Form 3801 CR Passive Activity Credit Limitations Form 3801 CR Passive Activity Credit Limitations

Understanding Form 3801 CR Passive Activity Credit Limitations

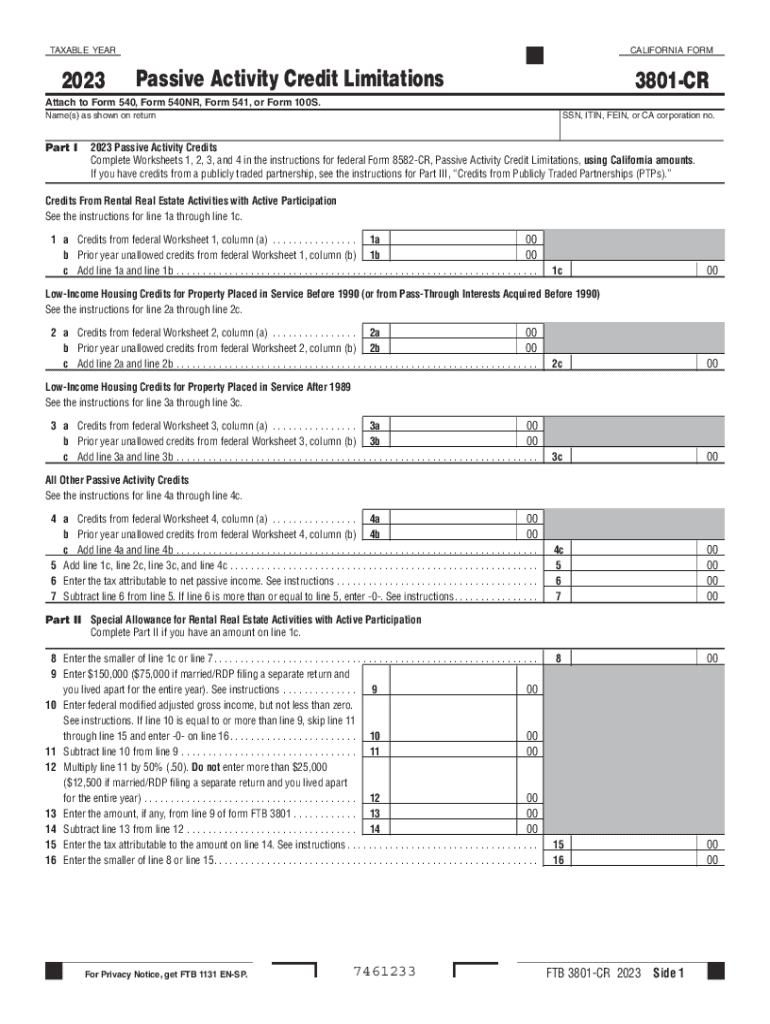

The Form 3801 CR Passive Activity Credit Limitations is a crucial document used by taxpayers in the United States to calculate and report passive activity credits. These credits are essential for individuals and businesses that have passive income, such as rental properties or limited partnerships. The form helps determine the allowable credits based on the taxpayer's income and the nature of their passive activities. Understanding this form is vital for ensuring compliance with IRS regulations and maximizing potential tax benefits.

How to Use Form 3801 CR Passive Activity Credit Limitations

Using Form 3801 CR involves several steps to ensure accurate reporting of passive activity credits. Taxpayers must first gather all relevant financial information related to their passive activities. This includes income, expenses, and any previous credits claimed. Once the necessary data is collected, the form can be filled out systematically. It is essential to follow the instructions carefully to avoid errors that could lead to delays or penalties. After completing the form, it must be submitted along with the taxpayer's annual tax return.

Steps to Complete Form 3801 CR Passive Activity Credit Limitations

Completing Form 3801 CR requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents related to passive activities.

- Review the IRS instructions for Form 3801 CR to understand the requirements.

- Fill out the form, ensuring all figures are accurate and correspond to your financial records.

- Double-check the calculations, particularly regarding credits and limitations.

- Attach the completed form to your tax return before submission.

Legal Use of Form 3801 CR Passive Activity Credit Limitations

The legal use of Form 3801 CR is governed by IRS regulations, which dictate how passive activity credits can be claimed. Taxpayers must ensure that they meet the eligibility criteria for claiming these credits. Misuse of the form, such as claiming credits for non-qualifying activities, can result in penalties. Therefore, it is crucial to adhere to the guidelines set forth by the IRS to maintain compliance and avoid legal repercussions.

Key Elements of Form 3801 CR Passive Activity Credit Limitations

Form 3801 CR includes several key elements that taxpayers must understand:

- Passive Activity Income: Income generated from passive activities, which is the basis for claiming credits.

- Credit Limitations: Rules that determine how much of the passive activity credit can be utilized in a given tax year.

- Carryover Provisions: Guidelines for carrying over unused credits to future tax years.

- Documentation Requirements: Necessary records to support claims made on the form.

Examples of Using Form 3801 CR Passive Activity Credit Limitations

Examples of scenarios where Form 3801 CR is applicable include:

- A taxpayer who owns rental properties and incurs losses that exceed their passive income.

- An investor in a limited partnership that generates passive income but has incurred expenses that need to be reported.

- A self-employed individual who participates in an activity that qualifies as passive under IRS rules.

Quick guide on how to complete form 3801 cr passive activity credit limitations form 3801 cr passive activity credit limitations

Accomplish Form 3801 CR Passive Activity Credit Limitations Form 3801 CR Passive Activity Credit Limitations smoothly on any gadget

Digital document management has gained traction among businesses and individuals. It offers a reliable eco-conscious alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to craft, modify, and electronically sign your documents quickly without delays. Manage Form 3801 CR Passive Activity Credit Limitations Form 3801 CR Passive Activity Credit Limitations on any device with airSlate SignNow applications for Android or iOS and enhance any document-related activity today.

How to modify and electronically sign Form 3801 CR Passive Activity Credit Limitations Form 3801 CR Passive Activity Credit Limitations with ease

- Locate Form 3801 CR Passive Activity Credit Limitations Form 3801 CR Passive Activity Credit Limitations and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize important sections of the documents or hide sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, text (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from your preferred device. Edit and electronically sign Form 3801 CR Passive Activity Credit Limitations Form 3801 CR Passive Activity Credit Limitations and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 3801 cr passive activity credit limitations form 3801 cr passive activity credit limitations

Create this form in 5 minutes!

How to create an eSignature for the form 3801 cr passive activity credit limitations form 3801 cr passive activity credit limitations

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 3801 CR Passive Activity Credit Limitations?

Form 3801 CR Passive Activity Credit Limitations is an IRS form used to determine the allowable passive activity loss and credit limitations. It is crucial for taxpayers who have passive activities and want to ensure compliance with IRS regulations regarding these limitations.

-

Why do I need to use Form 3801 CR for my taxes?

Using Form 3801 CR Passive Activity Credit Limitations is essential to accurately report any passive losses and ensure that you're not exceeding the credit limitations set by the IRS. This form helps you claim the correct amount of deductions, which can potentially save you money on your taxes.

-

How does airSlate SignNow simplify the process of handling Form 3801 CR?

airSlate SignNow simplifies the process of managing Form 3801 CR Passive Activity Credit Limitations by providing an intuitive platform for eSigning and sending documents securely. This allows you to quickly prepare and execute the necessary forms without the hassle of traditional paperwork.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers various features for managing tax documents, including eSigning, document templates, and automated workflows. These features ensure that you can handle Form 3801 CR Passive Activity Credit Limitations efficiently and accurately while minimizing delays in the signing process.

-

Is airSlate SignNow cost-effective for handling Form 3801 CR?

Yes, airSlate SignNow is a cost-effective solution for handling Form 3801 CR Passive Activity Credit Limitations. Our pricing plans are designed to fit different budgets, ensuring that businesses of all sizes can access essential document management features without overspending.

-

Can I integrate airSlate SignNow with other accounting software for my tax documents?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax software, enhancing your ability to manage Form 3801 CR Passive Activity Credit Limitations. This integration helps streamline your workflow and minimizes the chances of errors during the document handling process.

-

What are the benefits of using airSlate SignNow for tax forms like Form 3801 CR?

Using airSlate SignNow for tax forms like Form 3801 CR Passive Activity Credit Limitations offers multiple benefits, including speed, security, and ease of use. You can complete, send, and track documents in a secure environment, ensuring that your sensitive tax information remains protected while streamlining your workflow.

Get more for Form 3801 CR Passive Activity Credit Limitations Form 3801 CR Passive Activity Credit Limitations

- Navsup form 1282

- Ics 204 100463996 form

- Maneuverprocedure grade slip da form 4507 1 r dec 2009 armypubs army

- Da 2627 form

- Dd form 137 6 dependency statement full time student 21 22 years of age february 2016

- Army fax cover sheet form

- Applicant merit checklist 101680777 form

- Navpers 1070883 individual ready reserve irr request for reenlistmentextension public navy form

Find out other Form 3801 CR Passive Activity Credit Limitations Form 3801 CR Passive Activity Credit Limitations

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free