Mailing Address IndividualFiduciary Income Tax 2023

Understanding the Form 5118 City of Detroit

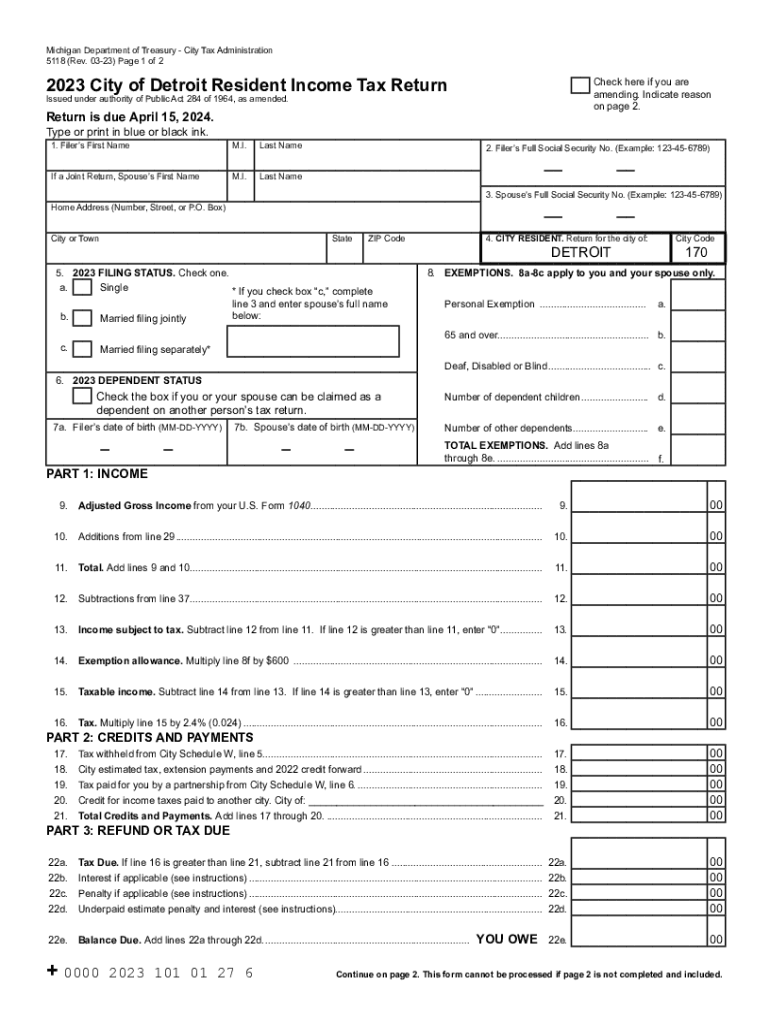

The Form 5118 is a tax form specifically designed for residents of the City of Detroit. It is used for reporting individual income tax and ensuring compliance with local tax regulations. This form is essential for individuals who earn income within the city limits and need to accurately report their earnings to the city tax authorities.

Steps to Complete the Form 5118

Completing the Form 5118 involves several straightforward steps:

- Gather all necessary financial documents, including W-2 forms and any other income statements.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income earned during the tax year, including wages, salaries, and any other sources of income.

- Calculate your taxable income by subtracting any applicable deductions.

- Determine the amount of tax owed based on the city tax rates.

- Sign and date the form before submission.

Filing Deadlines for Form 5118

It is important to be aware of the filing deadlines for the Form 5118 to avoid penalties. Typically, the form must be submitted by April 15 of the year following the tax year. For example, the deadline for filing the 2023 Form 5118 is April 15, 2024. If this date falls on a weekend or holiday, the deadline may be extended to the next business day.

Required Documents for Submission

When submitting Form 5118, certain documents are required to support your income claims. These documents may include:

- W-2 forms from employers

- 1099 forms for other income sources

- Any relevant documentation for deductions or credits claimed

Having these documents ready will streamline the filing process and ensure accuracy in your submission.

