Www Revenue Wi GovPagesTaxProDOR Reminder Form PW 2 Pass through Entity Withholding 2021-2026

Understanding the Wisconsin Form PW 2 for Pass-Through Entity Withholding

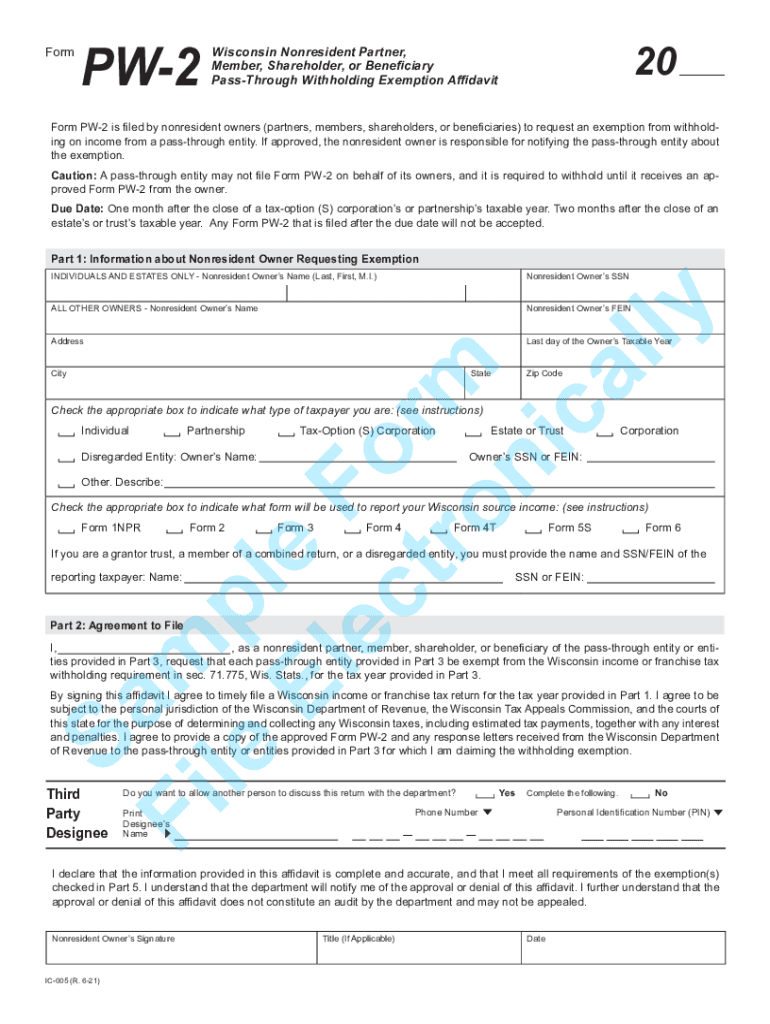

The Wisconsin Form PW 2 is a crucial document for pass-through entities, such as partnerships and S corporations, that are required to withhold taxes on behalf of their nonresident members. This form serves as a reminder for entities to comply with state tax withholding requirements. It ensures that the appropriate amount of tax is withheld from income distributed to nonresident partners or shareholders, thus facilitating compliance with Wisconsin tax laws.

Steps to Complete the Wisconsin Form PW 2

Filling out the Wisconsin Form PW 2 involves several key steps:

- Gather necessary information, including the entity's name, address, and federal employer identification number (FEIN).

- Identify the nonresident members and their respective shares of income.

- Calculate the total amount of withholding based on the income distributions to nonresidents.

- Complete the form by accurately entering the calculated withholding amounts and other required details.

- Review the form for accuracy before submission.

Obtaining the Wisconsin Form PW 2

The Wisconsin Form PW 2 can be obtained from the Wisconsin Department of Revenue's official website. It is available as a downloadable PDF, allowing for easy access and printing. Additionally, businesses can request a copy directly from the Department of Revenue if needed. Ensuring you have the most current version of the form is essential for compliance.

Legal Use of the Wisconsin Form PW 2

The legal use of the Wisconsin Form PW 2 is governed by state tax regulations. Pass-through entities must utilize this form to report and remit the required withholding tax for nonresident members. Failure to use the form appropriately can result in penalties and interest charges, making it vital for entities to understand their obligations under Wisconsin law.

Filing Deadlines for the Wisconsin Form PW 2

Filing deadlines for the Wisconsin Form PW 2 are critical for compliance. Typically, the form must be submitted by the due date of the entity's income tax return. This ensures that withholding amounts are reported and paid in a timely manner. It is advisable to check the Wisconsin Department of Revenue's website for specific dates, as they may vary annually.

Examples of Using the Wisconsin Form PW 2

Practical examples of using the Wisconsin Form PW 2 include scenarios where a partnership distributes income to its nonresident partners. For instance, if a partnership earns $100,000 and has two nonresident partners, the entity must calculate the appropriate withholding based on their share of the income. By accurately completing and submitting the PW 2, the partnership ensures compliance with state tax laws and avoids potential penalties.

Penalties for Non-Compliance with the Wisconsin Form PW 2

Non-compliance with the requirements associated with the Wisconsin Form PW 2 can lead to significant penalties. These may include fines, interest on unpaid taxes, and additional assessments from the Wisconsin Department of Revenue. It is essential for pass-through entities to adhere to all filing and payment deadlines to mitigate the risk of incurring penalties.

Quick guide on how to complete www revenue wi govpagestaxprodor reminder form pw 2 pass through entity withholding

Complete Www revenue wi govPagesTaxProDOR Reminder Form PW 2 Pass Through Entity Withholding seamlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without hassles. Manage Www revenue wi govPagesTaxProDOR Reminder Form PW 2 Pass Through Entity Withholding on any platform using airSlate SignNow Android or iOS applications and streamline any document-related operation today.

How to adjust and eSign Www revenue wi govPagesTaxProDOR Reminder Form PW 2 Pass Through Entity Withholding effortlessly

- Obtain Www revenue wi govPagesTaxProDOR Reminder Form PW 2 Pass Through Entity Withholding and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your delivery method for the form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Modify and eSign Www revenue wi govPagesTaxProDOR Reminder Form PW 2 Pass Through Entity Withholding to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct www revenue wi govpagestaxprodor reminder form pw 2 pass through entity withholding

Create this form in 5 minutes!

How to create an eSignature for the www revenue wi govpagestaxprodor reminder form pw 2 pass through entity withholding

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Wisconsin Form PW 2 and why is it important?

The Wisconsin Form PW 2 is crucial for tax reporting purposes in the state of Wisconsin. This form helps record and report wages paid to employees, ensuring compliance with state tax regulations. Using airSlate SignNow can simplify the process of completing and eSigning Wisconsin Form PW 2, making it easy for businesses to manage their payroll documentation accurately.

-

How does airSlate SignNow facilitate the completion of Wisconsin Form PW 2?

airSlate SignNow streamlines the completion of Wisconsin Form PW 2 by providing an intuitive interface for filling out forms electronically. The platform allows users to easily input necessary information and save templates for future use. Additionally, airSlate SignNow enables quick eSigning, which accelerates the overall workflow for businesses.

-

Is there a cost associated with using airSlate SignNow for Wisconsin Form PW 2?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs when processing documents like Wisconsin Form PW 2. Each plan is designed to provide value through features such as unlimited templates and integrations. Businesses can choose a plan that best fits their budget while gaining access to the tools necessary for efficient document management.

-

Can I integrate airSlate SignNow with other software for handling Wisconsin Form PW 2?

Absolutely! airSlate SignNow supports a variety of integrations with popular software tools, allowing for seamless management of Wisconsin Form PW 2 alongside other business processes. This means you can connect your HR, payroll, and accounting systems to easily transfer data and maintain accuracy. Maximizing integration capabilities can signNowly enhance your document workflow.

-

What are the key benefits of using airSlate SignNow for Wisconsin Form PW 2?

Using airSlate SignNow for Wisconsin Form PW 2 offers numerous benefits, including improved efficiency in document management and reduced turnaround times. It simplifies the eSigning process, ensuring that documents are signed quickly and securely. Additionally, the platform enhances compliance by maintaining accurate records of each transaction related to Wisconsin Form PW 2.

-

Is airSlate SignNow user-friendly for those unfamiliar with Wisconsin Form PW 2?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those unfamiliar with Wisconsin Form PW 2. The straightforward design and helpful tutorials guide users through the process of creating and eSigning their documents. This ensures that anyone can navigate the platform without a steep learning curve.

-

How secure is airSlate SignNow when handling Wisconsin Form PW 2?

airSlate SignNow prioritizes security and compliance when managing documents like Wisconsin Form PW 2. The platform employs advanced encryption methods to protect sensitive information during transmission and storage. Regular security audits also ensure that user data remains safe, complying with industry standards and regulations.

Get more for Www revenue wi govPagesTaxProDOR Reminder Form PW 2 Pass Through Entity Withholding

Find out other Www revenue wi govPagesTaxProDOR Reminder Form PW 2 Pass Through Entity Withholding

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT