California Schedule D 1 Sales of Business Property California Schedule D 1 Sales of Business Property 2022

What is the California Schedule D 1 Sales Of Business Property

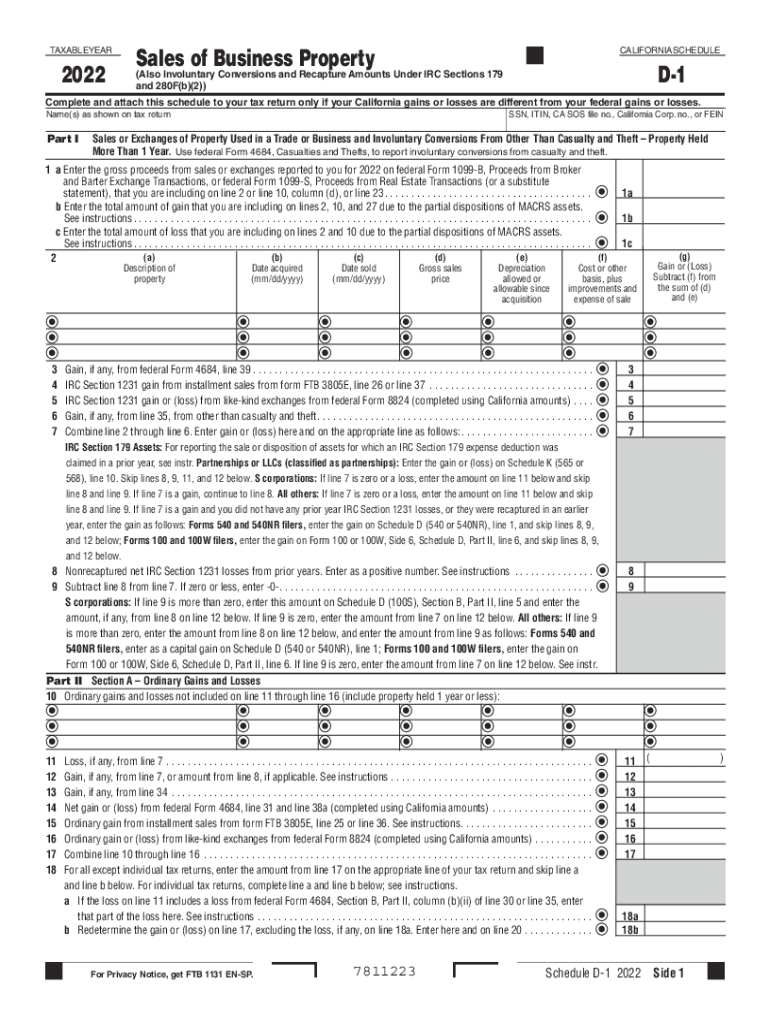

The California Schedule D 1 is a tax form used to report the sale of business property in California. This form is essential for taxpayers who have sold assets used in a business, such as equipment, real estate, or other tangible assets. It helps determine the capital gains or losses resulting from these sales, which must be reported on the taxpayer's income tax return. Understanding the Schedule D 1 is crucial for ensuring accurate tax reporting and compliance with state tax laws.

How to use the California Schedule D 1 Sales Of Business Property

Using the California Schedule D 1 involves several steps. First, gather all necessary documentation related to the sale of the business property, including purchase agreements, sales receipts, and records of any improvements made to the property. Next, fill out the form by providing details such as the description of the property sold, the date of sale, the selling price, and the original purchase price. Finally, calculate any capital gains or losses and report these figures on your California tax return.

Steps to complete the California Schedule D 1 Sales Of Business Property

Completing the California Schedule D 1 requires careful attention to detail. Follow these steps:

- Collect all relevant documents regarding the business property sold.

- Fill in the property description, including its type and location.

- Enter the date of acquisition and the date of sale.

- Record the selling price and the original purchase price.

- Calculate any adjustments, such as improvements or depreciation.

- Determine the capital gain or loss by subtracting the adjusted basis from the selling price.

- Transfer the calculated gain or loss to your California tax return.

Legal use of the California Schedule D 1 Sales Of Business Property

The legal use of the California Schedule D 1 is to ensure compliance with state tax regulations regarding the sale of business property. Taxpayers must accurately report any gains or losses to avoid penalties or audits. It is important to retain all supporting documentation for at least four years, as the California Franchise Tax Board may request these records to verify the information reported on the form.

Key elements of the California Schedule D 1 Sales Of Business Property

Key elements of the California Schedule D 1 include:

- Property Description: A detailed description of the asset sold.

- Acquisition Date: The date the property was originally purchased.

- Sale Date: The date the property was sold.

- Selling Price: The amount received from the sale.

- Original Purchase Price: The initial cost of acquiring the property.

- Adjustments: Any necessary adjustments for improvements or depreciation.

Filing Deadlines / Important Dates

Filing deadlines for the California Schedule D 1 typically align with the annual state tax return due date. For most taxpayers, this is April 15 of each year. If the deadline falls on a weekend or holiday, it may be extended to the next business day. It is essential to stay informed about any changes to deadlines or requirements to ensure timely and accurate filing.

Quick guide on how to complete california schedule d 1 sales of business property california schedule d 1 sales of business property

Prepare California Schedule D 1 Sales Of Business Property California Schedule D 1 Sales Of Business Property effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow supplies you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage California Schedule D 1 Sales Of Business Property California Schedule D 1 Sales Of Business Property on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to alter and eSign California Schedule D 1 Sales Of Business Property California Schedule D 1 Sales Of Business Property seamlessly

- Obtain California Schedule D 1 Sales Of Business Property California Schedule D 1 Sales Of Business Property and click on Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you want to send your form, either by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate the printing of new document copies. airSlate SignNow meets all your needs in document management in just a few clicks from any device of your choice. Edit and eSign California Schedule D 1 Sales Of Business Property California Schedule D 1 Sales Of Business Property and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california schedule d 1 sales of business property california schedule d 1 sales of business property

Create this form in 5 minutes!

How to create an eSignature for the california schedule d 1 sales of business property california schedule d 1 sales of business property

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is California Schedule D 1 Sales Of Business Property?

California Schedule D 1 Sales Of Business Property is a form used by taxpayers to report the sale of business property in California. It details capital gains and losses incurred from the sale, which is essential for accurate tax reporting. Understanding this form is crucial for ensuring compliance with California tax laws.

-

How can airSlate SignNow help with California Schedule D 1 Sales Of Business Property?

airSlate SignNow streamlines the process of preparing and eSigning documents like California Schedule D 1 Sales Of Business Property. Our easy-to-use platform ensures that all forms are completed accurately and efficiently. This allows businesses to focus on their operations while we simplify their document management and signing processes.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a variety of features tailored for managing documents like California Schedule D 1 Sales Of Business Property. These include customizable templates, automated workflows, and advanced eSignature capabilities. These features help ensure that your document handling is both efficient and compliant.

-

Is airSlate SignNow cost-effective for small businesses dealing with California Schedule D 1 Sales Of Business Property?

Yes, airSlate SignNow is a cost-effective solution for small businesses managing California Schedule D 1 Sales Of Business Property. Our pricing plans are designed to fit various budgets while providing comprehensive features. This ensures that even small enterprises can access essential document signing and management tools.

-

What integrations does airSlate SignNow offer?

airSlate SignNow integrates seamlessly with various business applications that can assist in managing California Schedule D 1 Sales Of Business Property. From CRM systems to accounting software, our integrations simplify data transfer and enhance productivity. This connectivity allows for a more streamlined document handling experience.

-

How secure is airSlate SignNow for sensitive documents?

AirSlate SignNow prioritizes the security of your documents, including California Schedule D 1 Sales Of Business Property. We utilize advanced encryption and security protocols to ensure that your sensitive information is always protected. Businesses can confidently use our platform knowing their data is safe and secure.

-

Can I access airSlate SignNow on mobile devices?

Absolutely! airSlate SignNow is optimized for mobile devices, allowing you to manage your documents, including California Schedule D 1 Sales Of Business Property, on the go. Our mobile platform ensures you can access and eSign important documents anytime, anywhere, making it ideal for busy professionals.

Get more for California Schedule D 1 Sales Of Business Property California Schedule D 1 Sales Of Business Property

- Referral order for urologic services urology of indiana form

- Property lossdamage claim form garrun groupcoza

- 14039 2016 form

- Mo ptc 2016 form

- Port theater employment application form please print all information requested except signature application for employment

- Request for approval of unusual field trip fairfax county public bb fcps form

- 2016 schedule j form

- Soces field trip permission slip los angeles unified school bb form

Find out other California Schedule D 1 Sales Of Business Property California Schedule D 1 Sales Of Business Property

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy