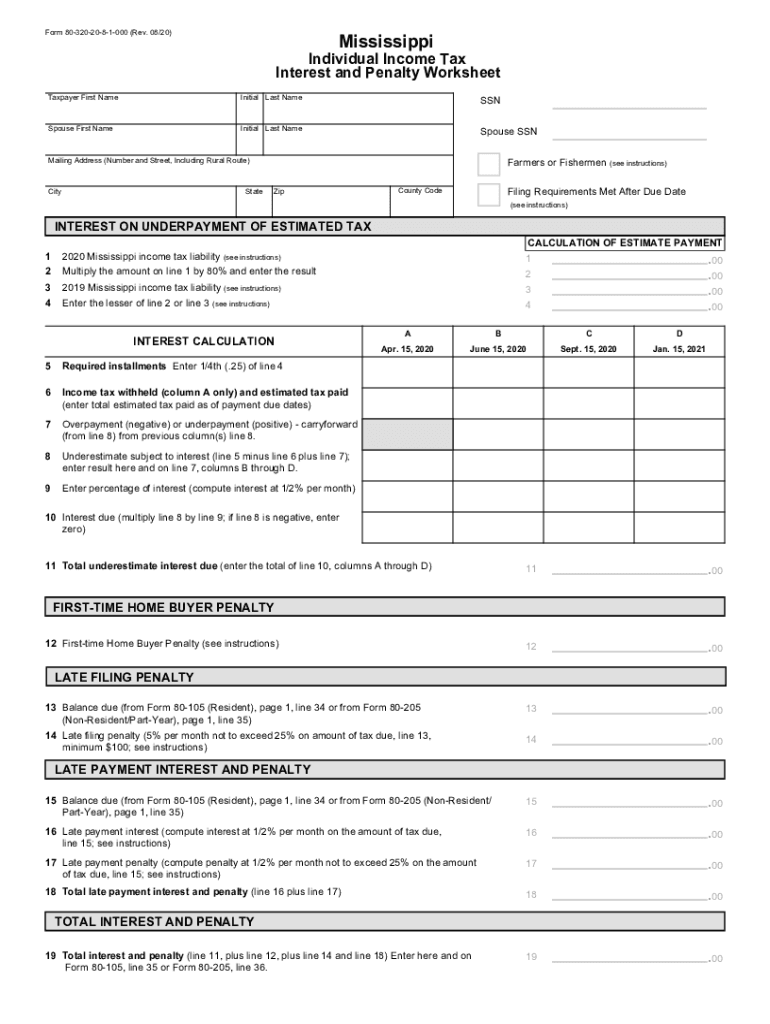

Mississippi Individual Income Tax Interest and Penalty Worksheet 2020

What is the 80 320 form?

The 80 320 form is a specific document used for reporting and calculating certain tax liabilities in the state of Mississippi. It is primarily associated with individual income tax and is essential for taxpayers who need to address interest and penalties related to their tax filings. Understanding the purpose of this form is crucial for ensuring compliance with state tax regulations.

Steps to complete the 80 320 form

Completing the 80 320 form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents, including previous tax returns and any correspondence from the Mississippi Department of Revenue.

- Begin filling out the form by entering your personal information, such as your name, address, and Social Security number.

- Calculate your total income and any applicable deductions to determine your tax liability.

- Follow the instructions provided on the form to calculate any interest and penalties owed.

- Review your completed form for accuracy before submission.

Legal use of the 80 320 form

The 80 320 form is legally binding when completed and submitted according to Mississippi tax laws. It is essential to ensure that all information provided is accurate and truthful, as discrepancies can lead to penalties or legal issues. The form must be signed, either electronically or in ink, to validate its contents. Compliance with the relevant tax laws is necessary for the form to be accepted by the state.

Filing Deadlines / Important Dates

Timely submission of the 80 320 form is critical to avoid additional penalties. The deadlines for filing typically align with the state income tax deadlines. Taxpayers should be aware of these dates to ensure compliance. It is advisable to check the Mississippi Department of Revenue's official website for the most current deadlines and any changes that may occur annually.

Who Issues the Form

The 80 320 form is issued by the Mississippi Department of Revenue. This state agency is responsible for overseeing tax collection and ensuring compliance with tax laws. Taxpayers can obtain the form directly from the department's website or through authorized tax professionals who assist with tax filings in Mississippi.

Penalties for Non-Compliance

Failure to file the 80 320 form or inaccuracies in the information provided can result in significant penalties. These may include monetary fines, interest on unpaid taxes, and potential legal action. It is essential for taxpayers to understand the implications of non-compliance and to seek assistance if they are unsure about their filing obligations.

Quick guide on how to complete mississippi individual income tax interest and penalty worksheet

Complete Mississippi Individual Income Tax Interest And Penalty Worksheet effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to locate the necessary form and safely keep it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly without delays. Handle Mississippi Individual Income Tax Interest And Penalty Worksheet on any platform using airSlate SignNow Android or iOS applications and streamline any document-centric process today.

The simplest way to edit and eSign Mississippi Individual Income Tax Interest And Penalty Worksheet seamlessly

- Find Mississippi Individual Income Tax Interest And Penalty Worksheet and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Edit and eSign Mississippi Individual Income Tax Interest And Penalty Worksheet and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mississippi individual income tax interest and penalty worksheet

Create this form in 5 minutes!

How to create an eSignature for the mississippi individual income tax interest and penalty worksheet

The way to make an electronic signature for your PDF in the online mode

The way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

How to make an eSignature for a PDF on Android OS

People also ask

-

What is the 80 320 form, and how can airSlate SignNow help?

The 80 320 form is an essential document for various legal and business transactions. airSlate SignNow simplifies the signing and sending process, allowing users to complete the 80 320 form seamlessly and securely. With our platform, you can streamline your workflow, ensuring that your documents are signed promptly.

-

What features does airSlate SignNow offer for handling the 80 320 form?

airSlate SignNow provides a variety of features tailored for the 80 320 form, including easy document uploading, customizable templates, and real-time tracking of signatures. These features enable efficient management of the document preparation and signature process. Additionally, our platform ensures compliance with legal standards.

-

Is there a cost associated with using airSlate SignNow for the 80 320 form?

Yes, there are various pricing plans available for using airSlate SignNow, including options that cater to businesses of all sizes. Each plan offers different features, making it easy to find a solution that fits your budget while efficiently managing the 80 320 form. You can start with a free trial to explore the platform's capabilities.

-

How does airSlate SignNow ensure the security of the 80 320 form?

airSlate SignNow prioritizes the security of all documents, including the 80 320 form. We implement advanced encryption methods and secure access protocols to protect your data from unauthorized access. Our compliance with industry standards ensures that your documents are handled in a safe and confidential manner.

-

Can I integrate airSlate SignNow with other software for the 80 320 form?

Yes, airSlate SignNow can be integrated with various third-party applications, enhancing your capability to manage the 80 320 form efficiently. Integrations with tools like CRM systems, project management software, and cloud storage solutions empower you to streamline your document management workflow. This flexibility allows for a cohesive work environment.

-

What are the benefits of using airSlate SignNow to manage the 80 320 form?

Using airSlate SignNow for the 80 320 form comes with numerous benefits, including improved efficiency, reduced paper usage, and faster turnaround times for signatures. The platform's user-friendly interface makes it easy to navigate, even for new users. With airSlate SignNow, you can elevate your document management process to a new level.

-

Does airSlate SignNow provide customer support for the 80 320 form?

Absolutely! airSlate SignNow offers dedicated customer support to assist users with any inquiries related to the 80 320 form. Our support team is available through various channels, including email, live chat, and phone, ensuring you get the help you need promptly. We strive to provide an exceptional customer experience every step of the way.

Get more for Mississippi Individual Income Tax Interest And Penalty Worksheet

Find out other Mississippi Individual Income Tax Interest And Penalty Worksheet

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later