Illinois Form IL 1040 X V Payment Voucher for Amended 2020

Understanding the Illinois Form IL 1040 V Payment Voucher

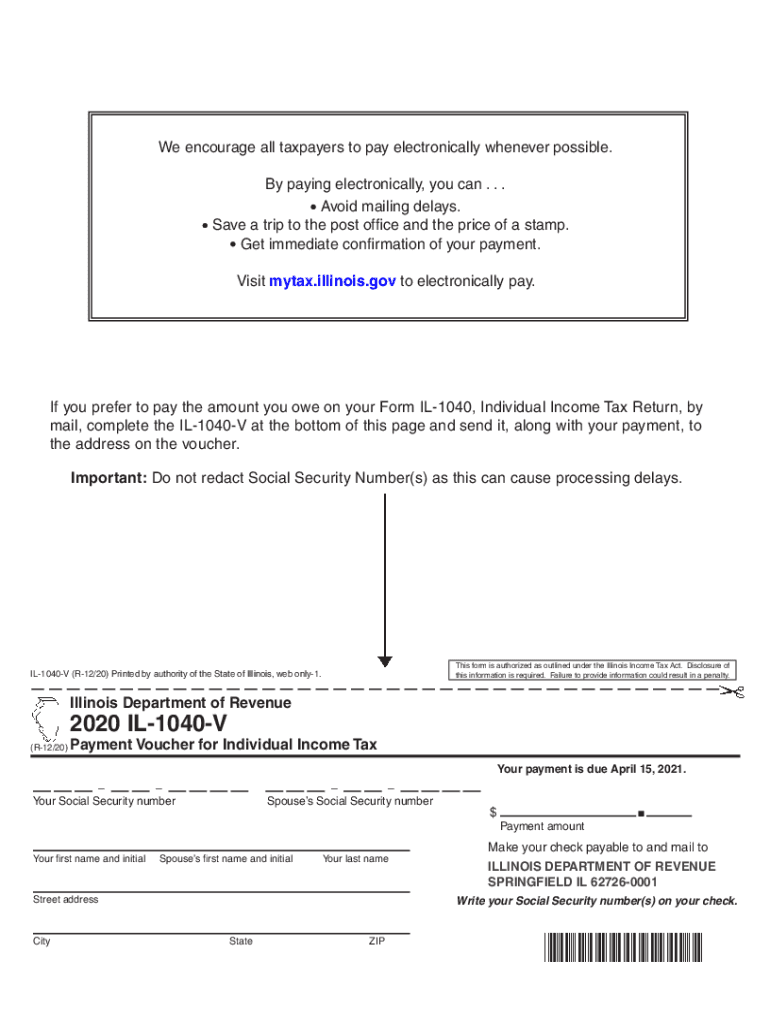

The Illinois Form IL 1040 V serves as a payment voucher for individuals who owe taxes and are submitting a payment with their tax return. This form is essential for ensuring that payments are correctly applied to the taxpayer's account. It is typically used alongside the Illinois 1040 individual income tax return, allowing taxpayers to remit their owed amounts directly to the Illinois Department of Revenue. By using this voucher, taxpayers can streamline the process of tax payment and ensure compliance with state tax obligations.

Steps to Complete the Illinois Form IL 1040 V Payment Voucher

Completing the Illinois Form IL 1040 V involves several straightforward steps. First, ensure you have your tax return information on hand, including your total tax liability. Next, fill in your name, address, and Social Security number at the top of the form. Indicate the amount you are paying on the designated line. After completing the form, review it for accuracy. Finally, submit the voucher along with your payment, either by mailing it to the appropriate address or including it with your tax return if filing by mail.

Legal Use of the Illinois Form IL 1040 V Payment Voucher

The Illinois Form IL 1040 V is legally recognized as a payment method for state taxes. When properly filled out and submitted, it serves as proof of payment, which is crucial for maintaining accurate tax records. To ensure its legal validity, taxpayers should adhere to all instructions provided with the form and retain copies of both the voucher and any accompanying payments for their records. Compliance with state tax laws is essential to avoid penalties and interest on unpaid taxes.

Filing Deadlines for the Illinois Form IL 1040 V Payment Voucher

Timely submission of the Illinois Form IL 1040 V is critical to avoid penalties. Generally, the payment voucher should be submitted by the same deadline as the Illinois individual income tax return, which is typically April 15. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Taxpayers should be aware of these deadlines to ensure their payments are processed without incurring additional fees.

Form Submission Methods for the Illinois Form IL 1040 V Payment Voucher

Taxpayers have several options for submitting the Illinois Form IL 1040 V. The most common method is mailing the completed voucher along with a check or money order to the Illinois Department of Revenue. Alternatively, individuals may choose to submit their payment electronically through the Illinois Department of Revenue's online payment system. This method offers a convenient and immediate way to ensure that payments are processed efficiently.

Examples of Using the Illinois Form IL 1040 V Payment Voucher

There are various scenarios in which a taxpayer might use the Illinois Form IL 1040 V. For instance, an individual who owes additional taxes after filing their return may submit this voucher to remit the outstanding balance. Additionally, if a taxpayer is making estimated tax payments throughout the year, they can use this form to ensure that their payments are correctly attributed to their account. Each of these examples illustrates the importance of the IL 1040 V in managing tax liabilities effectively.

Quick guide on how to complete illinois form il 1040 x v payment voucher for amended

Complete Illinois Form IL 1040 X V Payment Voucher For Amended effortlessly on any device

Online document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without any delays. Manage Illinois Form IL 1040 X V Payment Voucher For Amended on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Illinois Form IL 1040 X V Payment Voucher For Amended without hassle

- Locate Illinois Form IL 1040 X V Payment Voucher For Amended and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require new copies of documents to be printed. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Revise and eSign Illinois Form IL 1040 X V Payment Voucher For Amended and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct illinois form il 1040 x v payment voucher for amended

Create this form in 5 minutes!

How to create an eSignature for the illinois form il 1040 x v payment voucher for amended

The best way to create an eSignature for your PDF online

The best way to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to make an eSignature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

The best way to make an eSignature for a PDF on Android

People also ask

-

What is an Illinois 1040V?

The Illinois 1040V is a payment voucher used by taxpayers in Illinois when making a payment for their individual income tax. It ensures that your payment is properly credited to your tax account. Utilizing the Illinois 1040V can simplify your tax payment process.

-

How can airSlate SignNow help with submitting my Illinois 1040V?

airSlate SignNow provides an easy-to-use platform to eSign and submit your Illinois 1040V electronically. This eliminates the need for printing and mailing forms, making your tax payment process faster and more efficient. Our platform is designed to facilitate smooth and secure transactions.

-

Is there a cost associated with using airSlate SignNow for Illinois 1040V?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our solutions are designed to be cost-effective, ensuring that you get the best value for managing your Illinois 1040V and other document workflows. Explore our plans to find one that fits your requirements.

-

What features does airSlate SignNow offer for managing Illinois 1040V?

airSlate SignNow provides features such as customizable templates, easy document sharing, and secure eSignature capabilities specifically for Illinois 1040V. These tools streamline the process, reduce errors, and help you stay organized during tax season. Transform your tax management experience with our advanced features.

-

Can I integrate airSlate SignNow with other software for my Illinois 1040V?

Absolutely! airSlate SignNow seamlessly integrates with various software applications to enhance your workflow for the Illinois 1040V. This allows you to sync data, automate processes, and improve efficiency across your business operations. Check our integration options to see what works best for you.

-

Is it safe to use airSlate SignNow for my Illinois 1040V submissions?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Illinois 1040V submissions are protected. We use advanced encryption and security protocols to safeguard your sensitive information. Trust our platform to handle your tax documents with the utmost care.

-

Can airSlate SignNow help me track the status of my Illinois 1040V?

Yes, airSlate SignNow includes tools to track the status of your Illinois 1040V submissions, giving you peace of mind. You can easily see when documents are signed and submitted, allowing you to stay up-to-date throughout the tax process. Our tracking features are designed for effortless management.

Get more for Illinois Form IL 1040 X V Payment Voucher For Amended

- Employment certification for public service loan forgiveness form

- Public service loan forgiveness application for forgiveness pdf form

- Certification regarding lobbying ed80 0013 form

- Whereas public housing authority corry housing authoritypa066 herein called the pha hud form

- Hud third party tracer program form

- Race and ethnic data reporting form 2020

- Form hud 52769 62015 ross service coordinators portal hud

- Hud form 52578

Find out other Illinois Form IL 1040 X V Payment Voucher For Amended

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free