Qualifications for Filing a California Form 540 2EZ 2021

Qualifications for Filing a California Form 540 2EZ

The California Form 540 2EZ is designed for taxpayers who meet specific qualifications. To be eligible, you must be a resident of California for the entire tax year and have a total income that does not exceed a certain threshold. Generally, this form is suitable for single filers or married couples filing jointly with simple tax situations. Your adjusted gross income must be below the limit set by the California Franchise Tax Board, which is updated annually. Additionally, you cannot claim any dependents on your tax return, and you must not have income from sources such as self-employment, rental properties, or capital gains.

Steps to Complete the California Form 540 2EZ

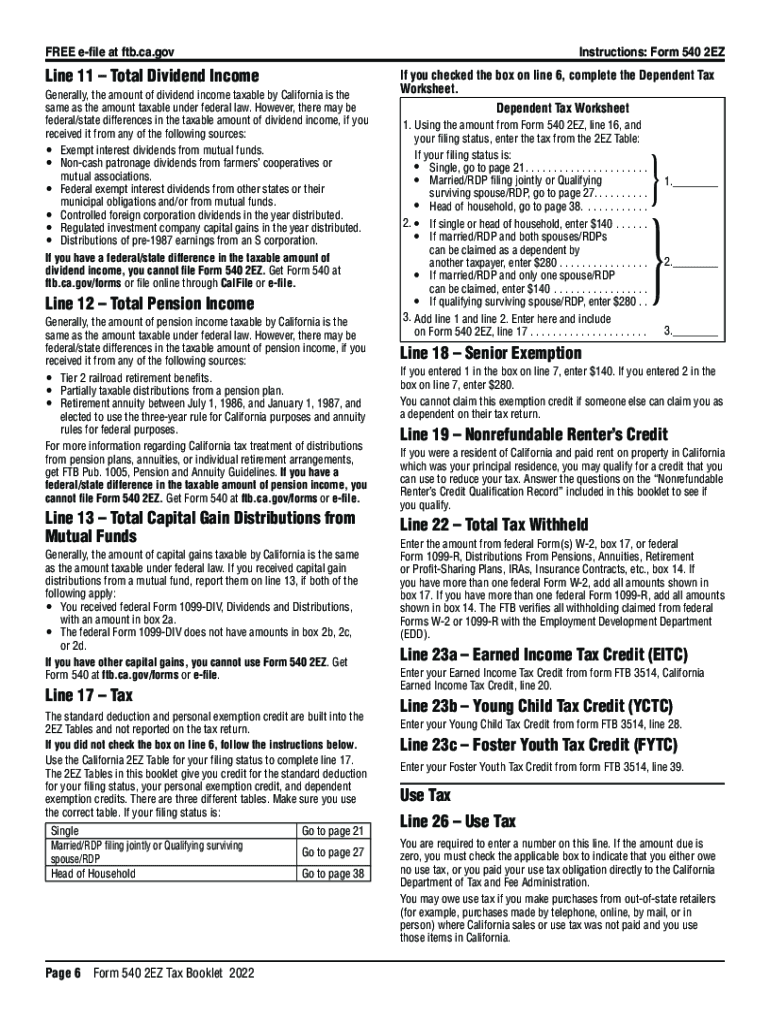

Completing the Form 540 2EZ involves several straightforward steps. First, gather all necessary documents, including your W-2 forms and any other income statements. Next, fill out your personal information, including your Social Security number and filing status. Then, report your income on the form, ensuring that all amounts are accurate and correspond to your documentation. After entering your income, calculate your total tax using the tax tables provided in the 540 2EZ tax booklet. Finally, review your completed form for accuracy before submitting it either electronically or by mail.

Required Documents for Filing

When preparing to file the California Form 540 2EZ, it is essential to have all required documents on hand. Key documents include your W-2 forms from employers, any 1099 forms for additional income, and records of any tax credits you may be eligible for. If you have received unemployment benefits, include the relevant documentation as well. Ensure that you have your California driver’s license or identification number, as this information is necessary for the form. Collecting these documents in advance will streamline the filing process and help avoid delays.

Filing Deadlines and Important Dates

Staying informed about filing deadlines is crucial for avoiding penalties. For the 2020 tax year, the deadline to file the California Form 540 2EZ is typically April 15 of the following year. However, if April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes to the filing schedule on the California Franchise Tax Board website. Additionally, if you need more time, you can request an extension, but be aware that this does not extend the time to pay any taxes owed.

Form Submission Methods

Taxpayers have various options for submitting the California Form 540 2EZ. You can file electronically using approved tax software, which often provides a more efficient and error-free process. Alternatively, you may print the completed form and mail it to the appropriate address as indicated in the instructions. If you prefer to file in person, you can visit a local tax office or community center that offers tax assistance. Regardless of the method chosen, ensure that you keep a copy of your submitted form and any supporting documents for your records.

Penalties for Non-Compliance

Failing to file the California Form 540 2EZ on time can result in penalties and interest on any unpaid taxes. The California Franchise Tax Board imposes a late filing penalty, which can accumulate over time. It is important to file even if you cannot pay the full amount owed, as this can help mitigate penalties. If you are unable to file by the deadline, consider requesting an extension to avoid further consequences. Understanding these penalties can motivate timely and accurate filing of your tax returns.

Quick guide on how to complete qualifications for filing a california form 540 2ez

Complete Qualifications For Filing A California Form 540 2EZ effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Qualifications For Filing A California Form 540 2EZ on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

The easiest way to modify and eSign Qualifications For Filing A California Form 540 2EZ without any hassle

- Locate Qualifications For Filing A California Form 540 2EZ and click on Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to preserve your changes.

- Select your preferred method to deliver your form: via email, SMS, invitation link, or download it directly to your computer.

Eliminate worries about lost or disorganized files, tedious form retrieval, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Qualifications For Filing A California Form 540 2EZ and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct qualifications for filing a california form 540 2ez

Create this form in 5 minutes!

How to create an eSignature for the qualifications for filing a california form 540 2ez

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 540 2ez form, and why do I need it?

The 540 2ez form is a simplified version of the California state income tax return designed for eligible taxpayers. It helps streamline the filing process, making it easier to report income and deductions. Using airSlate SignNow, you can easily access, complete, and eSign your 540 2ez form online, ensuring a hassle-free tax season.

-

How does airSlate SignNow help with the 540 2ez form?

airSlate SignNow provides an intuitive platform for preparing and eSigning your 540 2ez form quickly. With our user-friendly tools, you can fill out your tax information accurately and securely, minimizing errors. Additionally, you can share the document with tax professionals for review or file it directly from our platform.

-

Is there a cost associated with using airSlate SignNow for the 540 2ez form?

Yes, airSlate SignNow offers competitive pricing plans suited for individual users and businesses who need to eSign documents, including the 540 2ez form. We provide flexible subscription options to give you access to essential features and unlimited document signing. Visit our pricing page for more detailed information and to find a plan that fits your needs.

-

What features does airSlate SignNow offer for managing the 540 2ez form?

AirSlate SignNow includes numerous features to enhance your experience with the 540 2ez form, such as customizable templates, real-time collaboration, and bulk sending capabilities. You can track document status, receive notifications when your form is viewed or signed, and securely store all your documents for easy access. These features ensure you can manage your tax filings effectively.

-

Can I integrate airSlate SignNow with other software to assist with the 540 2ez form?

Absolutely! airSlate SignNow supports seamless integrations with popular accounting and tax software, making it easier to pull in data for your 540 2ez form. These integrations can help streamline your workflow and reduce redundancy, allowing you to focus on accuracy and compliance when filing your taxes.

-

Is airSlate SignNow secure for handling the 540 2ez form?

Yes, airSlate SignNow prioritizes the security of your documents, including the 540 2ez form. We utilize industry-leading encryption and comply with the highest data protection standards to ensure that your sensitive tax information remains confidential. You can trust that your files are safe while using our platform to manage your eSigning needs.

-

How can I access the 540 2ez form on airSlate SignNow?

To access the 540 2ez form on airSlate SignNow, simply log into your account and search for the form in our template library. If you have a hard copy, you can upload it and convert it into an editable format. Our platform allows for easy preparation, filling, and eSigning of the 540 2ez form, making tax season smoother for you.

Get more for Qualifications For Filing A California Form 540 2EZ

- Fort bend county farm bureau achievement and academic form

- Water tank cleaning checklist pdf form

- Drain cleaner restricted registrant verification of training affidavit answers form

- Reserve an appointment harris county clerks office form

- Pdf texas hazlewood act exemption application for continued form

- Daily building and grounds checklist form

- Fillable online duke clacs form to approve courses for

- Harris county appraisal district form 21mh 082011 hcad

Find out other Qualifications For Filing A California Form 540 2EZ

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter