Instructions for Form 8867 Internal Revenue Service 2020

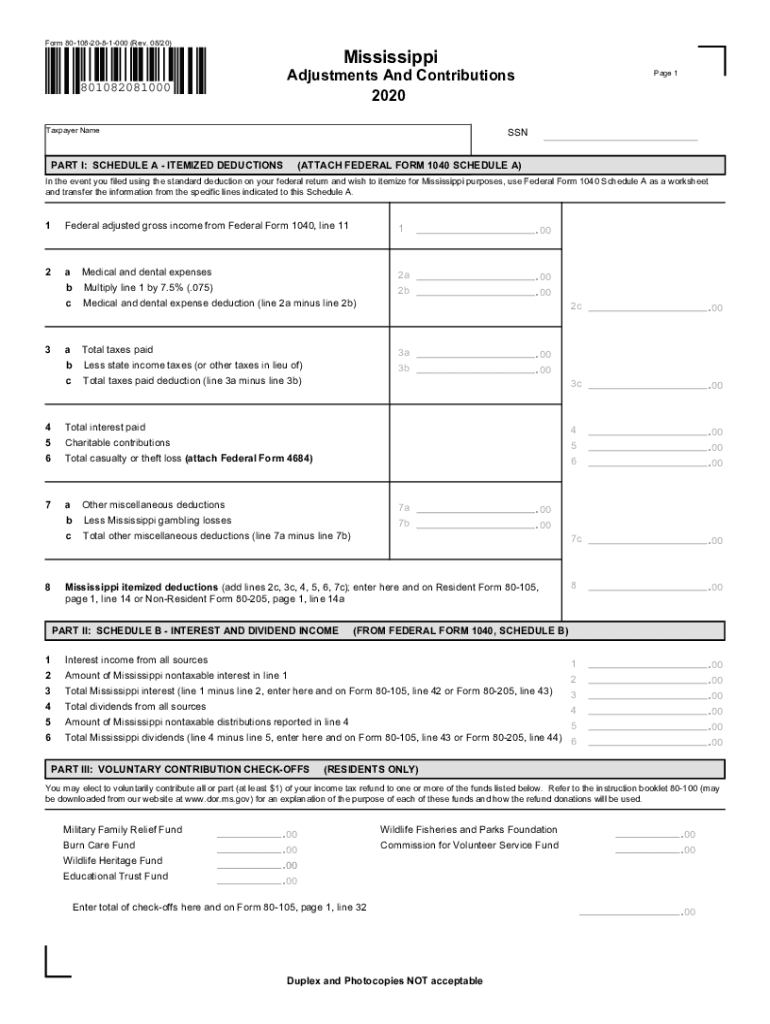

What is the 80 108 form?

The 80 108 form, also known as the Mississippi 108 form, is a tax document utilized in the state of Mississippi. It is specifically designed for individuals and businesses to report certain tax information to the Internal Revenue Service (IRS). This form is particularly relevant for claiming tax credits and deductions related to specific financial activities. Understanding the purpose and requirements of the 80 108 form is essential for ensuring compliance with state tax laws.

Steps to complete the 80 108 form

Completing the 80 108 form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including income statements and any relevant tax records. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. Pay special attention to the sections that require numerical data, as errors can lead to delays or penalties. After completing the form, review it thoroughly for any mistakes before submitting it to the appropriate tax authority.

Legal use of the 80 108 form

The legal use of the 80 108 form is governed by both state and federal tax regulations. To be considered valid, the form must be filled out correctly and submitted by the specified deadlines. Additionally, it is important to ensure that all claims made on the form are substantiated with appropriate documentation. Failure to comply with legal requirements can result in penalties or audits by tax authorities. Utilizing a reliable eSignature platform can help ensure that the form is signed and submitted in accordance with legal standards.

IRS Guidelines for the 80 108 form

The IRS provides specific guidelines for completing and submitting the 80 108 form. These guidelines outline the necessary information that must be included, as well as instructions for calculating any applicable tax credits or deductions. It is crucial to follow these guidelines closely to avoid potential issues with tax compliance. The IRS also emphasizes the importance of retaining copies of the completed form and any supporting documents for record-keeping purposes.

Filing Deadlines / Important Dates for the 80 108 form

Filing deadlines for the 80 108 form are critical to ensure timely compliance with tax regulations. Typically, the form must be submitted by the annual tax filing deadline, which is generally April fifteenth for most taxpayers. However, specific deadlines may vary based on individual circumstances or extensions granted by the IRS. Keeping track of these important dates is essential to avoid late filing penalties and ensure that all tax obligations are met on time.

Required Documents for the 80 108 form

To successfully complete the 80 108 form, certain documents are required. These typically include income statements, previous tax returns, and any documentation that supports claims for deductions or credits. It is important to gather all necessary paperwork before starting the form to ensure a smooth and efficient filing process. Having these documents readily available will also help in accurately reporting financial information and complying with IRS requirements.

Quick guide on how to complete instructions for form 8867 2020internal revenue service

Complete Instructions For Form 8867 Internal Revenue Service effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without any hold-ups. Handle Instructions For Form 8867 Internal Revenue Service on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Instructions For Form 8867 Internal Revenue Service with ease

- Locate Instructions For Form 8867 Internal Revenue Service and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all details and click on the Done button to save your changes.

- Select your preferred method for delivering your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Modify and eSign Instructions For Form 8867 Internal Revenue Service while ensuring exceptional communication throughout the entire document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 8867 2020internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 8867 2020internal revenue service

The way to make an electronic signature for your PDF file online

The way to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to make an eSignature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

How to make an eSignature for a PDF on Android devices

People also ask

-

What is the 80 108 form and why is it important?

The 80 108 form is a crucial document used in various business transactions for compliance and record-keeping. It helps streamline processes by providing a standardized format that can be easily filled and signed. Utilizing the 80 108 form can enhance transparency and trust in your business dealings.

-

How can airSlate SignNow help with the 80 108 form?

AirSlate SignNow simplifies the management and eSigning of the 80 108 form, allowing you to send it seamlessly to recipients. Our platform enables quick document review and facilitates legally binding electronic signatures, ensuring that your 80 108 form is processed efficiently.

-

Is there a cost associated with using the 80 108 form on airSlate SignNow?

AirSlate SignNow offers flexible pricing plans that cater to different business needs, including the handling of the 80 108 form. Depending on the plan you choose, features like unlimited eSigning and secure storage can vary. Check our pricing page for detailed information and select the best option for your organization.

-

What features does airSlate SignNow offer for the 80 108 form?

AirSlate SignNow provides a range of features for managing the 80 108 form, including customizable templates, automated reminders, and real-time tracking. Our platform also ensures document security with encryption, giving you peace of mind when handling sensitive information.

-

Can I integrate airSlate SignNow with other applications for managing the 80 108 form?

Yes, airSlate SignNow supports integration with various applications, making it easy to manage the 80 108 form alongside your existing tools. Whether you use CRM systems, cloud storage services, or project management software, our integrations enhance your workflow efficiency.

-

How does using the 80 108 form with airSlate SignNow benefit my business?

Using the 80 108 form with airSlate SignNow can signNowly streamline your document processes, reduce paperwork, and save time. The convenience of electronic signatures and automated workflows can lead to improved productivity and better customer satisfaction.

-

What types of businesses can benefit from the 80 108 form?

The 80 108 form can benefit a wide range of businesses across various industries, including real estate, finance, and healthcare. Any organization that requires formal documentation and signatures can leverage the efficiency of the 80 108 form through airSlate SignNow.

Get more for Instructions For Form 8867 Internal Revenue Service

Find out other Instructions For Form 8867 Internal Revenue Service

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe