Schedule D 1 Sales of Business Property Schedule D 1 Sales of Business Property 2021

Understanding the California D 1 Form

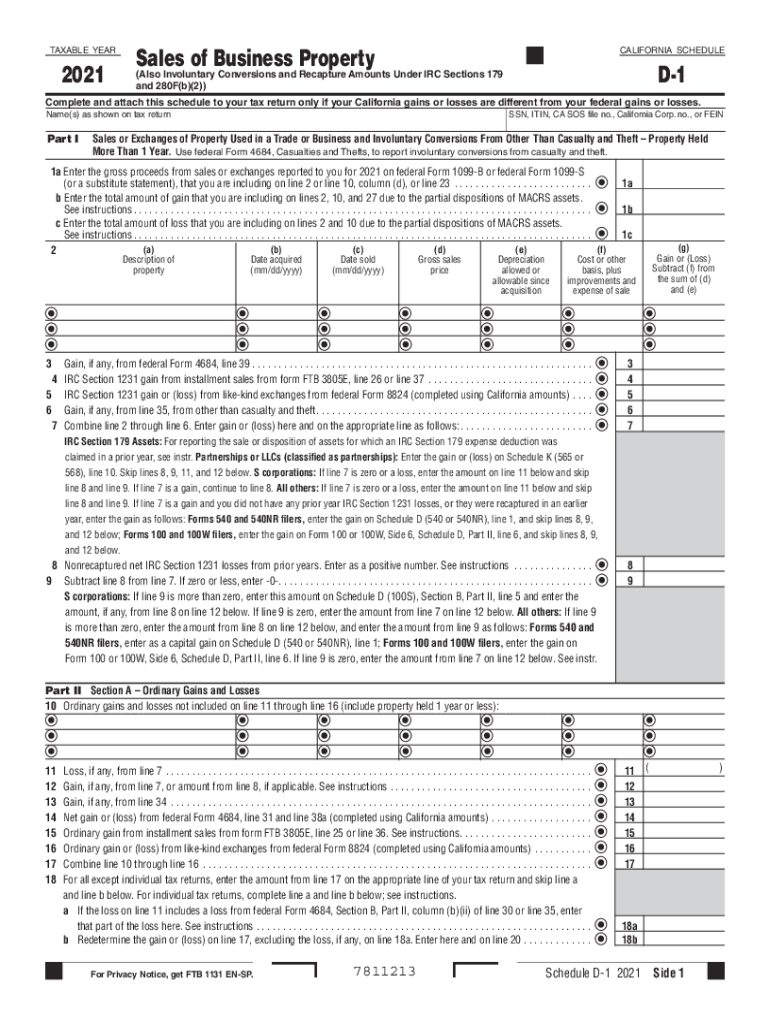

The California D 1 form, officially known as the Schedule D 1, is essential for reporting sales of business property. This form is utilized by individuals and businesses to detail the sale of assets used in a trade or business. It helps determine any capital gains or losses incurred from these transactions, which are critical for accurate tax reporting. Understanding the specifics of this form is crucial for compliance with California tax regulations.

Steps to Complete the California D 1 Form

Completing the California D 1 form involves several steps to ensure accuracy and compliance. First, gather all necessary documentation related to the sale of the business property, including purchase and sale agreements. Next, accurately report the details of the transaction, including the date of sale, sales price, and any costs associated with the sale. It is important to calculate any capital gains or losses by comparing the sales price to the original purchase price and any improvements made to the property. Finally, review the completed form for accuracy before submission.

Legal Use of the California D 1 Form

The California D 1 form serves a legal purpose in documenting the sale of business property for tax purposes. When filled out correctly, it ensures compliance with California tax laws and regulations. The information provided on this form can be used by the California Franchise Tax Board (FTB) for auditing purposes, making it essential to maintain accurate records and submit the form on time. Failure to comply with the legal requirements associated with this form can result in penalties.

Key Elements of the California D 1 Form

Several key elements must be included when filling out the California D 1 form. These include:

- Taxpayer Information: Name, address, and taxpayer identification number.

- Property Details: Description of the property sold, including its original purchase date and price.

- Sale Information: Date of sale, sales price, and any adjustments made.

- Capital Gains Calculation: Accurate calculations of gains or losses based on the provided data.

Obtaining the California D 1 Form

The California D 1 form can be obtained through the California Franchise Tax Board's official website or by contacting their offices directly. It is available in both digital and paper formats, allowing users to choose their preferred method for completion. For those who prefer to fill out the form digitally, platforms like signNow offer secure options for eSigning and submitting documents, ensuring compliance with legal standards.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines associated with the California D 1 form. Typically, the form must be submitted along with your annual tax return by the due date, which is usually April 15 for most taxpayers. However, if you are filing for an extension, ensure that the D 1 form is submitted by the extended deadline. Keeping track of these dates helps avoid penalties and ensures compliance with tax regulations.

Quick guide on how to complete 2021 schedule d 1 sales of business property 2021 schedule d 1 sales of business property

Complete Schedule D 1 Sales Of Business Property Schedule D 1 Sales Of Business Property effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow offers all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Schedule D 1 Sales Of Business Property Schedule D 1 Sales Of Business Property on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Schedule D 1 Sales Of Business Property Schedule D 1 Sales Of Business Property without stress

- Find Schedule D 1 Sales Of Business Property Schedule D 1 Sales Of Business Property and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with the tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Schedule D 1 Sales Of Business Property Schedule D 1 Sales Of Business Property and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 schedule d 1 sales of business property 2021 schedule d 1 sales of business property

Create this form in 5 minutes!

People also ask

-

What is the california d 1 form?

The california d 1 form is a document used for California driver's license or identification card applications and renewals. It includes essential information required by the Department of Motor Vehicles (DMV). With airSlate SignNow, you can easily fill out, sign, and e-file the california d 1 form to streamline the application process.

-

How does airSlate SignNow simplify completing the california d 1 form?

airSlate SignNow provides an intuitive interface that allows users to fill out the california d 1 form electronically. You can add signatures, initials, and even date stamps with just a few clicks. This eliminates errors and ensures that your form is submitted accurately and promptly.

-

What are the pricing options for using airSlate SignNow to handle the california d 1 form?

airSlate SignNow offers various pricing plans suitable for individuals and businesses looking to manage the california d 1 form. Pricing starts with a basic plan that includes essential features, and there are premium options that provide advanced functionalities. Review our pricing page for the best plan that fits your needs.

-

Can I integrate other tools with airSlate SignNow for the california d 1 form?

Yes, airSlate SignNow offers integrations with various applications such as Google Drive, Dropbox, and Microsoft Office. This allows for a seamless workflow when managing documents like the california d 1 form. Connect your favorite tools to ensure an efficient document management process.

-

What security measures does airSlate SignNow implement for the california d 1 form?

Security is a top priority at airSlate SignNow. When handling the california d 1 form, we use top-notch encryption and secure data storage to protect your sensitive information. Additionally, our platform complies with all relevant regulations, ensuring that your documents are secure and confidential.

-

Is it possible to track the status of the california d 1 form once submitted through airSlate SignNow?

Absolutely! airSlate SignNow provides a tracking feature that allows you to monitor the status of your california d 1 form after submission. You will be notified when the form is opened, signed, and finalized, giving you peace of mind and a clear understanding of the document’s progress.

-

Are there templates available for the california d 1 form on airSlate SignNow?

Yes, airSlate SignNow offers templates specifically for the california d 1 form to help you get started quickly. These templates include pre-filled sections to minimize time spent on data entry. You can customize these templates to fit your specific needs.

Get more for Schedule D 1 Sales Of Business Property Schedule D 1 Sales Of Business Property

Find out other Schedule D 1 Sales Of Business Property Schedule D 1 Sales Of Business Property

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form