Fillable Online Www2 Illinois Form IL 1040 V Fax Email Print 2021

Understanding the Illinois Payment Voucher

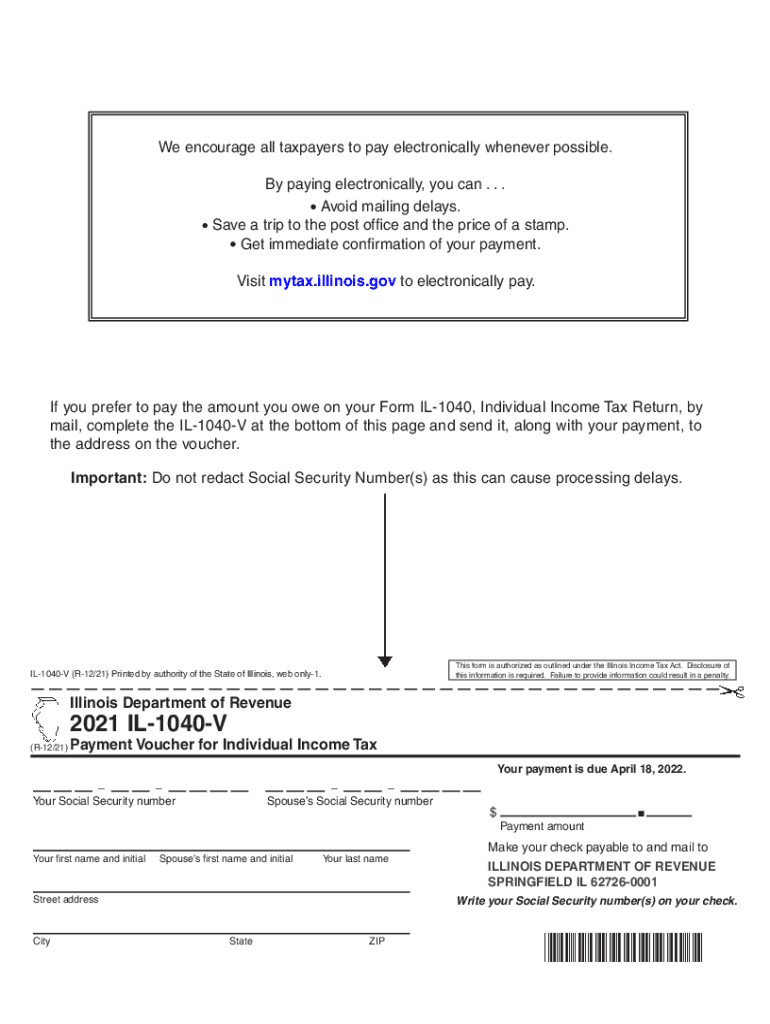

The Illinois payment voucher, known as the IL-1040-V, is a crucial document for taxpayers in Illinois who need to submit their state income tax payments. This form is specifically designed for individuals who are filing their income tax returns and wish to make a payment. It serves as a remittance form that accompanies the payment, ensuring that the Illinois Department of Revenue accurately processes the taxpayer's payment.

The IL-1040-V is essential for those who owe taxes and prefer to pay by check or money order. By including this voucher with their payment, taxpayers can help the state link the payment to their tax account, minimizing the risk of errors or delays in processing. This form is particularly important for individuals who are self-employed or have other income sources that may require additional tax payments beyond their regular withholding.

Steps to Complete the Illinois Payment Voucher

Completing the Illinois payment voucher involves several straightforward steps. First, ensure you have the correct form, which can be accessed online. Next, fill in your personal information, including your name, address, and Social Security number. It is important to double-check that all details are accurate to avoid any processing issues.

Then, indicate the amount you are paying. This should match the amount owed on your tax return. After completing the form, sign and date it. Finally, attach your payment, whether it’s a check or money order, made out to the Illinois Department of Revenue, and mail it to the appropriate address provided on the form. Keeping a copy of the voucher and payment for your records is also advisable.

Legal Use of the Illinois Payment Voucher

The Illinois payment voucher is legally recognized as part of the tax payment process. When properly filled out and submitted, it ensures compliance with state tax laws. Using the IL-1040-V helps establish a clear record of payment, which can be essential in case of disputes or audits by the Illinois Department of Revenue.

It is important to note that failure to include the voucher with your payment may lead to processing delays or misapplication of funds. Therefore, understanding the legal implications of this form is crucial for all taxpayers in Illinois.

Filing Deadlines for the Illinois Payment Voucher

Timely submission of the Illinois payment voucher is vital to avoid penalties and interest on unpaid taxes. Generally, the payment voucher should be submitted by the tax filing deadline, which is typically April 15 for most taxpayers. However, if you file for an extension, ensure that any payments due are made by the original deadline to avoid additional charges.

For taxpayers who are making estimated payments, the deadlines are usually quarterly. It is essential to keep track of these dates to ensure compliance and avoid any unnecessary penalties.

Form Submission Methods for the Illinois Payment Voucher

Taxpayers have several options for submitting the Illinois payment voucher. The most common method is by mail, where you send the completed voucher along with your payment to the designated address provided on the form. Ensure that you allow sufficient time for delivery, especially as deadlines approach.

Additionally, some taxpayers may opt to submit their payments electronically through the Illinois Department of Revenue's online services. This method can provide immediate confirmation of payment, which can be beneficial for record-keeping. However, it is important to verify that you are following the correct procedures for electronic submissions.

Key Elements of the Illinois Payment Voucher

When filling out the Illinois payment voucher, several key elements must be included for it to be processed correctly. These elements include:

- Taxpayer Information: Your name, address, and Social Security number.

- Payment Amount: The total amount you are submitting with the voucher.

- Signature: Your signature and the date to validate the submission.

- Payment Method: Indicate whether you are paying by check or money order.

Ensuring that all these elements are accurately completed will help facilitate a smooth processing of your payment and maintain compliance with Illinois tax regulations.

Quick guide on how to complete fillable online www2 illinois form il 1040 v fax email print

Handle Fillable Online Www2 Illinois Form IL 1040 V Fax Email Print effortlessly on any gadget

Web-based document administration has increasingly gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed materials, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly without interruptions. Manage Fillable Online Www2 Illinois Form IL 1040 V Fax Email Print on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Fillable Online Www2 Illinois Form IL 1040 V Fax Email Print with ease

- Find Fillable Online Www2 Illinois Form IL 1040 V Fax Email Print and click on Obtain Form to begin.

- Make use of the tools we provide to complete your document.

- Mark important sections of the documents or mask sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Finished button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from your preferred device. Modify and eSign Fillable Online Www2 Illinois Form IL 1040 V Fax Email Print and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online www2 illinois form il 1040 v fax email print

Create this form in 5 minutes!

How to create an eSignature for the fillable online www2 illinois form il 1040 v fax email print

The way to generate an e-signature for your PDF document online

The way to generate an e-signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is an Illinois payment voucher?

An Illinois payment voucher is a document used to remit payments to the state of Illinois, often utilized for tax-related purposes. This voucher facilitates organized and accurate payment submissions, ensuring compliance with state regulations. For businesses, using an Illinois payment voucher can streamline financial processes and help avoid penalties.

-

How can airSlate SignNow help with Illinois payment vouchers?

airSlate SignNow offers an efficient platform for signing and sending Illinois payment vouchers electronically. This feature enhances the speed and reliability of processing payments, allowing users to complete forms swiftly without paper clutter. Businesses can leverage SignNow’s digital tools to ensure they stay compliant with Illinois payment voucher regulations.

-

What are the cost options for using airSlate SignNow for Illinois payment vouchers?

airSlate SignNow provides various pricing plans tailored to different business needs, making it affordable to manage Illinois payment vouchers. Whether you are a small business or a larger enterprise, there’s a plan that fits your budget and requirements. Users can start with a free trial to explore the platform's functionality before committing.

-

Are there any benefits to using airSlate SignNow for Illinois payment vouchers?

Using airSlate SignNow for Illinois payment vouchers offers several benefits, including increased efficiency and reduced paperwork. The digital approach minimizes errors and helps users keep track of payment submissions in real time. Additionally, you can access your vouchers anywhere, ensuring seamless management of your financial documents.

-

Is it easy to integrate airSlate SignNow with other tools for managing Illinois payment vouchers?

Yes, airSlate SignNow integrates seamlessly with various tools commonly used for managing financial documentation, enhancing its utility for Illinois payment vouchers. This integration capability means users can synchronize their workflows and access all necessary tools in one place, improving overall efficiency. Popular integrations include CRM and accounting software.

-

Can multiple users collaborate on Illinois payment vouchers with airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate on Illinois payment vouchers, making teamwork easier and more efficient. Teams can work together in real time, ensuring all necessary signatures are obtained quickly. This feature helps maintain a smooth workflow, especially for businesses that handle numerous transactions.

-

What security features does airSlate SignNow offer for Illinois payment vouchers?

airSlate SignNow prioritizes the security of your Illinois payment vouchers by implementing top-notch measures to protect sensitive information. Features include two-factor authentication, secure cloud storage, and encrypted transactions, which ensure that your data remains safe. These robust security protocols provide peace of mind for businesses handling financial documents.

Get more for Fillable Online Www2 Illinois Form IL 1040 V Fax Email Print

- Mn married form

- Mn legal will form

- Minnesota married form

- Minnesota codicil form

- Legal last will and testament form for married person with adult and minor children from prior marriage minnesota

- Legal last will and testament form for married person with adult and minor children minnesota

- Mutual wills package with last wills and testaments for married couple with adult and minor children minnesota form

- Minnesota widow form

Find out other Fillable Online Www2 Illinois Form IL 1040 V Fax Email Print

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online