5118, City of Detroit Resident Income Tax Return 2024-2026

What is the 5118, City Of Detroit Resident Income Tax Return

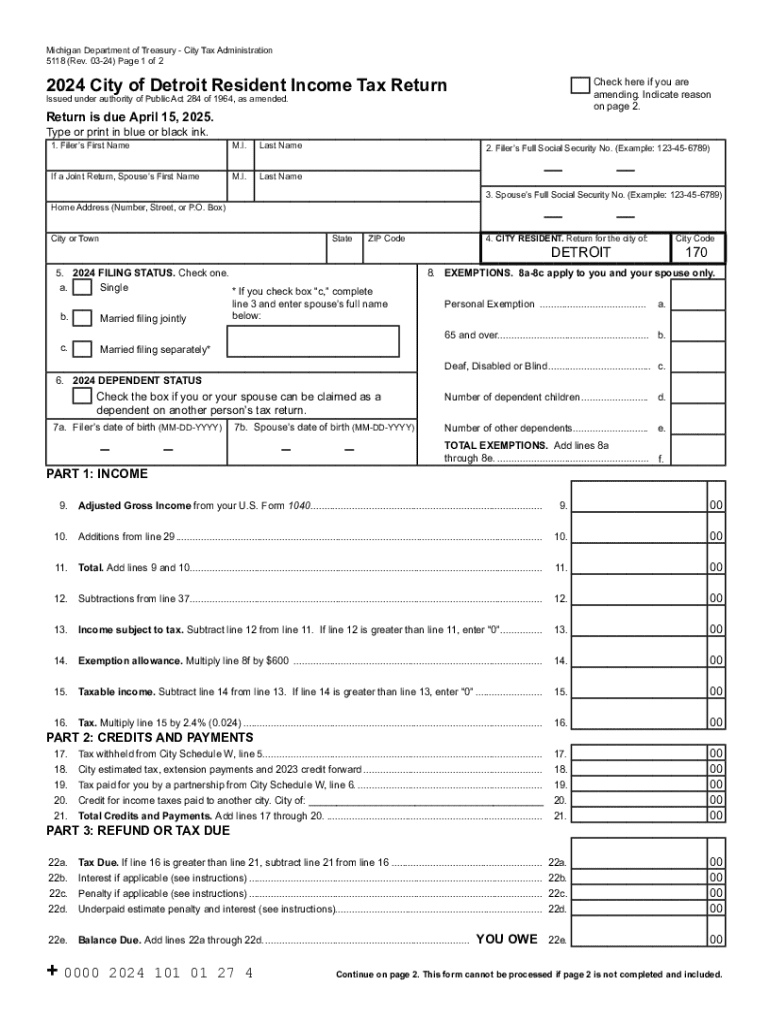

The 5118 form is the official document used for filing the City of Detroit Resident Income Tax Return. This form is essential for residents who earn income within the city limits and are required to report their earnings to the local government. The 5118 helps ensure compliance with Detroit's income tax regulations, allowing residents to accurately calculate their tax liabilities based on their income levels and applicable deductions.

How to use the 5118, City Of Detroit Resident Income Tax Return

Using the 5118 form involves several steps to ensure accurate completion. First, gather all necessary financial documents, including W-2 forms, 1099s, and any other income statements. Next, carefully fill out the form, providing details about your income, deductions, and credits. It's important to follow the instructions provided with the form to avoid errors. After completing the form, review it for accuracy before submitting it to the appropriate city tax authority.

Steps to complete the 5118, City Of Detroit Resident Income Tax Return

Completing the 5118 form requires a systematic approach:

- Gather all relevant income documentation.

- Fill in personal identification information at the top of the form.

- Report your total income, including wages and other earnings.

- Calculate any deductions or credits you may qualify for.

- Determine your total tax liability based on the provided tax rates.

- Sign and date the form before submission.

Required Documents

To accurately complete the 5118 form, certain documents are necessary. These typically include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Documentation of any additional income sources.

- Records of deductible expenses, if applicable.

Filing Deadlines / Important Dates

Filing the 5118 form must be done within specific deadlines to avoid penalties. Typically, the deadline for submitting the City of Detroit Resident Income Tax Return aligns with the federal tax filing deadline, which is usually April fifteenth. It's crucial to stay informed about any changes to these dates, especially during tax season.

Penalties for Non-Compliance

Failure to file the 5118 form on time or inaccuracies in reporting can lead to penalties. The City of Detroit may impose fines based on the amount of tax owed and the length of the delay in filing. Additionally, interest may accrue on unpaid taxes, further increasing the total amount owed. Understanding these potential penalties can motivate timely and accurate filing.

Create this form in 5 minutes or less

Find and fill out the correct 5118 city of detroit resident income tax return

Create this form in 5 minutes!

How to create an eSignature for the 5118 city of detroit resident income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the number 5118 in airSlate SignNow?

The number 5118 refers to a specific feature set within airSlate SignNow that enhances document management. This feature allows users to streamline their eSigning processes, making it easier to send and sign documents efficiently. Understanding 5118 can help businesses leverage the full potential of our platform.

-

How does airSlate SignNow pricing work for the 5118 feature?

airSlate SignNow offers competitive pricing plans that include access to the 5118 feature. Depending on your business needs, you can choose from various subscription tiers that provide different levels of access and functionality. This ensures that you only pay for what you need while benefiting from the robust capabilities of 5118.

-

What are the key features of airSlate SignNow related to 5118?

The 5118 feature in airSlate SignNow includes advanced eSigning capabilities, customizable templates, and real-time tracking of document status. These features are designed to enhance user experience and improve workflow efficiency. By utilizing 5118, businesses can signNowly reduce turnaround times for document approvals.

-

What benefits does the 5118 feature provide for businesses?

The 5118 feature in airSlate SignNow offers numerous benefits, including increased productivity and reduced operational costs. By simplifying the eSigning process, businesses can save time and resources, allowing them to focus on core activities. Additionally, 5118 enhances compliance and security for sensitive documents.

-

Can I integrate airSlate SignNow with other tools using the 5118 feature?

Yes, the 5118 feature in airSlate SignNow supports integrations with various third-party applications. This allows businesses to connect their existing tools and streamline workflows seamlessly. By leveraging these integrations, users can enhance their document management processes and improve overall efficiency.

-

Is the 5118 feature user-friendly for non-technical users?

Absolutely! The 5118 feature in airSlate SignNow is designed with user-friendliness in mind. Even non-technical users can easily navigate the platform and utilize its capabilities without extensive training. This accessibility ensures that all team members can participate in the eSigning process effortlessly.

-

How does airSlate SignNow ensure the security of documents signed using the 5118 feature?

Security is a top priority for airSlate SignNow, especially for documents signed using the 5118 feature. The platform employs advanced encryption and authentication measures to protect sensitive information. This ensures that all eSigned documents are secure and compliant with industry standards.

Get more for 5118, City Of Detroit Resident Income Tax Return

Find out other 5118, City Of Detroit Resident Income Tax Return

- Electronic signature Indiana Postnuptial Agreement Template Later

- Electronic signature New York Postnuptial Agreement Template Secure

- How Can I Electronic signature Colorado Prenuptial Agreement Template

- Electronic signature California Divorce Settlement Agreement Template Free

- Electronic signature Virginia Prenuptial Agreement Template Free

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later