Schedule D 1 Sales of Business Property Schedule D 1 Sales of Business Property 2023-2026

Understanding the California D-1 Form

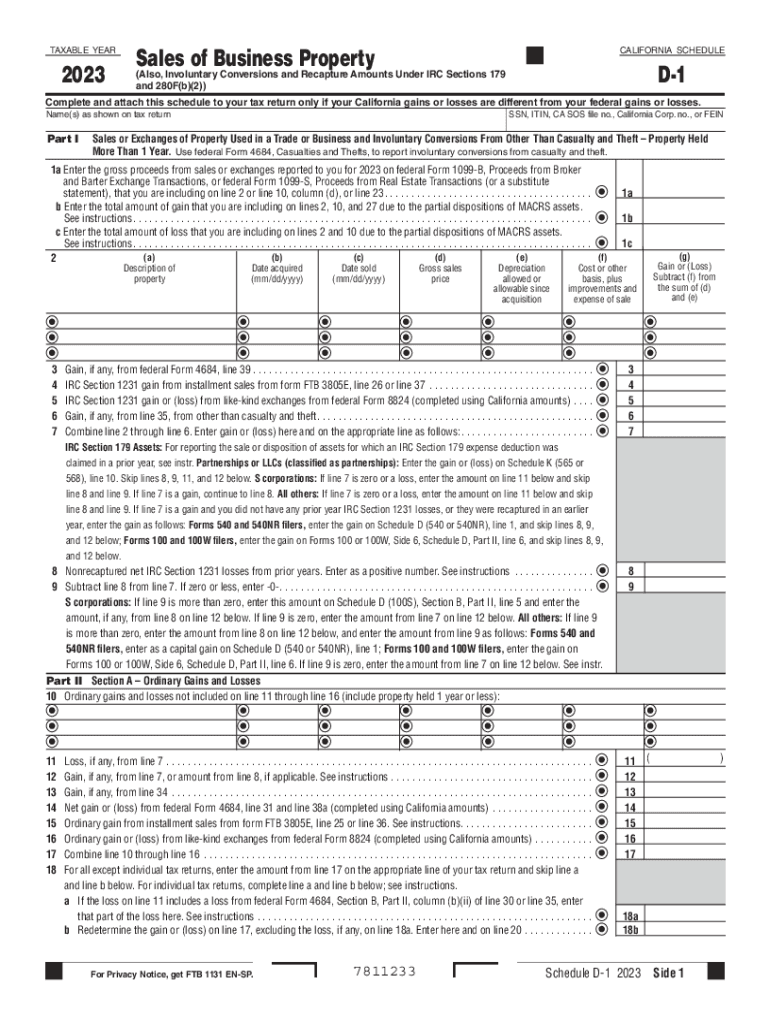

The California D-1 form, officially known as the Schedule D-1, is designed for reporting sales of business property. This form is essential for taxpayers who have sold assets used in their business operations. It provides a structured way to report gains or losses from these transactions, ensuring compliance with California tax regulations. Understanding the purpose of this form is crucial for accurate tax reporting.

Steps to Complete the California D-1 Form

Completing the California D-1 form involves several key steps:

- Gather all relevant financial documents related to the sale of business property.

- Determine the selling price and the adjusted basis of the property sold.

- Calculate the gain or loss by subtracting the adjusted basis from the selling price.

- Fill out the form by entering the required information, including details about the property and the calculations performed.

- Review the completed form for accuracy before submission.

Key Elements of the California D-1 Form

The California D-1 form contains several important sections that need to be completed accurately:

- Taxpayer Information: This section requires the taxpayer's name, address, and identification number.

- Property Details: Here, you will provide specifics about the property sold, including its description and date of sale.

- Financial Information: This includes the selling price, adjusted basis, and the resulting gain or loss.

- Signature: The form must be signed and dated by the taxpayer to validate the information provided.

Legal Use of the California D-1 Form

The California D-1 form is legally required for reporting sales of business property. Failing to file this form or providing inaccurate information can lead to penalties and additional scrutiny from tax authorities. It is important to ensure that all information is complete and truthful to maintain compliance with California tax laws.

Filing Deadlines for the California D-1 Form

Taxpayers must be aware of the filing deadlines associated with the California D-1 form. Generally, the form is due on the same date as the taxpayer's income tax return. For most individuals, this means the form must be filed by April 15 of the following year. However, if an extension is filed for the income tax return, the deadline for the D-1 form may also be extended.

Examples of Using the California D-1 Form

Common scenarios for using the California D-1 form include:

- Sale of commercial real estate owned by a business.

- Disposition of equipment or machinery used in business operations.

- Sale of vehicles that were part of the business assets.

Each of these examples requires careful documentation and accurate reporting to ensure compliance with tax regulations.

Quick guide on how to complete schedule d 1 sales of business property schedule d 1 sales of business property

Prepare Schedule D 1 Sales Of Business Property Schedule D 1 Sales Of Business Property effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly without any delays. Manage Schedule D 1 Sales Of Business Property Schedule D 1 Sales Of Business Property on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and eSign Schedule D 1 Sales Of Business Property Schedule D 1 Sales Of Business Property without hassle

- Locate Schedule D 1 Sales Of Business Property Schedule D 1 Sales Of Business Property and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all details and click on the Done button to save your changes.

- Choose your preferred method to send your form—via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new versions. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you select. Modify and eSign Schedule D 1 Sales Of Business Property Schedule D 1 Sales Of Business Property and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule d 1 sales of business property schedule d 1 sales of business property

Create this form in 5 minutes!

How to create an eSignature for the schedule d 1 sales of business property schedule d 1 sales of business property

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the California D 1 form?

The California D 1 form is an essential document required by businesses operating in California to report their partnership and corporate activities. It is crucial for ensuring compliance with state regulations. Understanding this form helps streamline your business processes and stay compliant.

-

How can airSlate SignNow help with the California D 1 form?

airSlate SignNow provides an efficient way to eSign and manage your California D 1 form digitally. With its user-friendly interface, you can easily fill out and submit the form without the hassle of paper documents. This solution not only saves time but also enhances your workflow.

-

What pricing options are available for using airSlate SignNow with the California D 1 form?

airSlate SignNow offers competitive pricing plans tailored for businesses of all sizes. You can choose from monthly or annual subscriptions that provide access to all features necessary for processing the California D 1 form. Explore our website to find the plan that best suits your needs.

-

Are there any special features for the California D 1 form on airSlate SignNow?

Yes, airSlate SignNow includes features specifically designed to streamline the process of completing the California D 1 form. These features include templates, automated workflows, and the ability to integrate with other services. This makes it easier than ever to manage your documents efficiently.

-

How secure is airSlate SignNow when handling the California D 1 form?

airSlate SignNow prioritizes security and compliance, ensuring that your California D 1 form is handled with the highest level of protection. We use encryption and secure cloud storage to keep your data safe. You can trust that your sensitive business information is in good hands.

-

Can I integrate airSlate SignNow with other tools I use for the California D 1 form?

Absolutely! airSlate SignNow offers various integrations with popular business tools, allowing you to streamline the process of managing your California D 1 form alongside other applications. This flexibility enhances your productivity and keeps all your documents organized.

-

What are the benefits of using airSlate SignNow for the California D 1 form?

Using airSlate SignNow for the California D 1 form offers numerous benefits, including faster document turnaround times, reduced paperwork, and improved collaboration among team members. It's an effective, cost-efficient solution that simplifies the eSigning process and enhances overall productivity.

Get more for Schedule D 1 Sales Of Business Property Schedule D 1 Sales Of Business Property

Find out other Schedule D 1 Sales Of Business Property Schedule D 1 Sales Of Business Property

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement