Wisconsin Form Pw 2 2019

What is the Wisconsin Form PW-2

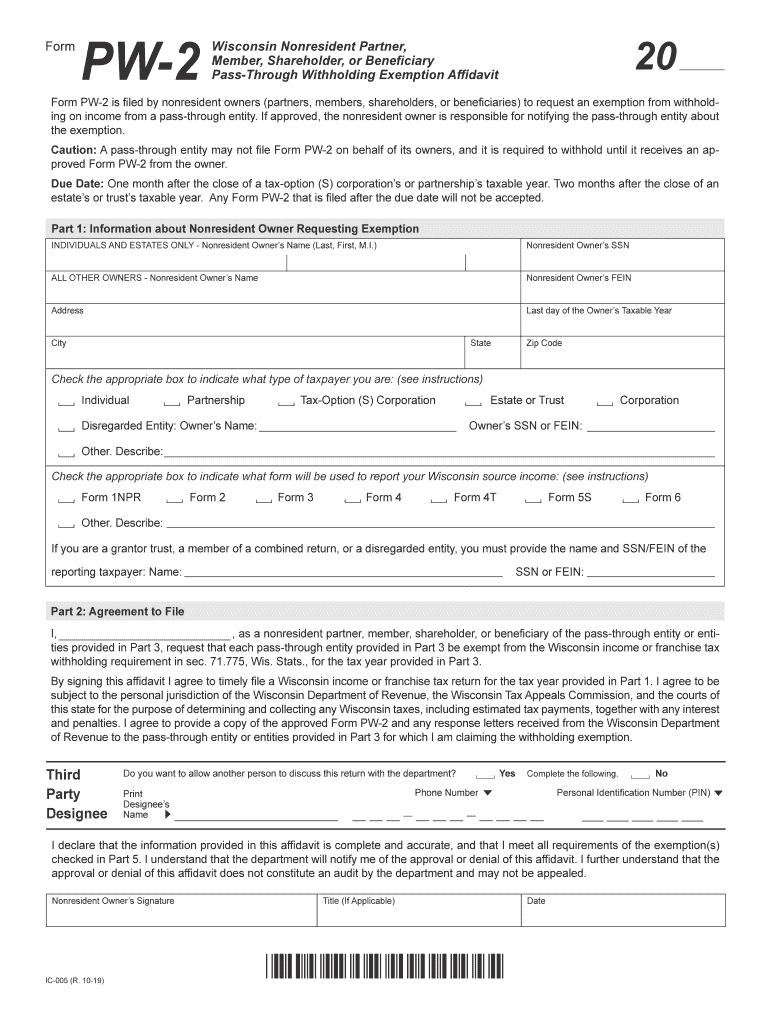

The Wisconsin Form PW-2 is a document used for reporting wages and tax information for employees in the state of Wisconsin. This form is essential for employers to report the wages paid to employees, along with the corresponding state and federal taxes withheld. It serves as a key component in ensuring compliance with state tax regulations and provides necessary information for employees when filing their personal income tax returns.

How to Use the Wisconsin Form PW-2

Using the Wisconsin Form PW-2 involves several steps to ensure accurate reporting of wages and taxes. Employers should first gather all necessary payroll records, including employee names, Social Security numbers, and total wages paid. Once this data is compiled, employers can accurately fill out the form, ensuring that all required fields are completed. After completing the form, it must be submitted to the Wisconsin Department of Revenue by the designated filing deadline to avoid penalties.

Steps to Complete the Wisconsin Form PW-2

Completing the Wisconsin Form PW-2 involves a systematic approach:

- Gather all payroll information, including employee details and wage amounts.

- Fill in the employee's name, Social Security number, and total wages in the respective sections of the form.

- Calculate the total state and federal taxes withheld for each employee.

- Review the completed form for accuracy and completeness.

- Submit the form to the Wisconsin Department of Revenue by the specified deadline.

Legal Use of the Wisconsin Form PW-2

The Wisconsin Form PW-2 is legally binding and must be completed in accordance with state laws. Employers are required to submit this form to report wages and taxes accurately. Failure to comply with these regulations can result in penalties, including fines and interest on unpaid taxes. It is crucial for employers to maintain accurate records and ensure timely submission to avoid legal repercussions.

Key Elements of the Wisconsin Form PW-2

Several key elements are essential when completing the Wisconsin Form PW-2:

- Employee Information: Accurate names and Social Security numbers of all employees.

- Total Wages: The total amount paid to each employee during the reporting period.

- Tax Withholdings: Detailed reporting of state and federal taxes withheld from employee wages.

- Employer Information: The employer's name, address, and identification number.

Form Submission Methods

The Wisconsin Form PW-2 can be submitted through various methods, ensuring flexibility for employers. The available submission methods include:

- Online Submission: Employers can use the Wisconsin Department of Revenue's online portal for electronic filing.

- Mail: Completed forms can be mailed to the appropriate address provided by the Department of Revenue.

- In-Person: Employers may also choose to deliver the form in person at designated state offices.

Quick guide on how to complete form p 100 download fillable pdf application to ascertain

Complete Wisconsin Form Pw 2 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without any hold-ups. Handle Wisconsin Form Pw 2 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered operation today.

How to modify and electronically sign Wisconsin Form Pw 2 with ease

- Obtain Wisconsin Form Pw 2 and then click Get Form to begin.

- Utilize the tools available to finalize your document.

- Emphasize pertinent sections of the documents or obscure sensitive data with the tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review all information and then click on the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), an invitation link, or download it to your computer.

Forget about lost or misfiled documents, time-consuming form navigation, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Edit and electronically sign Wisconsin Form Pw 2 while ensuring exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form p 100 download fillable pdf application to ascertain

Create this form in 5 minutes!

How to create an eSignature for the form p 100 download fillable pdf application to ascertain

How to create an electronic signature for the Form P 100 Download Fillable Pdf Application To Ascertain in the online mode

How to make an electronic signature for your Form P 100 Download Fillable Pdf Application To Ascertain in Chrome

How to make an eSignature for putting it on the Form P 100 Download Fillable Pdf Application To Ascertain in Gmail

How to create an eSignature for the Form P 100 Download Fillable Pdf Application To Ascertain straight from your mobile device

How to make an eSignature for the Form P 100 Download Fillable Pdf Application To Ascertain on iOS

How to generate an electronic signature for the Form P 100 Download Fillable Pdf Application To Ascertain on Android

People also ask

-

What is Wisconsin Form Pw 2 and how can airSlate SignNow help?

Wisconsin Form Pw 2 is a state-specific tax form used for reporting wage and tax information. With airSlate SignNow, businesses can easily send and eSign this form electronically, ensuring compliance and accuracy. Our platform streamlines the process, making it simple to manage and submit the Wisconsin Form Pw 2.

-

Is airSlate SignNow a cost-effective solution for managing Wisconsin Form Pw 2?

Yes, airSlate SignNow offers a cost-effective solution for managing Wisconsin Form Pw 2. Our pricing plans are designed to accommodate businesses of all sizes, providing features that enhance productivity without breaking the bank. You can save on printing and mailing costs while ensuring secure electronic submissions.

-

Can I integrate airSlate SignNow with other software I use for Wisconsin Form Pw 2?

Absolutely! airSlate SignNow integrates seamlessly with a variety of software platforms, making it easy to manage Wisconsin Form Pw 2 alongside your existing tools. Whether you use CRM systems, cloud storage, or accounting software, our integrations help streamline your workflow.

-

What features does airSlate SignNow offer for completing Wisconsin Form Pw 2?

airSlate SignNow provides a range of features tailored for completing Wisconsin Form Pw 2, including templates, customizable fields, and secure eSigning. These tools help ensure that your forms are filled accurately and efficiently, reducing the risk of errors and speeding up the submission process.

-

How does airSlate SignNow ensure the security of Wisconsin Form Pw 2?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure storage to protect your Wisconsin Form Pw 2 and other sensitive documents. Additionally, our platform complies with industry standards to ensure your data remains safe throughout the eSigning process.

-

Can I track the status of my Wisconsin Form Pw 2 with airSlate SignNow?

Yes, you can easily track the status of your Wisconsin Form Pw 2 using airSlate SignNow. Our platform provides real-time updates on when documents are sent, viewed, and signed, allowing you to stay informed throughout the entire process.

-

What are the benefits of using airSlate SignNow for Wisconsin Form Pw 2?

Using airSlate SignNow for Wisconsin Form Pw 2 offers numerous benefits, including increased efficiency, reduced paper waste, and enhanced compliance. Our user-friendly interface allows you to manage your forms from anywhere, ensuring you meet deadlines without hassle.

Get more for Wisconsin Form Pw 2

- Application for handicap parking permit ontario pdf form

- Safety standards forms number

- I i i alderman building form

- Hhsc medicaid provider agreement tmhpcom form

- Molina healthcare doctors note form

- Oklahoma operators security verification form

- Access lynx eligibility application for form

- Account information and contractor registration cityoftulsa

Find out other Wisconsin Form Pw 2

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later