Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 Educational ImprovementOpportunity Scholar 2013

What is the Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 Educational ImprovementOpportunity Scholar

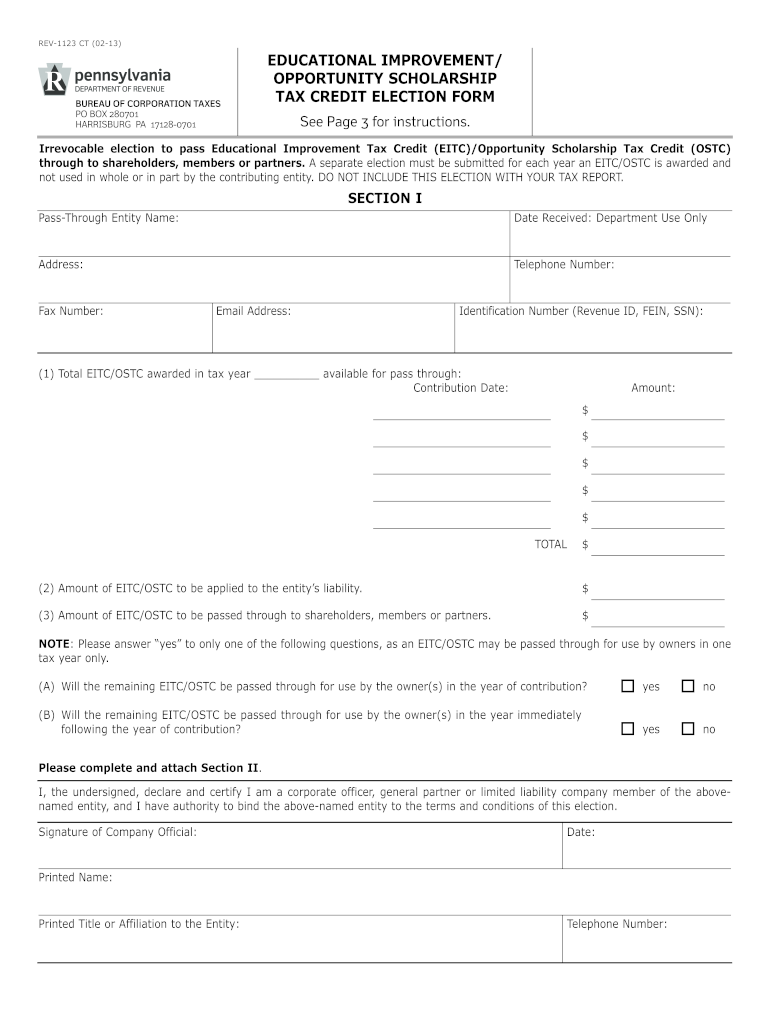

The Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 is a specific tax document designed for taxpayers in the United States seeking to claim tax credits related to educational improvement opportunities. This form allows eligible individuals and businesses to elect to contribute to scholarship organizations, which in turn provide scholarships to students attending eligible schools. By filling out this form, taxpayers can potentially reduce their tax liability while supporting educational initiatives in their communities.

Steps to complete the Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 Educational ImprovementOpportunity Scholar

Completing the Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 involves several key steps:

- Gather necessary information, including your personal details and tax identification number.

- Review the eligibility criteria to ensure you qualify for the tax credit.

- Fill out the form accurately, providing all requested information in the designated fields.

- Sign the form electronically using a compliant eSignature solution for validation.

- Submit the completed form according to the specified submission methods, ensuring it is sent before the deadline.

How to obtain the Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 Educational ImprovementOpportunity Scholar

The Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 can be obtained through various channels. Typically, it is available on the official state department of revenue website or educational agency websites. Additionally, taxpayers may request a physical copy from local tax offices or educational institutions that participate in the scholarship program. It is essential to ensure that you are using the most current version of the form to comply with any updates in tax regulations.

Legal use of the Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 Educational ImprovementOpportunity Scholar

To ensure the legal validity of the Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123, it must be completed in accordance with state laws and IRS guidelines. This includes providing accurate information and adhering to deadlines for submission. The form must be signed, either physically or electronically, to confirm the authenticity of the submission. Misrepresentation or failure to comply with legal requirements can result in penalties or disqualification from receiving the tax credit.

Key elements of the Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 Educational ImprovementOpportunity Scholar

Key elements of the Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 include:

- Taxpayer identification information, including name and Social Security number.

- Details of the scholarship organization to which contributions will be made.

- Amount of the tax credit being claimed.

- Signature section for the taxpayer or authorized representative.

- Instructions for submission and any additional documentation required.

Filing Deadlines / Important Dates

Filing deadlines for the Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 are crucial to ensure eligibility for the tax credit. Typically, the form must be submitted by a specific date, often aligned with the annual tax filing deadline. It is important to check the latest state regulations for any changes to these dates, as they can vary from year to year. Missing the deadline may result in the inability to claim the credit for that tax year.

Quick guide on how to complete educational improvementopportunity scholarship tax credit election form rev 1123 educational improvementopportunity scholarship

Your assistance manual on how to prepare your Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 Educational ImprovementOpportunity Scholar

If you’re curious about how to generate and submit your Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 Educational ImprovementOpportunity Scholar, below are some brief guidelines to simplify your tax filing process.

To start, you just need to sign up for your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an extremely intuitive and powerful document software that enables you to modify, create, and complete your tax paperwork effortlessly. With its editor, you can toggle between text, checkboxes, and electronic signatures, and revert to modify details as necessary. Streamline your tax handling with sophisticated PDF editing, eSigning, and easy sharing options.

Follow the instructions below to finalize your Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 Educational ImprovementOpportunity Scholar in no time:

- Create your account and commence working on PDFs almost instantly.

- Utilize our directory to find any IRS tax document; explore different versions and schedules.

- Click Get form to access your Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 Educational ImprovementOpportunity Scholar in our editor.

- Complete the necessary fillable sections with your details (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-recognized eSignature (if required).

- Examine your document and fix any inaccuracies.

- Preserve changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Keep in mind that submitting paper forms can lead to increased errors in returns and delays in refunds. Certainly, before e-filing your taxes, verify the IRS website for submission rules relevant to your state.

Create this form in 5 minutes or less

Find and fill out the correct educational improvementopportunity scholarship tax credit election form rev 1123 educational improvementopportunity scholarship

Create this form in 5 minutes!

How to create an eSignature for the educational improvementopportunity scholarship tax credit election form rev 1123 educational improvementopportunity scholarship

How to create an eSignature for your Educational Improvementopportunity Scholarship Tax Credit Election Form Rev 1123 Educational Improvementopportunity Scholarship online

How to generate an eSignature for the Educational Improvementopportunity Scholarship Tax Credit Election Form Rev 1123 Educational Improvementopportunity Scholarship in Chrome

How to create an electronic signature for putting it on the Educational Improvementopportunity Scholarship Tax Credit Election Form Rev 1123 Educational Improvementopportunity Scholarship in Gmail

How to generate an eSignature for the Educational Improvementopportunity Scholarship Tax Credit Election Form Rev 1123 Educational Improvementopportunity Scholarship from your smartphone

How to create an electronic signature for the Educational Improvementopportunity Scholarship Tax Credit Election Form Rev 1123 Educational Improvementopportunity Scholarship on iOS devices

How to make an electronic signature for the Educational Improvementopportunity Scholarship Tax Credit Election Form Rev 1123 Educational Improvementopportunity Scholarship on Android devices

People also ask

-

What is the Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 Educational ImprovementOpportunity Scholar?

The Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 Educational ImprovementOpportunity Scholar is a document designed to help eligible taxpayers allocate part of their tax liability to fund scholarships for students attending approved private schools. This form is a vital part of the process for individuals who want to contribute to educational improvement while receiving tax credits.

-

How does the Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 Educational ImprovementOpportunity Scholar benefit me?

By filling out the Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 Educational ImprovementOpportunity Scholar, you can receive tax credits that signNowly reduce your tax liability. This form ultimately allows you to make a positive impact on local education while also benefiting financially during tax season.

-

Is there a cost associated with using the Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 Educational ImprovementOpportunity Scholar?

Using the Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 Educational ImprovementOpportunity Scholar itself does not incur direct fees. However, it is essential to consult with a tax professional to understand any applicable costs or fees related to filing or assistance in utilizing this scholarship tax credit.

-

What are the features of the Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 Educational ImprovementOpportunity Scholar?

This form includes essential sections for reporting relevant taxpayer information and detailing the amount of tax credits intended for allocation. It is designed to streamline the process for taxpayers and ensure compliance with state educational funding requirements.

-

How can I submit the Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 Educational ImprovementOpportunity Scholar?

The Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 Educational ImprovementOpportunity Scholar can typically be submitted electronically through your state’s department of revenue or education portal. Ensure you follow the submission guidelines carefully to complete your application successfully.

-

Are there any deadlines for submitting the Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 Educational ImprovementOpportunity Scholar?

Yes, there are specific deadlines for submitting the Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 Educational ImprovementOpportunity Scholar each tax year. It is crucial to check your state's official guidelines to ensure your form is submitted on time to avoid missing out on potential tax credits.

-

Can I track my application for the Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 Educational ImprovementOpportunity Scholar?

Many state tax departments provide online tools to track the status of your application for the Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 Educational ImprovementOpportunity Scholar. It is advisable to keep a record of your submission and any confirmation number received.

Get more for Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 Educational ImprovementOpportunity Scholar

Find out other Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 Educational ImprovementOpportunity Scholar

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free