various pricing tiers, which may include access to the California Form 587 2019 Fillable. With our competitive pricing, users can enjoy an affordable solution for their eSignature and document management needs.

-

Can I integrate the California Form 587 2019 Fillable with other software?

Yes, airSlate SignNow allows for seamless integration with various software applications. This capability enables users to efficiently incorporate the California Form 587 2019 Fillable into their existing workflows while maintaining a professional standard.

-

What are the benefits of using airSlate SignNow for the California Form 587 2019 Fillable?

Using airSlate SignNow for the California Form 587 2019 Fillable provides numerous benefits, including a user-friendly interface, the ability to eSign documents, and secure storage options. This makes managing your forms and documents faster and more reliable.

-

Is it easy to fill out the California Form 587 2019 Fillable online?

Absolutely! The California Form 587 2019 Fillable on airSlate SignNow is designed for ease of use. Users can quickly fill out the form online, making document completion a breeze without the hassle of paper forms.

-

Can multiple users collaborate on the California Form 587 2019 Fillable?

Yes, airSlate SignNow allows for collaborative features that enable multiple users to work on the California Form 587 2019 Fillable simultaneously. This collaboration improves efficiency and ensures that all necessary information is captured securely.

Get more for FORM 587 Nonresident Withholding Allocation Worksheet CALIFORNIA

- Chapter 80 forms national interagency fire center

- Resource extension request form

- Choosing a retirement plan profit sharing planinternal form

- 457b plan deferred compensation form

- Lost person questionnaire form

- Lost person questionnaire 92474990 form

- Pretreatment program industrial user wastewater discharge form

- Fillable idaho voter registration form

Find out other FORM 587 Nonresident Withholding Allocation Worksheet CALIFORNIA

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free