4891, Michigan Corporate Income Tax Annual Return 2023

What is the 4891, Michigan Corporate Income Tax Annual Return

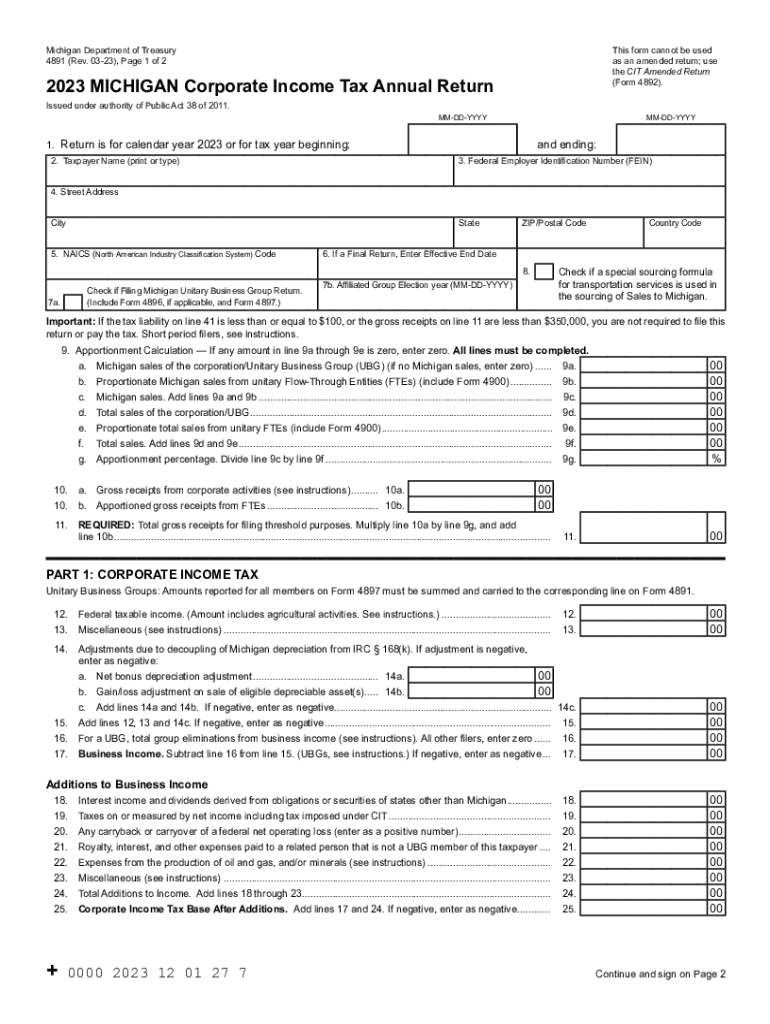

The Michigan Form 4891 is the Corporate Income Tax Annual Return, which businesses in Michigan must file to report their corporate income and calculate their tax liability. This form is specifically designed for corporations that are subject to the Michigan Corporate Income Tax (CIT), which applies to corporations doing business in Michigan. Understanding the purpose of Form 4891 is crucial for compliance with state tax laws and ensuring accurate reporting of corporate earnings.

How to use the 4891, Michigan Corporate Income Tax Annual Return

Using Form 4891 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and balance sheets. Next, fill out the form by providing details about your corporation's income, deductions, and credits. It is essential to follow the instructions carefully to avoid errors. Once completed, the form can be submitted either electronically or via mail, depending on your preference and the requirements set by the Michigan Department of Treasury.

Steps to complete the 4891, Michigan Corporate Income Tax Annual Return

Completing Form 4891 requires a systematic approach. Begin by entering your corporation's identifying information, including the name, address, and federal employer identification number (EIN). Then, report your total gross receipts, followed by any allowable deductions. Calculate your taxable income and apply the appropriate tax rate. Review all entries for accuracy before signing and dating the form. Finally, submit the completed form by the specified deadline to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for Form 4891 are critical to ensure compliance with Michigan tax laws. Generally, the form is due on the last day of the fourth month following the end of your corporation's fiscal year. For corporations operating on a calendar year, the due date is April 30. It is important to stay informed about any changes to deadlines, as late submissions may incur penalties and interest on unpaid taxes.

Required Documents

When preparing to file Form 4891, certain documents are necessary to support the information reported on the form. These documents include financial statements, such as income statements and balance sheets, as well as any supporting schedules that detail deductions and credits claimed. Additionally, corporations should have records of any estimated tax payments made during the year. Keeping these documents organized will facilitate a smoother filing process.

Penalties for Non-Compliance

Failing to file Form 4891 on time or submitting inaccurate information can result in significant penalties. The Michigan Department of Treasury imposes a penalty for late filings, which is typically a percentage of the unpaid tax amount. Additionally, interest accrues on any unpaid taxes from the due date until the payment is made. Understanding these penalties emphasizes the importance of timely and accurate filing to avoid financial repercussions.

Quick guide on how to complete 4891 michigan corporate income tax annual return 708156460

Effortlessly Prepare 4891, Michigan Corporate Income Tax Annual Return on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents quickly and without delays. Manage 4891, Michigan Corporate Income Tax Annual Return using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign 4891, Michigan Corporate Income Tax Annual Return with ease

- Acquire 4891, Michigan Corporate Income Tax Annual Return and click Get Form to initiate.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or conceal sensitive data with tools designed specifically for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, laborious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign 4891, Michigan Corporate Income Tax Annual Return to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 4891 michigan corporate income tax annual return 708156460

Create this form in 5 minutes!

How to create an eSignature for the 4891 michigan corporate income tax annual return 708156460

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the michigan form 4891?

The Michigan form 4891 is a tax form used for reporting personal property taxes. It is crucial for businesses to file this form accurately to avoid penalties. Utilizing airSlate SignNow, you can streamline this process and ensure your michigan form 4891 is signed and submitted efficiently.

-

How can airSlate SignNow help me with the michigan form 4891?

airSlate SignNow provides an intuitive platform for businesses to electronically sign and manage important documents like the michigan form 4891. Our eSigning solution ensures that your form is completed quickly and securely, allowing you to focus on your business operations without the hassle of paperwork.

-

Is there a cost associated with using airSlate SignNow for the michigan form 4891?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. The cost is competitive, providing excellent value for the seamless processing of documents including the michigan form 4891. You can choose a plan that fits your budget while ensuring compliance with tax regulations.

-

What features does airSlate SignNow offer for handling the michigan form 4891?

AirSlate SignNow includes features such as customizable templates, automatic reminders, and secure storage for the michigan form 4891. These features facilitate easy preparation, signing, and submission of your forms, enhancing your overall efficiency and record-keeping practices.

-

Can I integrate airSlate SignNow with other applications for my michigan form 4891?

Absolutely! airSlate SignNow offers robust integrations with popular business applications to help manage your michigan form 4891 seamlessly. Whether you use CRM systems or cloud storage solutions, you can integrate your tools for a smoother workflow.

-

What are the benefits of using airSlate SignNow for the michigan form 4891?

Using airSlate SignNow for the michigan form 4891 provides multiple benefits such as increased efficiency, reduced paperwork, and enhanced security. The eSigning process saves time and minimizes errors compared to traditional methods, ensuring you meet all filing deadlines effortlessly.

-

How secure is the signing process for the michigan form 4891 on airSlate SignNow?

Security is a top priority at airSlate SignNow. The signing process for your michigan form 4891 is protected by advanced encryption technology, ensuring that your documents remain confidential and secure throughout the entire eSignature process.

Get more for 4891, Michigan Corporate Income Tax Annual Return

- Allwell from peach state health plan discharge consultation form discharge consultation form

- Contact formansley animal clinic

- Pshp intensive outpatient day treatment form intensive outpatient day treatment form

- Doctors hospital of augusta form

- Patient forms packet georgia pain management

- Also please provide the receptionist a picture id and your insurance card form

- Gastroenterology specialists of dekalb llc form

- Patient financial responsibility form jennifer wagner ma

Find out other 4891, Michigan Corporate Income Tax Annual Return

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent