Printable California Form 540 Schedule D 1 Sales of Business Property 2020

Understanding the Printable California Form 540 Schedule D 1 Sales Of Business Property

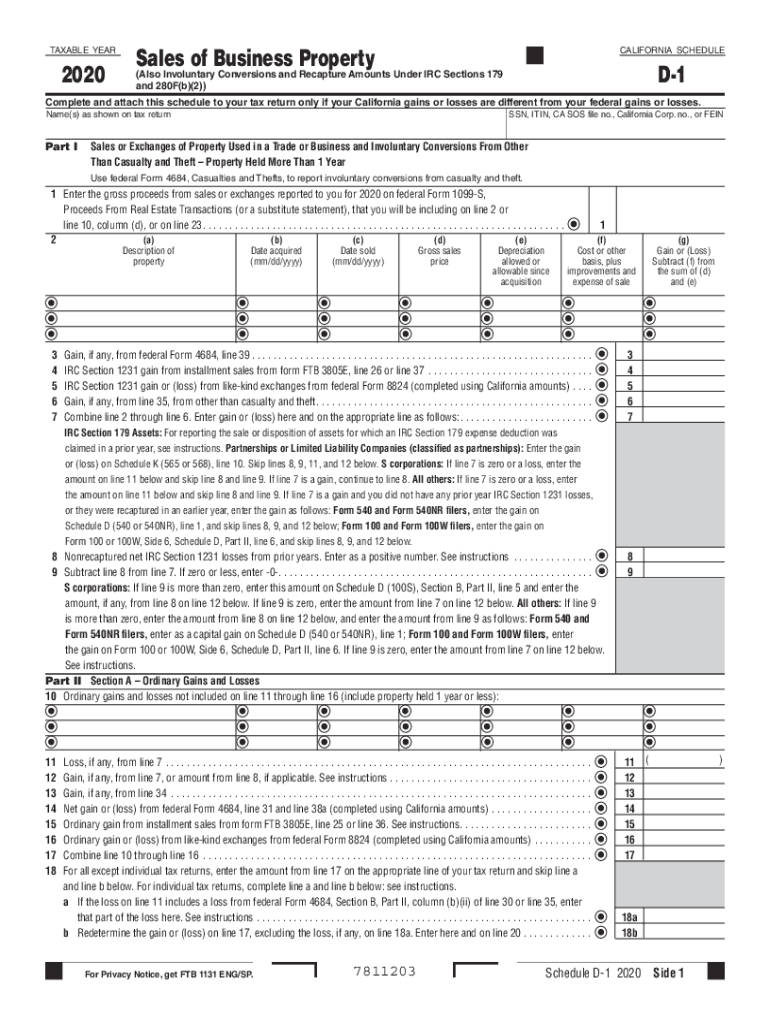

The Printable California Form 540 Schedule D 1 is specifically designed for reporting the sale of business property. This form is essential for California taxpayers who have sold or exchanged business assets during the tax year. It helps in calculating the gain or loss from these transactions, which is crucial for accurate tax reporting. The information provided on this form is used to determine the tax implications of the sale, ensuring compliance with state tax laws.

Steps to Complete the Printable California Form 540 Schedule D 1 Sales Of Business Property

Completing the California Schedule D 1 involves several key steps:

- Gather all necessary documentation related to the sale of the business property, including purchase and sale agreements, and any records of improvements made to the property.

- Fill out the top section of the form, which includes your personal information and details about the property sold.

- Calculate the adjusted basis of the property, which includes the original purchase price plus any improvements, minus any depreciation taken.

- Report the sale price and calculate the gain or loss by subtracting the adjusted basis from the sale price.

- Complete any additional sections that apply to your specific situation, such as special circumstances or additional deductions.

- Review the completed form for accuracy before submitting it with your tax return.

Key Elements of the Printable California Form 540 Schedule D 1 Sales Of Business Property

Several key elements must be included when filling out the Schedule D 1:

- Taxpayer Information: This includes your name, address, and Social Security number.

- Property Description: A detailed description of the business property sold, including its location and type.

- Sale Information: The sale price, date of sale, and any related expenses incurred during the sale process.

- Gain or Loss Calculation: A clear calculation of the gain or loss from the sale, which is critical for tax reporting.

Legal Use of the Printable California Form 540 Schedule D 1 Sales Of Business Property

The legal use of the California Schedule D 1 is governed by state tax regulations. It is crucial for taxpayers to ensure that the information provided is accurate and complete to avoid penalties. The form must be submitted along with your California tax return, and it is legally binding once signed. Failure to accurately report the sale of business property can lead to audits and potential legal consequences.

Filing Deadlines / Important Dates

Timely filing of the California Schedule D 1 is essential to avoid penalties. The typical deadline for submitting your California tax return, including the Schedule D 1, is April 15. However, if you file for an extension, you may have until October 15 to submit your forms. It is important to keep track of these dates to ensure compliance with state tax laws.

Who Issues the Form

The Printable California Form 540 Schedule D 1 is issued by the California Franchise Tax Board (FTB). This state agency is responsible for administering California's income tax laws and ensuring that taxpayers comply with their reporting obligations. The FTB provides resources and guidance for completing the form accurately, which can be beneficial for taxpayers navigating the complexities of business property sales.

Quick guide on how to complete printable 2020 california form 540 schedule d 1 sales of business property

Effortlessly prepare Printable California Form 540 Schedule D 1 Sales Of Business Property on any device

Digital document management has gained traction among companies and individuals alike. It offers an ideal sustainable option to classic printed and signed documents since you can acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Printable California Form 540 Schedule D 1 Sales Of Business Property on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related procedure today.

The easiest way to edit and electronically sign Printable California Form 540 Schedule D 1 Sales Of Business Property without hassle

- Find Printable California Form 540 Schedule D 1 Sales Of Business Property and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information using the tools that airSlate SignNow has available for that specific purpose.

- Create your electronic signature with the Sign tool, which takes only a few seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the concerns of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Printable California Form 540 Schedule D 1 Sales Of Business Property while ensuring effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 california form 540 schedule d 1 sales of business property

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 california form 540 schedule d 1 sales of business property

How to make an eSignature for your PDF file online

How to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The best way to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

The best way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is ftb business property and how does it relate to airSlate SignNow?

Ftb business property refers to the property used for business purposes that you may need to manage or sign documents for. airSlate SignNow provides a seamless process for sending and eSigning documents related to ftb business property, ensuring that all transactions are completed efficiently and without hassle.

-

How can airSlate SignNow help streamline the management of ftb business property?

With airSlate SignNow, you can easily send, receive, and sign documents related to your ftb business property. The platform simplifies document management by allowing you to consolidate all necessary paperwork in one place, thus enhancing workflow and saving valuable time.

-

What features does airSlate SignNow offer for ftb business property transactions?

airSlate SignNow offers features like document templates, bulk sending, secure signing, and integration with popular apps. These features ensure that managing your ftb business property documentation is straightforward and efficient, making it easier for businesses to keep track of important agreements.

-

Is airSlate SignNow cost-effective for handling ftb business property documents?

Yes, airSlate SignNow is a cost-effective solution for handling ftb business property documents. The pricing plans are designed to meet various business needs, providing excellent value especially when you consider the time saved on document management and the ease of electronic signing.

-

Can I integrate airSlate SignNow with other tools I use for managing ftb business property?

Absolutely! airSlate SignNow offers integrations with a variety of tools including CRM systems, cloud storage solutions, and email platforms. This flexibility allows you to manage your ftb business property documents effortlessly alongside your existing workflows.

-

How secure is airSlate SignNow for handling ftb business property documents?

Security is a top priority for airSlate SignNow. The platform uses advanced encryption standards to protect your documents and sensitive information related to ftb business property, giving you peace of mind when sending and signing documents.

-

What are the benefits of eSigning documents for ftb business property with airSlate SignNow?

eSigning documents for ftb business property with airSlate SignNow offers numerous benefits, including speed, convenience, and reduced paper waste. It allows you to finalize agreements from anywhere, reducing turnaround time signNowly compared to traditional signing methods.

Get more for Printable California Form 540 Schedule D 1 Sales Of Business Property

Find out other Printable California Form 540 Schedule D 1 Sales Of Business Property

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free