Form Submission Methods

The Form 5118 can be submitted in several ways, providing flexibility for taxpayers. You can choose to:

- File online through the City of Detroit's tax portal.

- Mail a paper copy of the completed form to the designated tax office.

- Submit the form in person at the local tax office.

Each method has its own advantages, so consider your preferences and circumstances when deciding how to file.

Penalties for Non-Compliance

Failing to file Form 5118 by the deadline or inaccurately reporting income can result in penalties. The City of Detroit imposes fines for late filings and underpayment of taxes. It is essential to ensure that the form is completed accurately and submitted on time to avoid these financial repercussions.

Quick guide on how to complete mailing address individualfiduciary income tax

Effortlessly Set Up Mailing Address IndividualFiduciary Income Tax on Any Device

Digital document management has become increasingly favored by both companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to retrieve the appropriate form and securely keep it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly and efficiently. Handle Mailing Address IndividualFiduciary Income Tax on any device using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to Edit and eSign Mailing Address IndividualFiduciary Income Tax with Ease

- Obtain Mailing Address IndividualFiduciary Income Tax and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools specially designed by airSlate SignNow for this purpose.

- Craft your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose your delivery method for the form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow fulfills your document management needs in just a few clicks from any selected device. Revise and eSign Mailing Address IndividualFiduciary Income Tax to ensure seamless communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mailing address individualfiduciary income tax

Create this form in 5 minutes!

How to create an eSignature for the mailing address individualfiduciary income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 5118 city of detroit?

The form 5118 city of Detroit is a document used for certain local tax purposes, specifically for businesses operating within the city. It requires specific information related to your business operations and revenue. Understanding how to complete this form properly is crucial to ensure compliance with city tax regulations.

-

How can airSlate SignNow help me with form 5118 city of detroit?

airSlate SignNow streamlines the signing and submission process for the form 5118 city of Detroit. Our platform allows you to easily upload the form, fill it out, and securely eSign it in just a few clicks. This simplifies your tax filing and ensures you meet all deadlines promptly.

-

What are the pricing options for using airSlate SignNow for form 5118 city of detroit?

airSlate SignNow offers a range of pricing plans tailored to different business needs. Plans include features that allow for unlimited signing capabilities and document management, all at an affordable price. You can start with a free trial to explore how it can help you with the form 5118 city of Detroit.

-

Can I integrate airSlate SignNow with my existing software for form 5118 city of detroit?

Yes, airSlate SignNow seamlessly integrates with various popular software, allowing you to streamline your document management process. This means you can easily manage and send your form 5118 city of Detroit alongside your other business applications. Enhancing workflow efficiency is just a few clicks away.

-

What features does airSlate SignNow offer for completing form 5118 city of detroit?

airSlate SignNow provides a suite of features designed to enhance your document signing experience. With functionalities like templates, custom branding, and tracking, you can easily manage the form 5118 city of Detroit efficiently. These features ensure that your documents are completed correctly and on time.

-

How secure is airSlate SignNow when handling form 5118 city of detroit documents?

Security is a top priority for airSlate SignNow. We implement advanced encryption technologies to protect your documents, including the form 5118 city of Detroit, during uploading, signing, and storage. Rest assured that your sensitive information is safe with us.

-

Is there customer support available for questions about form 5118 city of detroit?

Absolutely! airSlate SignNow offers dedicated customer support to assist users with questions regarding the form 5118 city of Detroit. Our team is available to guide you through any issues or inquiries, ensuring that you have the information you need for a smooth eSigning experience.

Get more for Mailing Address IndividualFiduciary Income Tax

- A 4 240720 veterinary conditions for the form

- Fillable dogs and cats from category b countries form

- Qld_oir_form65 1pdf

- P877 form

- Toolbox talk template printable form

- International dealings schedule 2018 section a international form

- Dla1 form

- Commonwealth bank of australia 2015 section 165d dodd frank act tailored resolution plan federalreserve form

Find out other Mailing Address IndividualFiduciary Income Tax

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney