Information Return PenaltiesInternal Revenue Service 2022

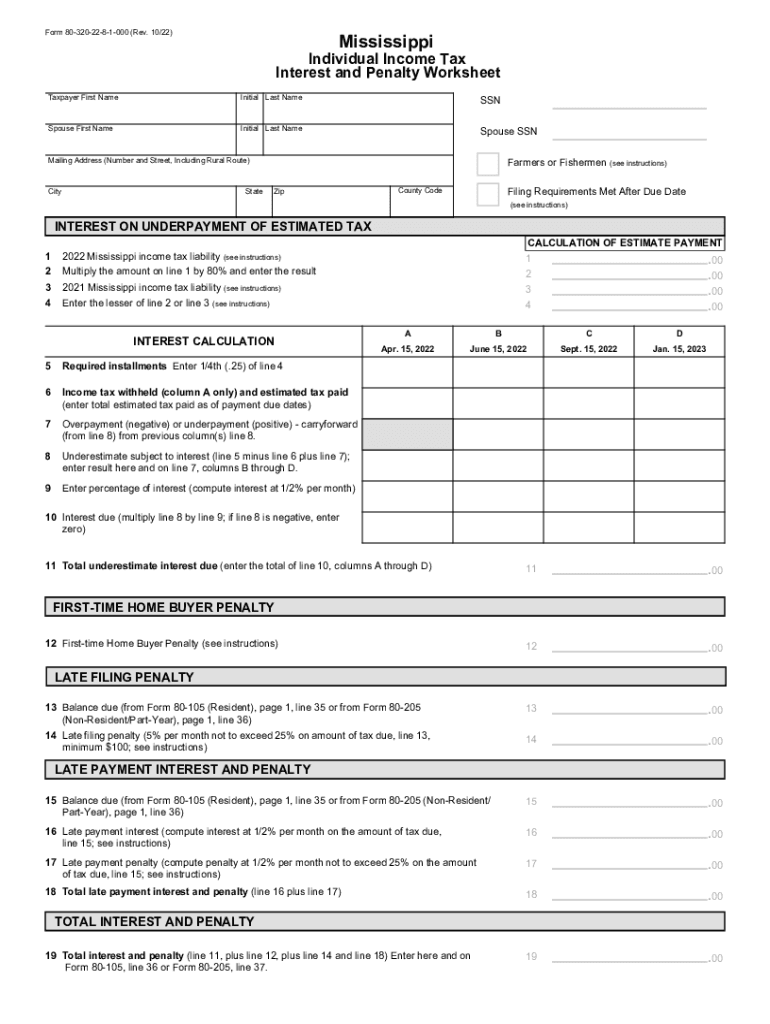

Understanding the 80 320 Form

The 80 320 form, also known as the Mississippi State Income Tax form, is essential for individuals and businesses to report their income and calculate their tax liability. This form is specifically designed for residents of Mississippi and is crucial for compliance with state tax regulations. It captures various income sources, deductions, and credits that taxpayers may be eligible for, ensuring accurate tax reporting.

Steps to Complete the 80 320 Form

Completing the 80 320 form involves several key steps to ensure accuracy and compliance:

- Gather Required Documents: Collect all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Fill Out Personal Information: Provide your name, address, and Social Security number at the top of the form.

- Report Income: Accurately report all sources of income, including wages, interest, and dividends.

- Claim Deductions and Credits: Identify any eligible deductions or credits that can reduce your taxable income.

- Calculate Tax Liability: Use the provided tax tables or formulas to calculate the amount owed or refund due.

- Review and Sign: Carefully review all entries for accuracy before signing and dating the form.

Penalties for Non-Compliance

Failure to file the 80 320 form or inaccuracies in reporting can result in significant penalties. The Mississippi Department of Revenue may impose fines for late submissions or underreporting income. These penalties can accumulate over time, leading to increased financial burdens. It is essential to file the form accurately and on time to avoid these consequences.

Filing Deadlines and Important Dates

Being aware of filing deadlines is crucial for taxpayers. The 80 320 form is typically due on April fifteenth of each year for individual taxpayers. Extensions may be available, but it is important to file for an extension before the deadline to avoid penalties. Keeping track of these dates ensures compliance and helps avoid unnecessary fees.

Legal Use of the 80 320 Form

The 80 320 form is legally recognized for reporting state income tax in Mississippi. To ensure its validity, it must be filled out completely and accurately, adhering to all state tax laws. Using reliable electronic tools, such as signNow, can facilitate the signing and submission process while maintaining compliance with legal standards for electronic signatures.

Examples of Using the 80 320 Form

Taxpayers may use the 80 320 form in various scenarios, such as:

- Individuals Reporting Employment Income: Employees use the form to report wages and any additional income.

- Self-Employed Individuals: Freelancers and business owners report their earnings and expenses to determine tax liability.

- Claiming Deductions: Taxpayers may use the form to claim deductions for education expenses or mortgage interest.

Quick guide on how to complete information return penaltiesinternal revenue service

Complete Information Return PenaltiesInternal Revenue Service effortlessly on any device

Web-based document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Information Return PenaltiesInternal Revenue Service on any device using airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

How to modify and electronically sign Information Return PenaltiesInternal Revenue Service easily

- Obtain Information Return PenaltiesInternal Revenue Service and then click Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize important sections of the documents or obscure sensitive details with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and then click the Done button to secure your modifications.

- Select how you would prefer to share your form, via email, text message (SMS), or link invitation, or download it to your computer.

Say goodbye to lost or missing files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow manages your document needs in just a few clicks from any device you choose. Modify and electronically sign Information Return PenaltiesInternal Revenue Service and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct information return penaltiesinternal revenue service

Create this form in 5 minutes!

How to create an eSignature for the information return penaltiesinternal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the '80 320' number in airSlate SignNow?

The '80 320' refers to the specific pricing tier within the airSlate SignNow service, tailored for businesses looking for cost-effective solutions for eSigning. This plan offers essential features without the high costs associated with other platforms. With '80 320', users can streamline their document workflows efficiently.

-

What features are included in the '80 320' pricing plan?

The '80 320' plan includes a wide range of features such as unlimited document uploads, advanced eSigning capabilities, and template creation. Additionally, users get access to real-time status updates and reminders, ensuring no step in the signing process is overlooked. This feature-rich plan enables businesses to eliminate delays in document handling.

-

How does the '80 320' plan enhance document security?

With the '80 320' plan, airSlate SignNow employs top-notch security measures including encryption and secure cloud storage. Each document signed under this plan is protected with advanced authentication options to verify user identity and maintain document integrity. This ensures that your important documents remain secure throughout the signing process.

-

What are the benefits of using airSlate SignNow compared to other eSigning solutions?

The '80 320' pricing plan offers unmatched affordability combined with robust features, making it a standout choice among eSigning solutions. Unlike some competitors, it emphasizes user-friendliness and integrates seamlessly with existing workflows. Businesses benefit from faster turnaround times and improved efficiency in document management.

-

Can I integrate airSlate SignNow with other software tools using the '80 320' plan?

Yes, the '80 320' plan supports integration with a variety of popular platforms including CRM systems, project management tools, and cloud storage services. This flexibility allows businesses to incorporate eSigning into their preferred workflow seamlessly. Additionally, these integrations help enhance overall productivity and streamline document processes.

-

Is customer support included with the '80 320' pricing plan?

Absolutely! The '80 320' pricing plan includes comprehensive customer support, ensuring you have assistance whenever needed. Customers can access support via chat, email, and phone, allowing for quick resolutions to any queries. This level of support enhances user experience and helps businesses maximize the benefits of their eSigning solution.

-

How can I get started with the '80 320' plan?

Getting started with the '80 320' plan is simple. Just visit the airSlate SignNow website, select the plan, and create an account to begin your free trial. Once registered, you can immediately take advantage of the platform's features and start sending documents for eSigning without any hassle.

Get more for Information Return PenaltiesInternal Revenue Service

Find out other Information Return PenaltiesInternal Revenue Service

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free