How to Select Checkboxes and Radio Buttons Via the Keyboard 2020

Understanding the Shareholder Digit Taxpayer Form

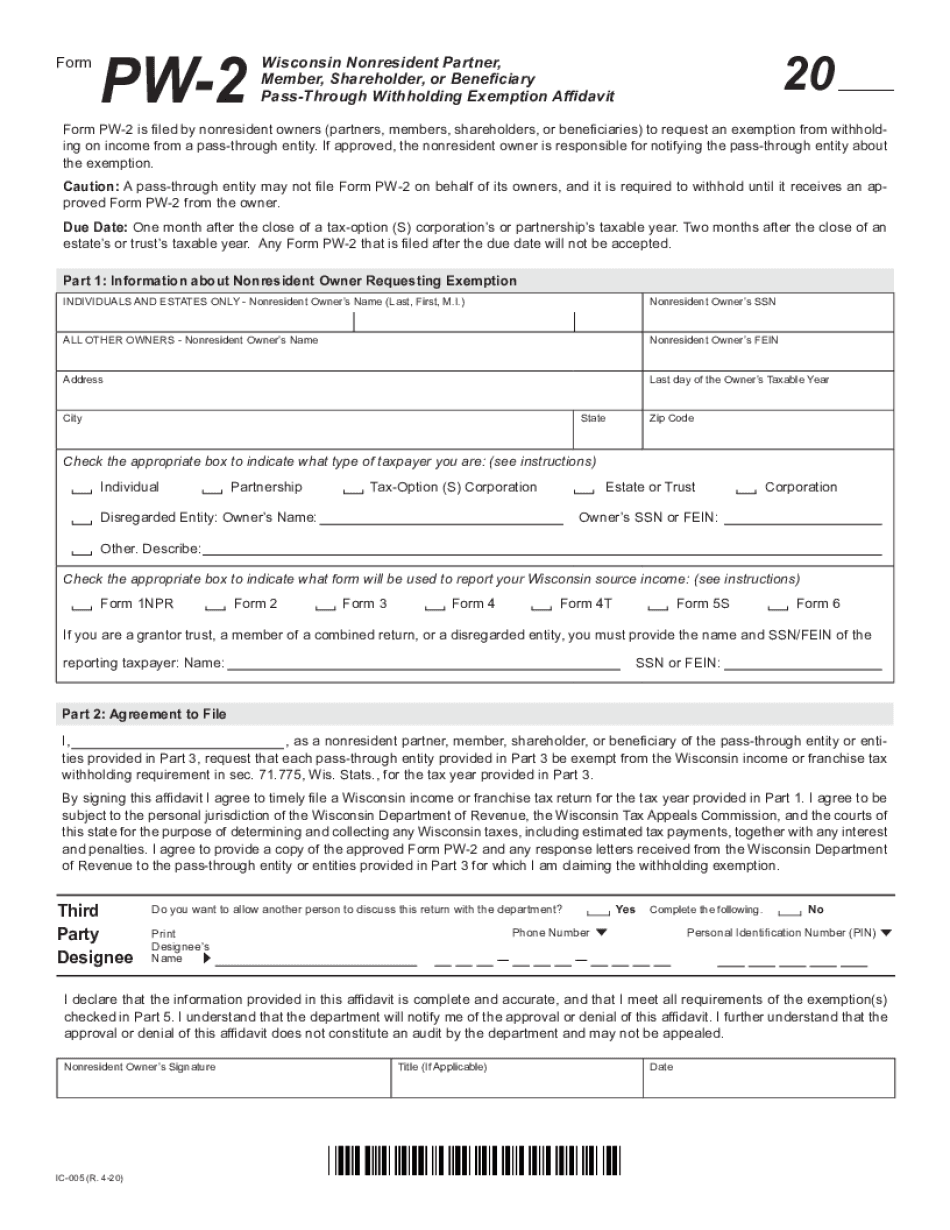

The shareholder digit taxpayer form is essential for individuals involved in partnerships or corporations to report their income accurately. This form helps ensure that shareholders fulfill their tax obligations while also allowing businesses to maintain compliance with IRS regulations. Understanding the nuances of this form is crucial for both taxpayers and businesses to avoid penalties and ensure proper reporting.

IRS Guidelines for Shareholder Tax Reporting

The Internal Revenue Service (IRS) provides specific guidelines on how shareholders should report their income. These guidelines outline the necessary information that must be included on the form, such as the shareholder's name, identification number, and the amount of income attributable to them. Adhering to these guidelines is vital for accurate tax reporting and to prevent any issues during audits.

Filing Deadlines and Important Dates

Timely submission of the shareholder digit taxpayer form is crucial. The IRS sets specific deadlines for filing these forms, which typically coincide with the tax filing season. Missing these deadlines can lead to penalties and interest on unpaid taxes. It is advisable to keep track of these dates to ensure compliance and avoid unnecessary complications.

Required Documents for Completion

To complete the shareholder digit taxpayer form accurately, several documents are typically required. These may include previous tax returns, documentation of income received from the entity, and any relevant financial statements. Having these documents readily available can streamline the process and help ensure that all necessary information is included on the form.

Digital vs. Paper Version of the Form

Choosing between the digital and paper versions of the shareholder digit taxpayer form can impact the filing process. The digital version often allows for easier completion and submission, as well as enhanced tracking capabilities. In contrast, the paper version may require more time for processing and can lead to delays. Understanding the benefits of each option can help taxpayers make informed decisions.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the shareholder digit taxpayer form can result in significant penalties. These penalties may include fines or interest on unpaid taxes. It is essential for shareholders to understand the implications of non-compliance to avoid financial repercussions and maintain good standing with the IRS.

Quick guide on how to complete how to select checkboxes and radio buttons via the keyboard

Prepare How To Select Checkboxes And Radio Buttons Via The Keyboard effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents promptly and without delays. Manage How To Select Checkboxes And Radio Buttons Via The Keyboard on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to edit and eSign How To Select Checkboxes And Radio Buttons Via The Keyboard with ease

- Obtain How To Select Checkboxes And Radio Buttons Via The Keyboard and click on Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Emphasize signNow sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to submit your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign How To Select Checkboxes And Radio Buttons Via The Keyboard and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to select checkboxes and radio buttons via the keyboard

Create this form in 5 minutes!

How to create an eSignature for the how to select checkboxes and radio buttons via the keyboard

The way to create an eSignature for your PDF file online

The way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to create an eSignature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

How to create an eSignature for a PDF on Android devices

People also ask

-

What is airSlate SignNow and how does it benefit a shareholder digit taxpayer?

airSlate SignNow is an intuitive eSignature platform designed to streamline the signing process for documents. For a shareholder digit taxpayer, this means quicker approval times and enhanced efficiency in managing legal documents related to tax matters.

-

How does airSlate SignNow ensure the security of documents for shareholder digit taxpayers?

The platform employs advanced encryption methods and secure cloud storage to protect documents. For a shareholder digit taxpayer, this ensures that sensitive tax-related information remains confidential and secure throughout the signing process.

-

What are the pricing plans available for airSlate SignNow for a shareholder digit taxpayer?

airSlate SignNow offers flexible pricing plans that cater to the needs of businesses, including options suitable for small enterprises and larger organizations. For a shareholder digit taxpayer, these plans are designed to provide cost-effective eSigning solutions without compromising on features.

-

Can airSlate SignNow integrate with other tools for shareholder digit taxpayers?

Yes, airSlate SignNow seamlessly integrates with a variety of popular business applications such as Google Workspace, Microsoft Office, and CRM systems. This allows a shareholder digit taxpayer to enhance their document workflow and improve productivity.

-

What features does airSlate SignNow offer for simplifying the eSigning process for shareholder digit taxpayers?

Key features include customizable templates, mobile access, and real-time tracking of document status. These functionalities are particularly beneficial for shareholder digit taxpayers looking to expedite their document handling.

-

How can airSlate SignNow help a shareholder digit taxpayer comply with legal requirements?

airSlate SignNow meets industry standards for electronic signatures, ensuring that documents signed through its platform hold legal weight. For a shareholder digit taxpayer, this means meeting compliance obligations effortlessly.

-

Is there customer support available for shareholder digit taxpayers using airSlate SignNow?

Yes, airSlate SignNow provides dedicated customer support through various channels, including live chat and email. This ensures that a shareholder digit taxpayer can receive assistance promptly to resolve any issues they might encounter.

Get more for How To Select Checkboxes And Radio Buttons Via The Keyboard

- Quitclaim deed from llc to llc washington form

- Washington personal representative deed form

- Washington motion 497429311 form

- Non responsive form

- Washington professional form

- Quitclaim deed from individual to two individuals in joint tenancy washington form

- Owners demand for release mechanics liens individual washington form

- Quitclaim deed by two individuals to husband and wife washington form

Find out other How To Select Checkboxes And Radio Buttons Via The Keyboard

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple