4891, Michigan Corporate Income Tax Annual Return 2024-2026

What is the 4891, Michigan Corporate Income Tax Annual Return

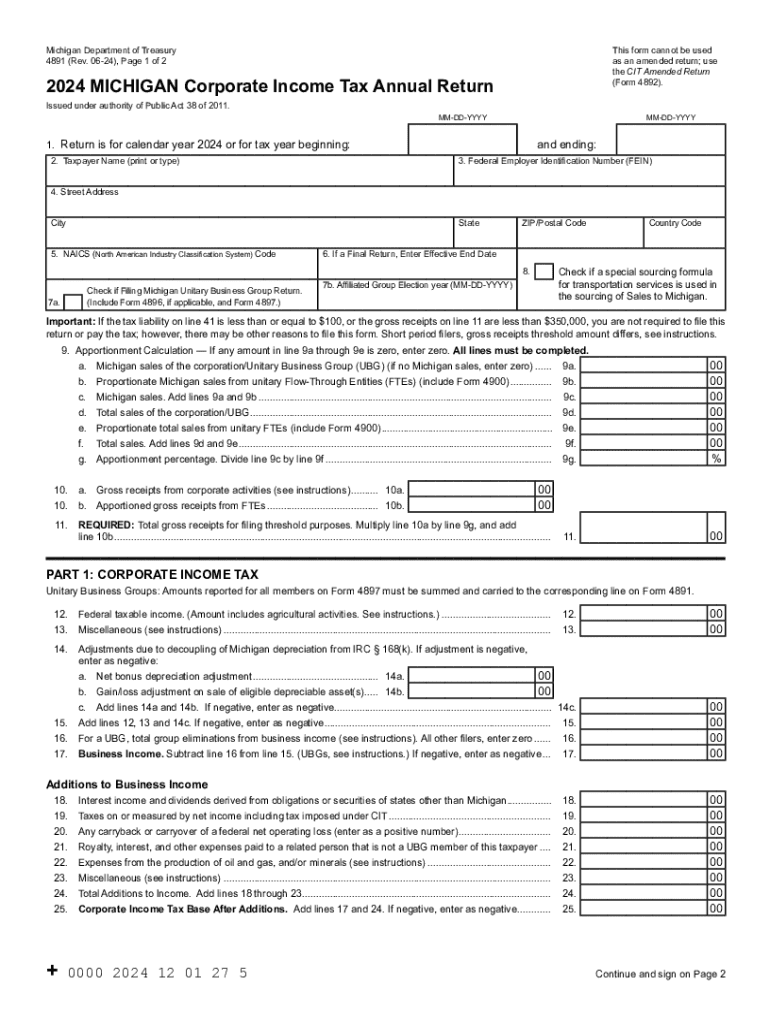

The 4891 form, officially known as the Michigan Corporate Income Tax Annual Return, is a crucial document for corporations operating in Michigan. This form is used to report the income, deductions, and tax liability of corporations subject to the Michigan Corporate Income Tax (CIT). The CIT applies to corporations that do business in Michigan and is calculated based on gross receipts rather than traditional income. Understanding the 4891 form is essential for compliance with state tax regulations and for ensuring accurate reporting of corporate financials.

Steps to complete the 4891, Michigan Corporate Income Tax Annual Return

Completing the 4891 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense reports. Next, fill out the form by entering gross receipts, allowable deductions, and calculating the tax liability. It's important to follow the specific instructions provided by the Michigan Department of Treasury to avoid errors. After completing the form, review all entries for accuracy before submitting it either online or by mail.

How to obtain the 4891, Michigan Corporate Income Tax Annual Return

The 4891 form can be easily obtained through the Michigan Department of Treasury's website. It is available for download in PDF format, allowing businesses to fill it out digitally or print it for manual completion. Additionally, businesses can request paper copies of the form directly from the department if needed. Ensuring you have the latest version of the form is essential for compliance, as tax regulations may change annually.

Key elements of the 4891, Michigan Corporate Income Tax Annual Return

The 4891 form includes several key elements that are critical for accurate reporting. These elements consist of sections for reporting gross receipts, deductions, and tax credits. Corporations must also provide identifying information, such as the business name, address, and federal employer identification number (EIN). Understanding these components is vital for effectively completing the form and ensuring compliance with Michigan tax laws.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the 4891 form to avoid penalties. The annual return is generally due on the last day of the fourth month following the end of the corporation's fiscal year. For most corporations operating on a calendar year, this means the form is due by April fifteenth. It is essential for businesses to mark these dates on their calendars and ensure timely submission to maintain compliance with state regulations.

Form Submission Methods (Online / Mail / In-Person)

The 4891 form can be submitted through various methods, providing flexibility for businesses. Corporations can file online via the Michigan Department of Treasury's e-filing system, which offers a streamlined process. Alternatively, businesses may choose to mail the completed form to the appropriate address provided in the instructions. In-person submissions are also accepted at designated state offices. Each method has its own advantages, and businesses should select the one that best fits their needs.

Create this form in 5 minutes or less

Find and fill out the correct 4891 michigan corporate income tax annual return 771947482

Create this form in 5 minutes!

How to create an eSignature for the 4891 michigan corporate income tax annual return 771947482

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 4891 fill feature in airSlate SignNow?

The 4891 fill feature in airSlate SignNow allows users to easily fill out and sign documents electronically. This feature streamlines the document management process, making it efficient and user-friendly. With 4891 fill, you can ensure that all necessary fields are completed accurately before sending.

-

How much does airSlate SignNow cost for using the 4891 fill feature?

Pricing for airSlate SignNow varies based on the plan you choose, but all plans include access to the 4891 fill feature. This cost-effective solution is designed to fit businesses of all sizes, ensuring you get the best value for your document signing needs. For detailed pricing, visit our website.

-

What are the benefits of using the 4891 fill feature?

Using the 4891 fill feature in airSlate SignNow enhances productivity by reducing the time spent on document preparation. It also minimizes errors by guiding users through the filling process. Additionally, this feature supports compliance and security, ensuring your documents are handled safely.

-

Can I integrate the 4891 fill feature with other applications?

Yes, airSlate SignNow offers integrations with various applications, allowing you to utilize the 4891 fill feature seamlessly within your existing workflows. This flexibility enhances your document management capabilities and improves overall efficiency. Check our integrations page for a complete list of compatible applications.

-

Is the 4891 fill feature suitable for all types of documents?

Absolutely! The 4891 fill feature in airSlate SignNow is designed to work with a wide range of document types, including contracts, agreements, and forms. This versatility makes it an ideal solution for businesses across various industries looking to streamline their document processes.

-

How secure is the 4891 fill feature in airSlate SignNow?

The 4891 fill feature is built with security in mind, employing advanced encryption and authentication measures to protect your documents. airSlate SignNow complies with industry standards to ensure that your sensitive information remains confidential. You can trust that your documents are safe while using our platform.

-

Can I track the status of documents filled using the 4891 fill feature?

Yes, airSlate SignNow provides tracking capabilities for documents filled using the 4891 fill feature. You can easily monitor the status of your documents, including when they are viewed and signed. This transparency helps you stay informed and manage your document workflows effectively.

Get more for 4891, Michigan Corporate Income Tax Annual Return

Find out other 4891, Michigan Corporate Income Tax Annual Return

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure