CALIFORNIA 540 2EZ Forms & Instructions Personal Income Tax Booklet CALIFORNIA 540 2EZ Forms & Instructions Personal Inc 2020

Understanding the 2020 540 2EZ Tax Booklet

The 2020 540 2EZ tax booklet is a simplified form used by California residents to file their personal income taxes. This form is designed for individuals with straightforward tax situations, making it easier to report income and claim deductions. The 540 2EZ is particularly beneficial for those who do not have complex tax situations, such as multiple sources of income or significant itemized deductions.

To qualify for using the 2020 540 2EZ, taxpayers must meet specific criteria, including income limits and filing status. This form allows for a streamlined process, which can significantly reduce the time and effort required to complete a tax return.

Steps to Complete the 2020 540 2EZ Tax Booklet

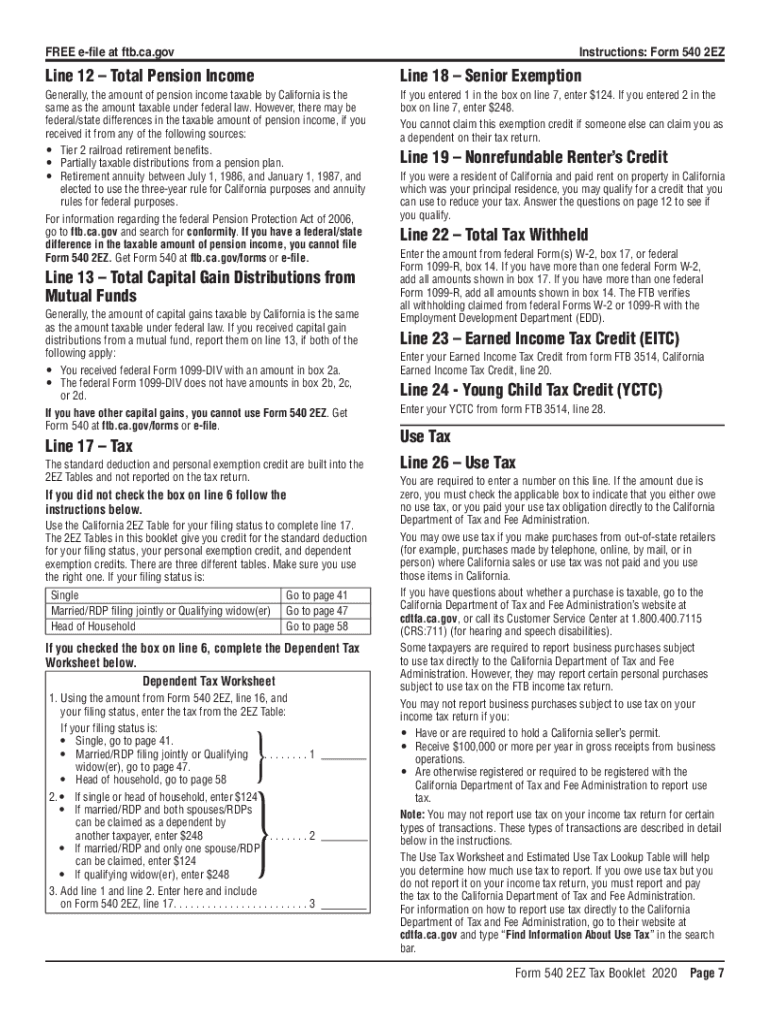

Completing the 2020 540 2EZ tax booklet involves several clear steps to ensure accurate filing. First, gather all necessary documents, including W-2 forms, 1099s, and any other income statements. Next, follow the instructions in the booklet carefully, filling out each section as prompted. Key sections include personal information, income details, and any applicable credits or deductions.

Once the form is filled out, review all entries for accuracy. It is crucial to ensure that all figures are correct to avoid potential issues with the California Franchise Tax Board. Finally, sign and date the form before submitting it, either electronically or by mail.

Legal Use of the 2020 540 2EZ Tax Booklet

The 2020 540 2EZ tax booklet is legally recognized as a valid document for filing state income taxes in California. To maintain its legal standing, it is essential to comply with all relevant tax laws and regulations. This includes ensuring that the information provided is accurate and complete, as any discrepancies may lead to penalties or audits.

Utilizing a reliable eSignature platform, like signNow, can enhance the security and legitimacy of your submission. This ensures that your signed document meets the legal requirements set forth by California tax authorities.

Obtaining the 2020 540 2EZ Tax Booklet

Taxpayers can obtain the 2020 540 2EZ tax booklet through various channels. The California Franchise Tax Board provides downloadable versions on its official website, allowing users to access the form conveniently. Additionally, physical copies may be available at local tax offices or libraries.

For those preferring a digital approach, e-filing options are also available, which can streamline the process and reduce the need for paper forms. Using an eSignature solution can further simplify the submission process, ensuring compliance and security.

Filing Deadlines for the 2020 540 2EZ Tax Booklet

It is important to be aware of the filing deadlines associated with the 2020 540 2EZ tax booklet. Typically, the deadline for filing personal income tax returns in California is April 15. However, taxpayers should confirm any changes or extensions that may apply for the current tax year.

Filing on time is crucial to avoid penalties and interest on any taxes owed. If additional time is needed, taxpayers can file for an extension, but it is essential to pay any estimated taxes due by the original deadline to avoid penalties.

Quick guide on how to complete california 540 2ez forms amp instructions 2020 personal income tax booklet california 540 2ez forms amp instructions 2020

Complete CALIFORNIA 540 2EZ Forms & Instructions Personal Income Tax Booklet CALIFORNIA 540 2EZ Forms & Instructions Personal Inc effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle CALIFORNIA 540 2EZ Forms & Instructions Personal Income Tax Booklet CALIFORNIA 540 2EZ Forms & Instructions Personal Inc on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign CALIFORNIA 540 2EZ Forms & Instructions Personal Income Tax Booklet CALIFORNIA 540 2EZ Forms & Instructions Personal Inc with no hassle

- Obtain CALIFORNIA 540 2EZ Forms & Instructions Personal Income Tax Booklet CALIFORNIA 540 2EZ Forms & Instructions Personal Inc and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive data using tools specifically provided by airSlate SignNow.

- Create your signature using the Sign feature, which takes moments and has the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your needs in document management in just a few clicks from any device. Update and eSign CALIFORNIA 540 2EZ Forms & Instructions Personal Income Tax Booklet CALIFORNIA 540 2EZ Forms & Instructions Personal Inc to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california 540 2ez forms amp instructions 2020 personal income tax booklet california 540 2ez forms amp instructions 2020

Create this form in 5 minutes!

How to create an eSignature for the california 540 2ez forms amp instructions 2020 personal income tax booklet california 540 2ez forms amp instructions 2020

How to create an e-signature for a PDF online

How to create an e-signature for a PDF in Google Chrome

The best way to create an e-signature for signing PDFs in Gmail

The best way to create an electronic signature from your smartphone

How to generate an e-signature for a PDF on iOS

The best way to create an electronic signature for a PDF file on Android

People also ask

-

What is the 2020 540 2ez form, and why do I need it?

The 2020 540 2ez form is a simplified California income tax form that many taxpayers can use for easier filing. This form is designed for individuals with straightforward financial situations, making it beneficial for those who want to expedite their tax process. Utilizing airSlate SignNow can help streamline the e-signature process for your 2020 540 2ez, ensuring a smooth submission.

-

How can airSlate SignNow assist with my 2020 540 2ez filing?

airSlate SignNow provides an easy-to-use platform for eSigning documents, including the 2020 540 2ez. By using our service, you can quickly obtain signatures from relevant parties and ensure timely submission of your tax forms. Our platform simplifies the workflow, making tax season less stressful.

-

Are there any costs associated with using airSlate SignNow for the 2020 540 2ez?

Yes, while airSlate SignNow offers various plans, our pricing is competitive and designed to offer value for businesses and individuals needing to eSign documents like the 2020 540 2ez. We provide different subscription levels based on your signing needs, ensuring you only pay for what you require.

-

Can airSlate SignNow integrate with other platforms for handling my taxes?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, allowing you to streamline your workflow when managing documents like the 2020 540 2ez. This integration helps centralize your processes, making it easier to manage important tax paperwork alongside your other financial tools.

-

What are the benefits of using airSlate SignNow for the 2020 540 2ez?

Using airSlate SignNow for the 2020 540 2ez offers several benefits, including increased efficiency, reduced paperwork, and the convenience of electronic signatures. Our solution eliminates the hassle of printing or mailing documents, helping you complete your tax submissions quickly and accurately.

-

Is airSlate SignNow secure for signing sensitive documents like the 2020 540 2ez?

Yes, security is a top priority at airSlate SignNow. Our platform utilizes robust encryption and security measures to protect your personal information and documents, including sensitive tax forms like the 2020 540 2ez. You can sign with confidence, knowing your data is safe.

-

Who can benefit from using airSlate SignNow for the 2020 540 2ez?

Individuals, freelancers, and small business owners who need to file their taxes using the 2020 540 2ez can all benefit from airSlate SignNow. Our platform caters to various users, providing solutions that streamline the eSigning process for anyone trying to manage their tax documents.

Get more for CALIFORNIA 540 2EZ Forms & Instructions Personal Income Tax Booklet CALIFORNIA 540 2EZ Forms & Instructions Personal Inc

Find out other CALIFORNIA 540 2EZ Forms & Instructions Personal Income Tax Booklet CALIFORNIA 540 2EZ Forms & Instructions Personal Inc

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free