Form 80 320 23 8 1 000 Rev 2023

Understanding the 80320 Penalty Form

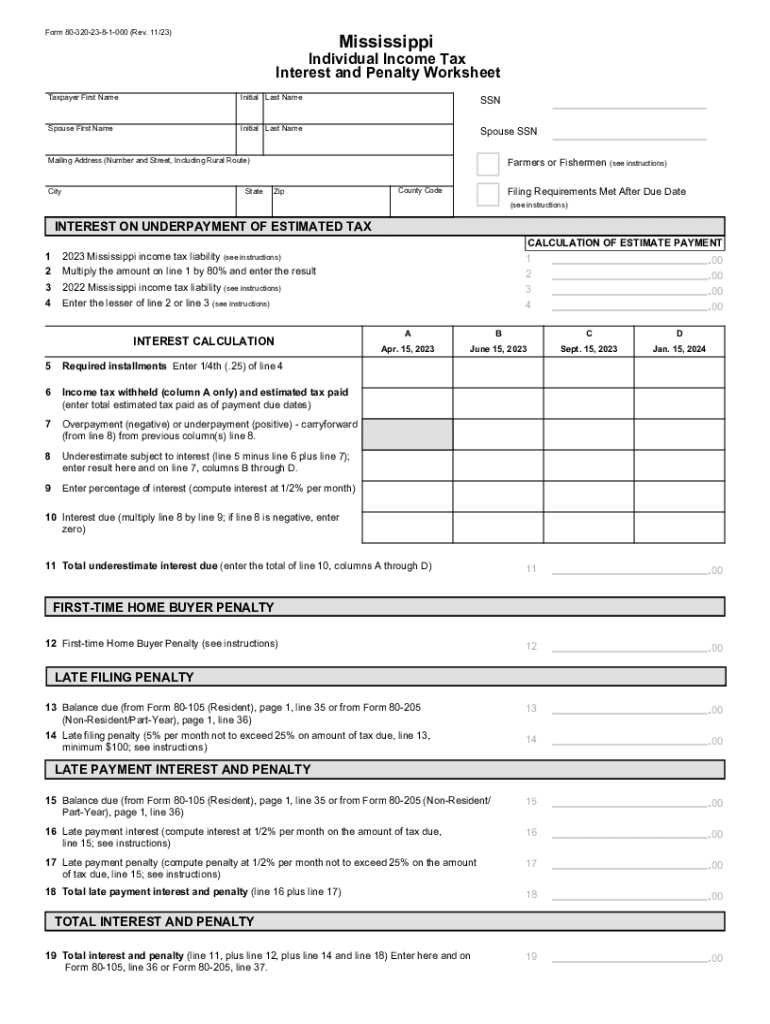

The 80320 penalty form is a specific document used for reporting and addressing penalties associated with tax compliance in the United States. This form is essential for taxpayers who may have incurred penalties due to late filings or underpayment of taxes. Understanding this form helps ensure that individuals and businesses can manage their tax obligations effectively and avoid further penalties.

Steps to Complete the 80320 Penalty Form

Completing the 80320 penalty form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, accurately fill out each section of the form, paying close attention to the details regarding penalties incurred. It is crucial to provide correct information about your tax situation, including any mitigating circumstances that may apply. Once completed, review the form for accuracy before submission.

Filing Deadlines and Important Dates

Timeliness is critical when submitting the 80320 penalty form. Be aware of the specific deadlines for filing to avoid additional penalties. Generally, forms should be submitted as soon as the penalty is recognized, ideally within the timeframe specified by the IRS for the tax year in question. Keeping track of these important dates helps ensure compliance and reduces the risk of incurring further penalties.

Penalties for Non-Compliance

Failure to submit the 80320 penalty form on time can result in additional penalties and interest charges. The IRS may impose these penalties based on the amount owed and the duration of the delay. Understanding the consequences of non-compliance emphasizes the importance of timely and accurate submission of this form. Taxpayers should be proactive in addressing any penalties to mitigate potential financial repercussions.

