4891, Michigan Corporate Income Tax Annual Return 2020

What is the 4891, Michigan Corporate Income Tax Annual Return

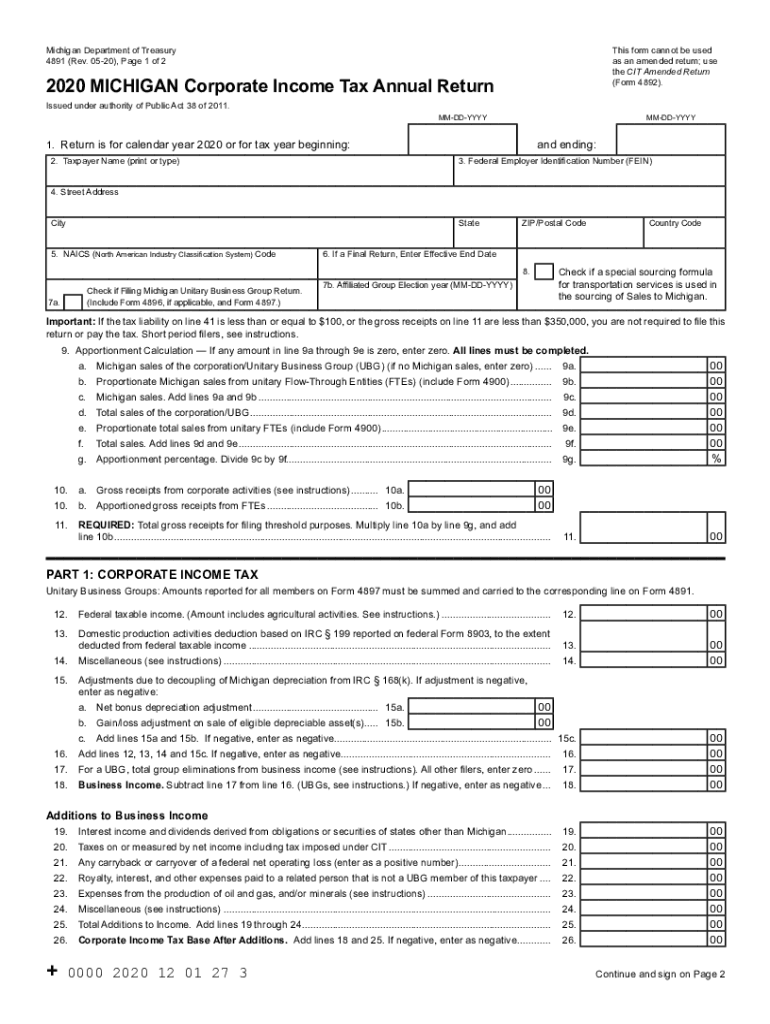

The Michigan Form 4891 is the Corporate Income Tax Annual Return used by corporations operating in Michigan. This form is essential for reporting income, calculating tax liability, and ensuring compliance with state tax laws. Corporations must complete and submit this form to the Michigan Department of Treasury, detailing their financial activities for the tax year. The form is designed to capture various financial metrics, including gross receipts and deductions, which ultimately determine the corporation's tax obligations.

Steps to complete the 4891, Michigan Corporate Income Tax Annual Return

Completing the Michigan Form 4891 involves several key steps:

- Gather necessary financial documents, including income statements, balance sheets, and prior tax returns.

- Calculate total gross receipts for the tax year, ensuring all income sources are accounted for.

- Identify allowable deductions and credits that may reduce the overall tax liability.

- Fill out the form accurately, entering all financial data in the designated sections.

- Review the completed form for accuracy and compliance with state regulations.

- Submit the form electronically or via mail to the Michigan Department of Treasury by the designated deadline.

Legal use of the 4891, Michigan Corporate Income Tax Annual Return

The Michigan Form 4891 is legally binding and must be completed in accordance with state tax laws. Corporations are required to file this form annually to report their income and pay any taxes owed. Failure to file the form accurately or on time can result in penalties, interest, and potential legal action. To ensure compliance, corporations should familiarize themselves with the relevant tax laws and guidelines provided by the Michigan Department of Treasury.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing the Michigan Form 4891. The annual return is typically due on the last day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April 30. It is crucial for corporations to be aware of these deadlines to avoid late fees and penalties associated with non-compliance.

Form Submission Methods (Online / Mail / In-Person)

The Michigan Form 4891 can be submitted through various methods, providing flexibility for corporations. The available submission methods include:

- Online submission: Corporations can file electronically through the Michigan Department of Treasury's online portal, which offers a streamlined process.

- Mail: The completed form can be printed and mailed to the appropriate address provided by the Michigan Department of Treasury.

- In-person: Corporations may also choose to deliver the form directly to a local Treasury office, ensuring immediate receipt.

Key elements of the 4891, Michigan Corporate Income Tax Annual Return

Understanding the key elements of the Michigan Form 4891 is essential for accurate completion. Important sections of the form include:

- Gross receipts: This section requires the total income generated by the corporation during the tax year.

- Deductions: Corporations can list allowable deductions that reduce taxable income, such as business expenses and credits.

- Tax calculation: This part of the form calculates the corporation's tax liability based on the reported income and deductions.

- Signature: The form must be signed by an authorized officer of the corporation, validating the information provided.

Quick guide on how to complete 4891 michigan corporate income tax annual return

Prepare 4891, Michigan Corporate Income Tax Annual Return seamlessly on any gadget

Web-based document management has become favored by businesses and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents promptly without delays. Handle 4891, Michigan Corporate Income Tax Annual Return on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to adjust and eSign 4891, Michigan Corporate Income Tax Annual Return effortlessly

- Obtain 4891, Michigan Corporate Income Tax Annual Return and click Get Form to begin.

- Utilize the resources we offer to fill out your form.

- Emphasize important sections of your documents or obscure confidential information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to share your form, via email, SMS, invite link, or download it to your desktop.

Eliminate worries about missing or lost documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Modify and eSign 4891, Michigan Corporate Income Tax Annual Return to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 4891 michigan corporate income tax annual return

Create this form in 5 minutes!

How to create an eSignature for the 4891 michigan corporate income tax annual return

How to create an electronic signature for your PDF file online

How to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to create an eSignature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

The best way to create an eSignature for a PDF document on Android devices

People also ask

-

What are the key features of airSlate SignNow for managing Michigan Form 4891?

airSlate SignNow offers robust features that simplify the management of Michigan Form 4891 instructions 2021. You'll benefit from electronic signature capabilities, customizable templates, and secure document storage. These features help streamline the process and ensure compliance with state regulations.

-

How does airSlate SignNow assist with the completion of Michigan Form 4891?

With airSlate SignNow, users can easily fill out Michigan Form 4891 instructions 2021 through an intuitive interface. The platform provides guided steps and User-friendly templates that can greatly enhance the accuracy and efficiency of completing the form. Additionally, users can collaborate in real-time to ensure all necessary data is captured correctly.

-

Is there a free trial available for airSlate SignNow users interested in Michigan Form 4891?

Yes, airSlate SignNow offers a free trial period so prospective users can explore the functionalities that assist with Michigan Form 4891 instructions 2021. During this trial, you can test out all features with no obligations, helping you evaluate the impact of our solution on your business processes.

-

What are the pricing options for using airSlate SignNow for Michigan Form 4891?

airSlate SignNow provides flexible pricing plans that cater to various business sizes and needs when working with Michigan Form 4891 instructions 2021. Whether you're a small business or a large enterprise, you can choose a plan that fits your budget while providing essential features for document signing and management.

-

Can I integrate airSlate SignNow with other applications for handling Michigan Form 4891?

Absolutely! airSlate SignNow offers seamless integrations with numerous applications, which makes handling Michigan Form 4891 instructions 2021 much easier. You can connect with tools like Google Drive, Dropbox, and various CRMs to streamline your workflow and centralize document management.

-

What are the benefits of using airSlate SignNow for Michigan Form 4891?

Using airSlate SignNow for Michigan Form 4891 instructions 2021 brings multiple benefits, including increased efficiency and reduced processing time. The platform signNowly minimizes paperwork and enhances collaboration among team members. Additionally, you can track document statuses in real-time, ensuring smoother transactions.

-

Is airSlate SignNow secure for handling sensitive forms like Michigan Form 4891?

airSlate SignNow prioritizes security, making it compliant with industry standards and regulations when dealing with Michigan Form 4891 instructions 2021. Features such as end-to-end encryption, secure access controls, and comprehensive audit logs ensure your sensitive information is protected throughout the signing process.

Get more for 4891, Michigan Corporate Income Tax Annual Return

- Affidavit of life form

- Sample declaration for spousal support form

- Prufrock analysis worksheet pdf form

- Engineering invoice template form

- Buying a lennar home what am i doing rhomebuilding form

- Eagle project time log signin sheet nametroop form

- Imago intentional dialogue basic concepts and explanation of form

- Project pre proposal conference po205 pa construction ddcftp nyc form

Find out other 4891, Michigan Corporate Income Tax Annual Return

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed