80320248 2024-2026

What is the 80320 Tax Form?

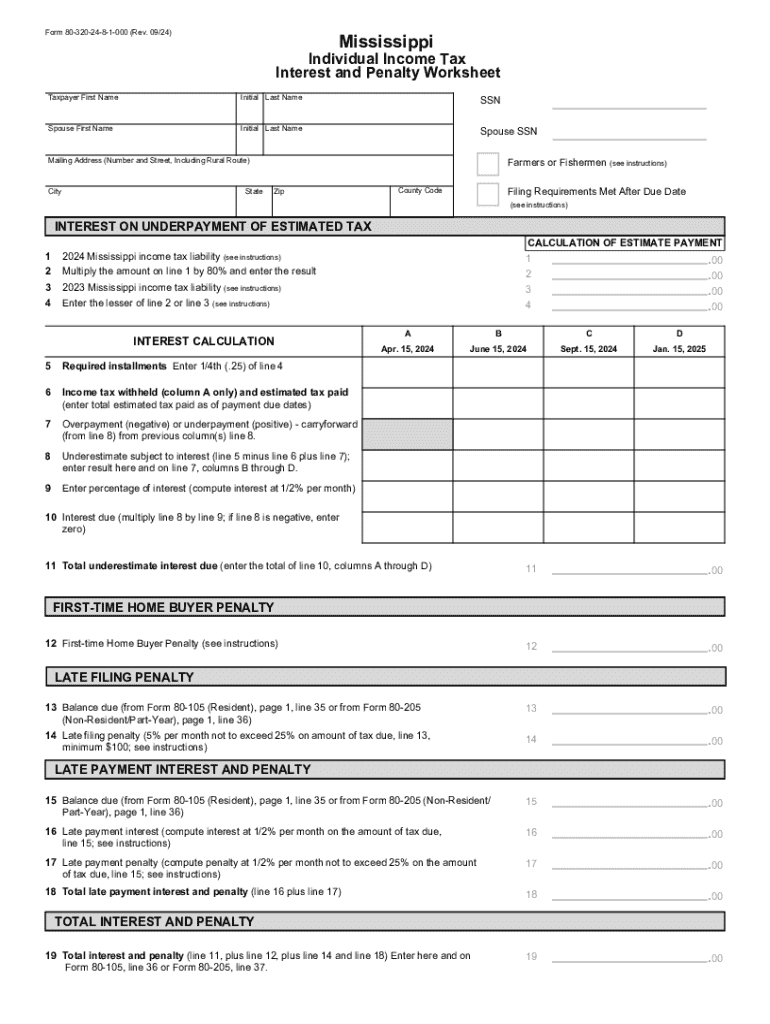

The 80320 tax form is a specific document used by taxpayers in the United States to report certain tax-related information. It is essential for individuals and businesses to understand this form, as it plays a crucial role in tax compliance. The form typically includes details regarding income, deductions, and credits that may affect the taxpayer's overall tax liability. Understanding the purpose of the 80320 form can help ensure accurate reporting and compliance with IRS regulations.

How to Complete the 80320 Tax Form

Completing the 80320 tax form involves several key steps. First, gather all necessary financial documents, including income statements, receipts for deductions, and any relevant tax records. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. Pay special attention to areas that require specific data, such as income sources and applicable deductions. After filling out the form, review it for errors before submission. This careful approach can help prevent delays or issues with the IRS.

Filing Deadlines for the 80320 Tax Form

Filing deadlines for the 80320 tax form are crucial for taxpayers to observe. Typically, the form must be submitted by April 15 of the tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any potential extensions that can be requested, allowing additional time to file. Staying informed about these deadlines can help avoid penalties and interest charges associated with late submissions.

Required Documents for the 80320 Tax Form

To successfully complete the 80320 tax form, taxpayers need to gather several important documents. These typically include W-2 forms from employers, 1099 forms for any freelance or contract work, and receipts for deductible expenses. Additionally, any documentation supporting claims for credits or deductions should be included. Having these documents organized and readily available can streamline the filing process and enhance accuracy.

Penalties for Non-Compliance with the 80320 Tax Form

Failing to comply with the requirements associated with the 80320 tax form can result in significant penalties. The IRS may impose fines for late submissions, inaccuracies, or failure to file altogether. These penalties can accumulate over time, leading to increased financial liability. Understanding the importance of timely and accurate filing can help taxpayers avoid these costly consequences.

IRS Guidelines for the 80320 Tax Form

The IRS provides specific guidelines regarding the completion and submission of the 80320 tax form. These guidelines outline the necessary information to be reported, as well as instructions on how to fill out the form correctly. Taxpayers are encouraged to consult the IRS website or official publications for the most current information and updates regarding the form. Adhering to these guidelines is essential for ensuring compliance and minimizing the risk of audits or penalties.

Examples of Using the 80320 Tax Form

Understanding practical applications of the 80320 tax form can enhance its usefulness for taxpayers. For instance, self-employed individuals may use this form to report income from various sources, while small business owners might utilize it to claim deductions for business expenses. Additionally, individuals claiming specific tax credits must accurately report their eligibility using this form. These examples illustrate the diverse scenarios in which the 80320 tax form is applicable, highlighting its importance in the tax filing process.

Create this form in 5 minutes or less

Find and fill out the correct 80320248

Create this form in 5 minutes!

How to create an eSignature for the 80320248

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 80 tax and how does it affect my business?

The 2024 80 tax refers to specific tax regulations that may impact your business operations. Understanding these regulations is crucial for compliance and financial planning. By utilizing airSlate SignNow, you can streamline document management related to tax filings and ensure you meet all necessary requirements efficiently.

-

How can airSlate SignNow help with 2024 80 tax documentation?

airSlate SignNow provides an easy-to-use platform for sending and eSigning documents related to the 2024 80 tax. Our solution simplifies the process of managing tax documents, ensuring that you can quickly prepare and submit necessary paperwork. This efficiency can save you time and reduce the risk of errors in your tax submissions.

-

What are the pricing options for airSlate SignNow in relation to 2024 80 tax needs?

airSlate SignNow offers flexible pricing plans that cater to various business sizes and needs, including those focused on the 2024 80 tax. Our cost-effective solution ensures that you can access essential features without breaking the bank. You can choose a plan that best fits your budget while still addressing your tax documentation requirements.

-

What features does airSlate SignNow offer for managing 2024 80 tax documents?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing 2024 80 tax documents. These tools help you maintain organization and ensure that all necessary documents are completed accurately and on time. Additionally, our user-friendly interface makes it easy for anyone to navigate.

-

Can I integrate airSlate SignNow with other software for 2024 80 tax purposes?

Yes, airSlate SignNow seamlessly integrates with various software applications that can assist with your 2024 80 tax needs. This includes accounting software and document management systems, allowing for a more streamlined workflow. Integrating these tools can enhance your efficiency and ensure that all your tax-related documents are easily accessible.

-

What are the benefits of using airSlate SignNow for 2024 80 tax compliance?

Using airSlate SignNow for 2024 80 tax compliance offers numerous benefits, including improved accuracy, faster processing times, and enhanced security for your documents. Our platform helps reduce the risk of errors that can lead to compliance issues. Additionally, the ability to track document status in real-time ensures that you stay on top of your tax obligations.

-

Is airSlate SignNow suitable for small businesses dealing with 2024 80 tax?

Absolutely! airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses facing 2024 80 tax challenges. Our platform provides the necessary tools to manage tax documents efficiently without requiring extensive resources. This makes it an ideal choice for small business owners looking to simplify their tax processes.

Get more for 80320248

- Performance appraisalassociate employee self

- Employees service agreement for receipt of a form

- Gsa order gsagov form

- Retention incentive service agreement usaid form

- Title of document heading 1calibri bold 18pt cdc form

- Other unusual circumstances name of requestor form

- Employee requesting evacuation assistance form

- Shop safety manual university of californiaoffice of the form

Find out other 80320248

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will