Obtaining the 80320 Penalty Form

The 80320 penalty form can be obtained through various channels. Taxpayers can download the form directly from the IRS website or request a physical copy from their local IRS office. It is important to ensure that you are using the most current version of the form to comply with all regulations. Additionally, many tax preparation software programs include the form, making it easier to fill out and submit electronically.

Legal Use of the 80320 Penalty Form

The 80320 penalty form is legally recognized as a means for taxpayers to report and address penalties related to their tax obligations. Proper use of the form ensures that individuals and businesses can communicate effectively with the IRS regarding any penalties incurred. Understanding the legal implications of this form is crucial for maintaining compliance with tax laws and regulations.

Quick guide on how to complete form 80 320 23 8 1 000 rev

Complete Form 80 320 23 8 1 000 Rev effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Form 80 320 23 8 1 000 Rev on any platform with airSlate SignNow Android or iOS applications and simplify your document-based processes today.

How to modify and eSign Form 80 320 23 8 1 000 Rev with ease

- Find Form 80 320 23 8 1 000 Rev and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign option, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, either via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your choice. Edit and eSign Form 80 320 23 8 1 000 Rev and ensure outstanding communication throughout any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 80 320 23 8 1 000 rev

Create this form in 5 minutes!

How to create an eSignature for the form 80 320 23 8 1 000 rev

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 80320 penalty form and who needs it?

The 80320 penalty form is a specific document used by businesses to address penalties associated with tax filing errors or late submissions. Companies that have incurred such penalties may need to fill out this form to request relief or adjust their situation. Understanding its importance can help businesses avoid future issues.

-

How does airSlate SignNow facilitate the submission of the 80320 penalty form?

With airSlate SignNow, submitting the 80320 penalty form is streamlined through our easy-to-use eSignature features. You can fill out, sign, and send the form electronically, ensuring that it's submitted quickly and securely. This reduces the risk of errors and delays in processing.

-

What are the pricing plans for using airSlate SignNow with the 80320 penalty form?

airSlate SignNow offers various pricing plans that cater to different business needs. Our plans include features that simplify the completion of the 80320 penalty form and other documents. Check our website for detailed pricing information and choose a plan that best fits your requirement.

-

Can I save my 80320 penalty form templates in airSlate SignNow?

Yes, airSlate SignNow allows you to create and save templates for the 80320 penalty form. This feature enables you to reuse the form quickly without having to fill out the information each time. Saving templates streamlines your workflow and increases efficiency.

-

Does airSlate SignNow integrate with other software for processing the 80320 penalty form?

Absolutely! airSlate SignNow integrates seamlessly with various software platforms that enhance your document management processes. This integration is particularly useful when working on the 80320 penalty form, as it ensures a smooth transfer of data and better collaboration.

-

How secure is the submission of the 80320 penalty form via airSlate SignNow?

Security is a top priority at airSlate SignNow. When submitting the 80320 penalty form, your data is encrypted and securely stored, protecting it from unauthorized access. We follow industry-standard security practices to ensure that your sensitive information remains confidential.

-

What are the benefits of using airSlate SignNow for the 80320 penalty form?

Using airSlate SignNow for the 80320 penalty form offers numerous benefits, including time savings and greater accuracy. Our platform eliminates the hassle of paperwork by providing a digital solution that is both efficient and user-friendly. Additionally, you’ll have access to tracking and notifications for enhanced document management.

Get more for Form 80 320 23 8 1 000 Rev

- Please give us the following information about you ct

- Std 23 ct form

- Connecticut valley hospital ct form

- Dc board of medicine character reference form

- Ibudget florida hcbs waiver eligibility work sheet apd apdcares form

- Florida application cannabis get form

- Apd florida ibudget form

- Amvir agreement form

Find out other Form 80 320 23 8 1 000 Rev

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free