Schedule a Form 1040 a Guide to the Itemized Deduction 2023-2026

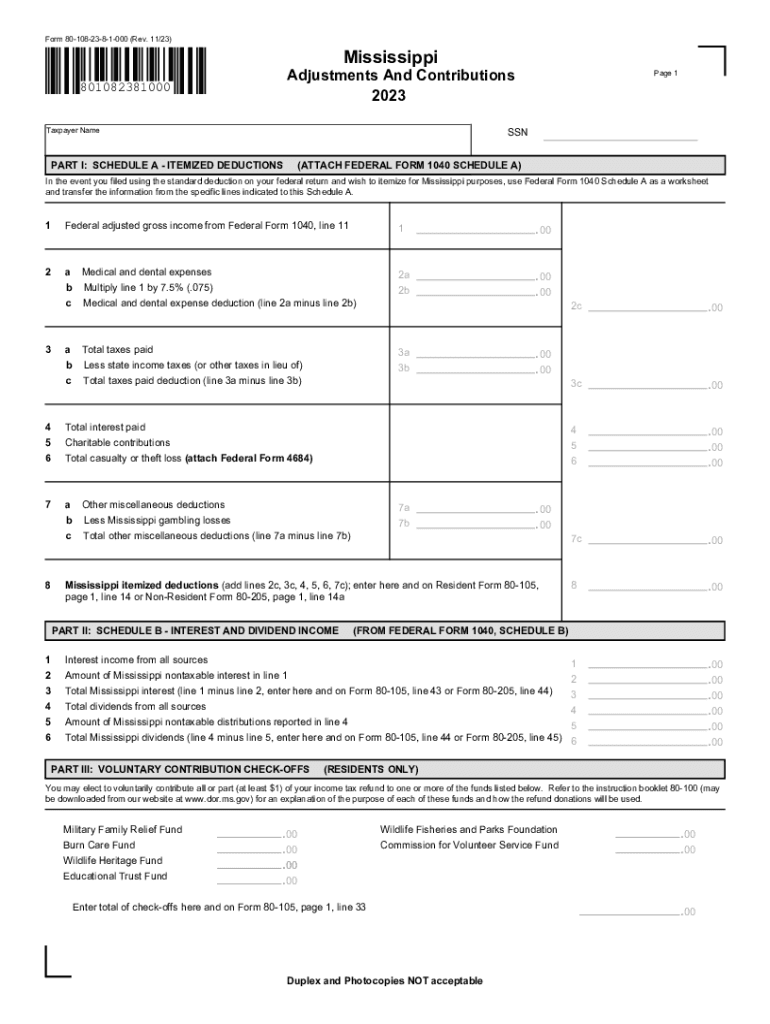

Understanding the 80 108 Form

The 80 108 form, also known as the Mississippi 108 form, is primarily used for tax purposes in the state of Mississippi. This form is essential for individuals and businesses looking to report specific financial information accurately. It serves as a means for taxpayers to disclose their income, deductions, and credits, which ultimately impacts their tax obligations. Understanding the purpose and requirements of this form is crucial for compliance with state tax laws.

Steps to Complete the 80 108 Form

Filling out the 80 108 form involves several key steps to ensure accuracy and completeness. Begin by gathering all necessary financial documents, including income statements, previous tax returns, and any relevant receipts for deductions. Next, follow these steps:

- Enter personal information, including your name, address, and Social Security number.

- Report your total income from various sources, such as wages, self-employment income, and investment earnings.

- Detail any deductions you are eligible for, such as medical expenses or charitable contributions.

- Calculate your taxable income by subtracting your deductions from your total income.

- Determine your tax liability based on the applicable tax rates.

- Sign and date the form before submission.

Required Documents for the 80 108 Form

To complete the 80 108 form accurately, you will need several documents that support the information you provide. These documents include:

- W-2 forms from employers, showing your annual earnings.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as medical bills or educational costs.

- Previous year’s tax return for reference.

Having these documents on hand will streamline the process and help ensure that all information reported is accurate.

Filing Deadlines for the 80 108 Form

It is important to be aware of the filing deadlines associated with the 80 108 form to avoid penalties. Typically, the deadline for submitting this form aligns with the federal tax return deadline. For most taxpayers, this means the form is due on April fifteenth each year. If you require additional time, you may file for an extension, but it is crucial to pay any estimated taxes owed by the original deadline to avoid interest and penalties.

IRS Guidelines for the 80 108 Form

While the 80 108 form is specific to Mississippi, it is essential to adhere to IRS guidelines when completing any state tax form. This includes ensuring that all income is reported accurately and that any applicable deductions are claimed in accordance with federal tax laws. Familiarizing yourself with IRS publications can provide valuable insights into how state and federal tax systems interact, helping you avoid common pitfalls.

Penalties for Non-Compliance with the 80 108 Form

Failure to file the 80 108 form correctly or on time can result in significant penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on any unpaid taxes, which can increase your overall tax liability.

- Potential legal consequences for fraudulent reporting.

Understanding these penalties emphasizes the importance of timely and accurate filing.

Quick guide on how to complete schedule a form 1040 a guide to the itemized deduction

Effortlessly Prepare Schedule A Form 1040 A Guide To The Itemized Deduction on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Schedule A Form 1040 A Guide To The Itemized Deduction on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to Alter and eSign Schedule A Form 1040 A Guide To The Itemized Deduction with Ease

- Find Schedule A Form 1040 A Guide To The Itemized Deduction and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important parts of your documents or conceal confidential information using tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and has the same legal validity as a traditional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your PC.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Edit and eSign Schedule A Form 1040 A Guide To The Itemized Deduction and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule a form 1040 a guide to the itemized deduction

Create this form in 5 minutes!

How to create an eSignature for the schedule a form 1040 a guide to the itemized deduction

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 80 108 form and how can it be used?

The 80 108 form is a specific document used for various administrative purposes, often related to financial or legal transactions. Utilizing airSlate SignNow, you can easily create, send, and eSign this form, ensuring all parties approve the required declarations swiftly and securely. This digital solution streamlines the process, making it efficient for both businesses and individuals.

-

How does airSlate SignNow simplify the signing process for the 80 108 form?

airSlate SignNow provides an intuitive interface that allows users to send the 80 108 form for eSignature within minutes. With features like drag-and-drop document uploading and customizable signing workflows, you can quickly get the necessary approvals. This user-friendly approach eliminates the lag associated with traditional paperwork.

-

Is there a cost associated with using the 80 108 form on airSlate SignNow?

While using the 80 108 form itself is free, airSlate SignNow operates on a subscription model that offers a variety of pricing plans. These plans are designed to meet the needs of individuals and businesses of all sizes, delivering value through features such as unlimited document signing and advanced integrations. Consider your requirements to select the best plan.

-

What integrations does airSlate SignNow offer for the 80 108 form?

airSlate SignNow seamlessly integrates with a variety of platforms, such as Google Drive, Dropbox, and Salesforce, to facilitate easy management of the 80 108 form. These integrations enable you to automatically store, share, and track the document throughout its lifecycle. By connecting your favorite tools, you enhance workflow efficiency and data management.

-

Can I customize the 80 108 form in airSlate SignNow?

Yes, airSlate SignNow allows users to customize their 80 108 form according to specific needs. You can add branding elements, modify fields, and set up conditional workflows to ensure the document meets all required specifications. This level of customization helps create a professional look while addressing unique organizational requirements.

-

How secure is the processing of the 80 108 form with airSlate SignNow?

Security is a top priority for airSlate SignNow, especially when handling the 80 108 form. The platform employs industry-standard encryption technologies combined with secure servers to protect your documents from unauthorized access. You can confidently manage sensitive details knowing that your information is safe throughout the signing process.

-

What benefits does airSlate SignNow offer for managing documents like the 80 108 form?

airSlate SignNow provides numerous benefits for managing documents like the 80 108 form, including increased efficiency, reduced turnaround time, and lower operational costs. The platform automates many manual tasks associated with document management, allowing teams to focus on core business activities. Enhanced tracking and reporting capabilities also make it easier to manage compliance.

Get more for Schedule A Form 1040 A Guide To The Itemized Deduction

- Transcriptsoffice of the registraruniversity of la verne form

- Sonoma state university transcript request form

- La verne ca recently sold homes realtorcom form

- Community service verification form community service verification form

- Student id last four digits of ssn birth date form

- Purchasing card sign out sheet ball state university form

- Lawmakers unveil details of historic federal paid parental form

- Uk eep form

Find out other Schedule A Form 1040 A Guide To The Itemized Deduction

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors