IL 1040 V, Payment Voucher for Individual Income Tax 2022

What is the IL 1040 V, Payment Voucher For Individual Income Tax

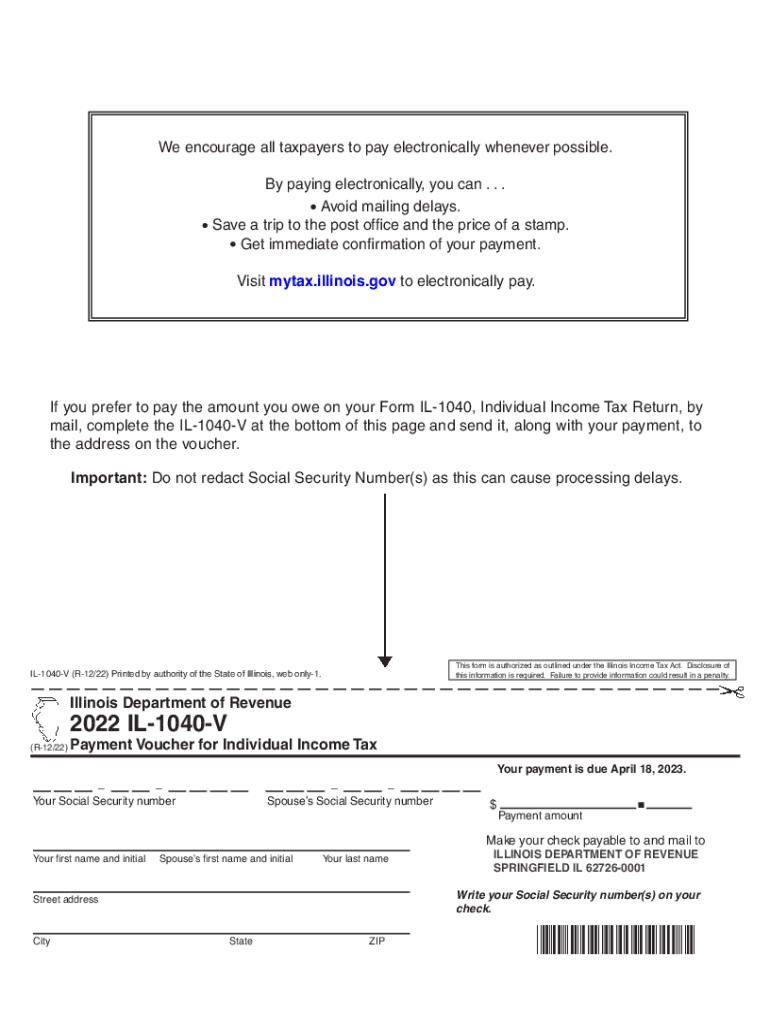

The IL 1040 V is a payment voucher used by individuals in Illinois to submit their state income tax payments. This form is essential for taxpayers who owe taxes when filing their annual income tax returns. The voucher provides a systematic way to ensure that payments are accurately credited to the taxpayer's account with the Illinois Department of Revenue. It is important for individuals to use this form to avoid any discrepancies in their tax payments and to maintain compliance with state tax regulations.

How to use the IL 1040 V, Payment Voucher For Individual Income Tax

Using the IL 1040 V involves a few straightforward steps. First, ensure that you have completed your IL 1040 income tax return. After determining the amount owed, fill out the IL 1040 V with your personal information, including your name, address, and Social Security number. Next, indicate the payment amount on the voucher. Finally, submit the completed voucher along with your payment to the designated address provided on the form. This process helps ensure that your payment is processed correctly and promptly.

Steps to complete the IL 1040 V, Payment Voucher For Individual Income Tax

Completing the IL 1040 V requires careful attention to detail. Follow these steps:

- Gather your IL 1040 income tax return to determine the amount owed.

- Obtain the IL 1040 V form from the Illinois Department of Revenue website or other official sources.

- Fill in your personal details, including your name, address, and Social Security number.

- Clearly state the payment amount you are submitting.

- Sign and date the voucher to validate your payment.

- Mail the voucher along with your payment to the address specified on the form.

Legal use of the IL 1040 V, Payment Voucher For Individual Income Tax

The IL 1040 V serves a legal purpose in the tax payment process. It is recognized by the Illinois Department of Revenue as an official document that confirms the taxpayer's intent to pay their state income tax. For the payment to be legally binding, it must be submitted in accordance with the guidelines set forth by the state. This includes using the correct form, providing accurate information, and ensuring timely submission to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the IL 1040 V align with the annual income tax return deadlines. Typically, individual income tax returns are due on April 15 of each year, unless that date falls on a weekend or holiday. In such cases, the deadline may be extended to the next business day. Taxpayers should ensure that their IL 1040 V payment voucher is submitted by this deadline to avoid late fees and interest on unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

The IL 1040 V can be submitted through various methods. Taxpayers may choose to mail the completed voucher along with their payment to the address specified on the form. Alternatively, some taxpayers may have the option to make payments electronically through the Illinois Department of Revenue's online portal. In-person submissions may also be possible at designated state offices, depending on local regulations and availability.

Quick guide on how to complete 2021 il 1040 v payment voucher for individual income tax

Easily prepare IL 1040 V, Payment Voucher For Individual Income Tax on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, edit, and electronically sign your documents promptly without delays. Manage IL 1040 V, Payment Voucher For Individual Income Tax on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign IL 1040 V, Payment Voucher For Individual Income Tax effortlessly

- Find IL 1040 V, Payment Voucher For Individual Income Tax and click on Get Form to begin.

- Leverage the tools we provide to fill out your form.

- Mark important sections of the documents or redact confidential information with specialized tools that airSlate SignNow offers for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information carefully and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, or errors that require new document copies to be printed. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign IL 1040 V, Payment Voucher For Individual Income Tax and ensure seamless communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 il 1040 v payment voucher for individual income tax

Create this form in 5 minutes!

How to create an eSignature for the 2021 il 1040 v payment voucher for individual income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is il 1040 v and how does it relate to e-signing?

Il 1040 v is a specific form used in tax filing, and e-signing it can simplify the submission process. With airSlate SignNow, you can easily eSign il 1040 v, ensuring that your tax documents are securely signed and submitted on time.

-

How does airSlate SignNow ensure the security of my il 1040 v documents?

AirSlate SignNow employs advanced encryption technologies and follows strict compliance standards to protect your il 1040 v documents. By using our platform, you can confidently eSign and manage sensitive tax forms with peace of mind.

-

What features does airSlate SignNow offer for managing il 1040 v forms?

AirSlate SignNow offers a range of features for managing il 1040 v forms, including templates, bulk sending, and automated reminders. These tools make it easy to organize your tax documents and ensure timely eSignature collection.

-

Can I integrate airSlate SignNow with other software for handling il 1040 v?

Yes, airSlate SignNow integrates seamlessly with various software applications, allowing you to link your workflow for handling il 1040 v. This integration can boost efficiency by synchronizing data across platforms.

-

What are the pricing options for using airSlate SignNow for il 1040 v e-signing?

AirSlate SignNow offers flexible pricing plans that cater to businesses of all sizes for managing il 1040 v e-signing. You can choose the plan that best fits your needs, ensuring that you get the features you require without overspending.

-

How can airSlate SignNow benefit my business when handling il 1040 v?

By using airSlate SignNow for your il 1040 v, your business can streamline the e-signing process, reduce paper usage, and save time on document management. This efficiency can lead to a more productive work environment.

-

Is it easy to eSign an il 1040 v document on airSlate SignNow?

Absolutely! ESigning an il 1040 v on airSlate SignNow is straightforward and user-friendly. The platform's intuitive interface ensures that you can quickly navigate the signing process with minimal hassle.

Get more for IL 1040 V, Payment Voucher For Individual Income Tax

Find out other IL 1040 V, Payment Voucher For Individual Income Tax

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter