4892, Michigan Corporate Income Tax Amended Return 2019

What is the 4892, Michigan Corporate Income Tax Amended Return

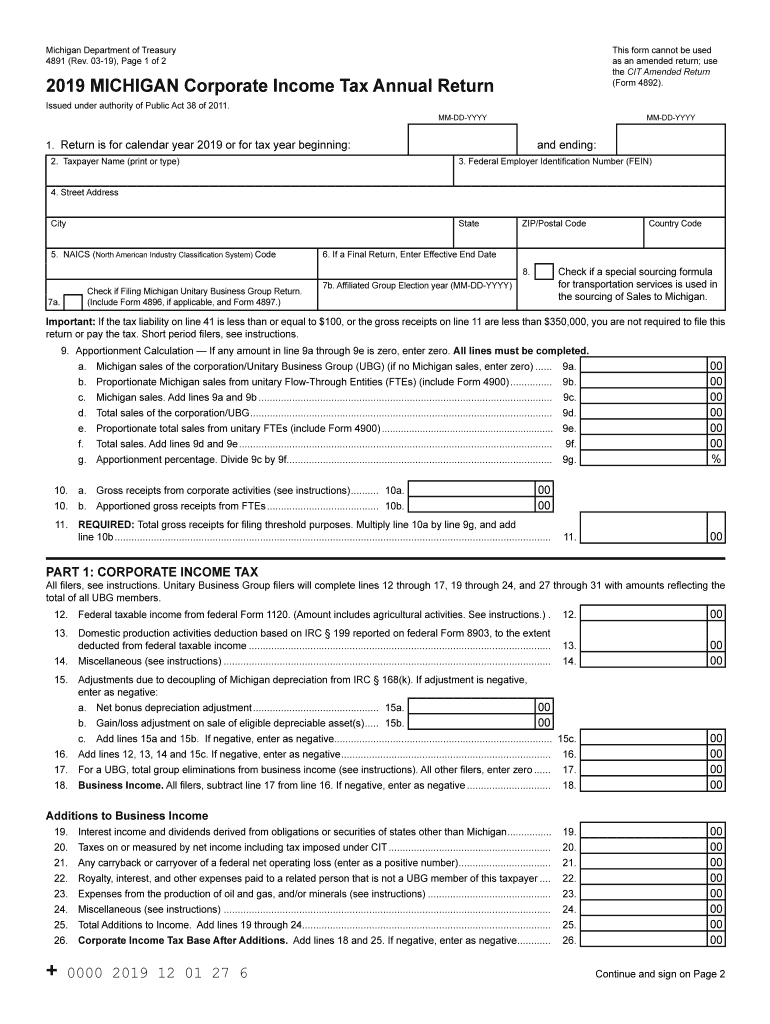

The 4892 form is the Michigan Corporate Income Tax Amended Return, used by corporations to amend previously filed corporate income tax returns. This form allows businesses to correct errors, update information, or adjust tax calculations from earlier submissions. It is essential for ensuring compliance with Michigan tax laws and for accurately reflecting a corporation's tax obligations.

Steps to complete the 4892, Michigan Corporate Income Tax Amended Return

Completing the 4892 form involves several key steps to ensure accuracy and compliance:

- Gather all relevant documents, including the original return and any supporting materials.

- Clearly indicate the changes being made on the amended return.

- Provide accurate calculations for any adjustments to income, deductions, or credits.

- Sign and date the amended return to validate the submission.

- Submit the form to the appropriate Michigan tax authority either online or via mail.

Legal use of the 4892, Michigan Corporate Income Tax Amended Return

The 4892 form must be used in accordance with Michigan tax regulations. It is legally binding when completed accurately and submitted within the required timeframe. Corporations are advised to retain copies of both the amended return and any supporting documentation for their records, as these may be requested during audits or reviews.

Filing Deadlines / Important Dates

Corporations should be aware of the filing deadlines associated with the 4892 form. Typically, the amended return must be filed within a specific period following the original return's due date. This timeframe is crucial to avoid penalties and ensure compliance with state tax laws. It is advisable to check the Michigan Department of Treasury's website for the most current deadlines.

Required Documents

When filing the 4892 form, corporations need to prepare several documents to support their amendments. These may include:

- The original corporate income tax return.

- Any schedules or attachments that were part of the original submission.

- Documentation supporting the changes being made, such as financial statements or tax credit certificates.

Penalties for Non-Compliance

Failure to file the 4892 form correctly or on time may result in penalties imposed by the Michigan Department of Treasury. These penalties can include fines and interest on any unpaid taxes. It is important for corporations to understand their obligations and ensure timely compliance to avoid these consequences.

Form Submission Methods (Online / Mail / In-Person)

The 4892 form can be submitted through various methods to accommodate different preferences. Corporations may choose to file online for quicker processing, or they can mail the completed form to the designated tax office. In-person submissions may also be possible at certain locations, depending on local regulations. Each method has its own guidelines and requirements, so it is essential to follow the instructions provided by the Michigan Department of Treasury.

Quick guide on how to complete 4892 michigan corporate income tax amended return

Effortlessly Prepare 4892, Michigan Corporate Income Tax Amended Return on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent eco-conscious alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents quickly and efficiently. Manage 4892, Michigan Corporate Income Tax Amended Return on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The Simplest Method to Edit and Electronically Sign 4892, Michigan Corporate Income Tax Amended Return with Ease

- Obtain 4892, Michigan Corporate Income Tax Amended Return and click Get Form to commence.

- Use the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred delivery method for the form—by email, SMS, or a shareable link, or download it to your computer.

Say goodbye to lost or misplaced files, exhausting document searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign 4892, Michigan Corporate Income Tax Amended Return and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 4892 michigan corporate income tax amended return

Create this form in 5 minutes!

How to create an eSignature for the 4892 michigan corporate income tax amended return

The best way to create an electronic signature for your PDF in the online mode

The best way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

The way to generate an eSignature for a PDF document on Android OS

People also ask

-

What is the mi form 4891 fillable 2015 and how can airSlate SignNow help?

The mi form 4891 fillable 2015 is a document used for tax purposes in Michigan. With airSlate SignNow, you can easily fill out, sign, and send this form electronically, simplifying the filing process and ensuring you stay compliant with regulations.

-

Is airSlate SignNow a cost-effective solution for handling the mi form 4891 fillable 2015?

Yes, airSlate SignNow offers a cost-effective solution for managing the mi form 4891 fillable 2015. Our competitive pricing plans are designed to fit various budgets, making it easier for you to access the tools you need without breaking the bank.

-

Can I legally sign the mi form 4891 fillable 2015 using airSlate SignNow?

Absolutely! When you use airSlate SignNow to sign the mi form 4891 fillable 2015, you are complying with electronic signature laws. Our platform is built with security in mind, ensuring that your electronic signatures are legally binding.

-

What features does airSlate SignNow offer for the mi form 4891 fillable 2015?

airSlate SignNow provides a range of features for the mi form 4891 fillable 2015, including customizable templates, secure storage, and real-time notifications. These features enhance your productivity and streamline the document management process.

-

Are there integrations available with airSlate SignNow for the mi form 4891 fillable 2015?

Yes, airSlate SignNow integrates seamlessly with numerous applications and platforms. This allows you to easily import or export data for the mi form 4891 fillable 2015, making it easier to manage your workload and maintain organized records.

-

What are the benefits of using airSlate SignNow for the mi form 4891 fillable 2015?

Using airSlate SignNow for the mi form 4891 fillable 2015 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. You'll save time while ensuring that your documents are handled with care and professionalism.

-

Can I access my mi form 4891 fillable 2015 documents on mobile devices with airSlate SignNow?

Yes, airSlate SignNow is fully functional on mobile devices, allowing you to access your mi form 4891 fillable 2015 documents anytime, anywhere. This flexibility helps you stay on top of your tasks whether you're in the office or on the go.

Get more for 4892, Michigan Corporate Income Tax Amended Return

- Wisconsin intestate succession form

- Wis unemployment claim online 497430514 form

- Quitclaim deed from individual to individual wisconsin form

- Warranty deed from individual to individual wisconsin form

- Wisconsin transfer deed 497430517 form

- Wi quitclaim deed form

- Gift deed individual to individual wisconsin form

- Warranty deed to child reserving a life estate in the parents wisconsin form

Find out other 4892, Michigan Corporate Income Tax Amended Return

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF