Form IL 1040 X Amended Individual Income Tax Return 2023-2026

What is the Form IL 1040 X Amended Individual Income Tax Return

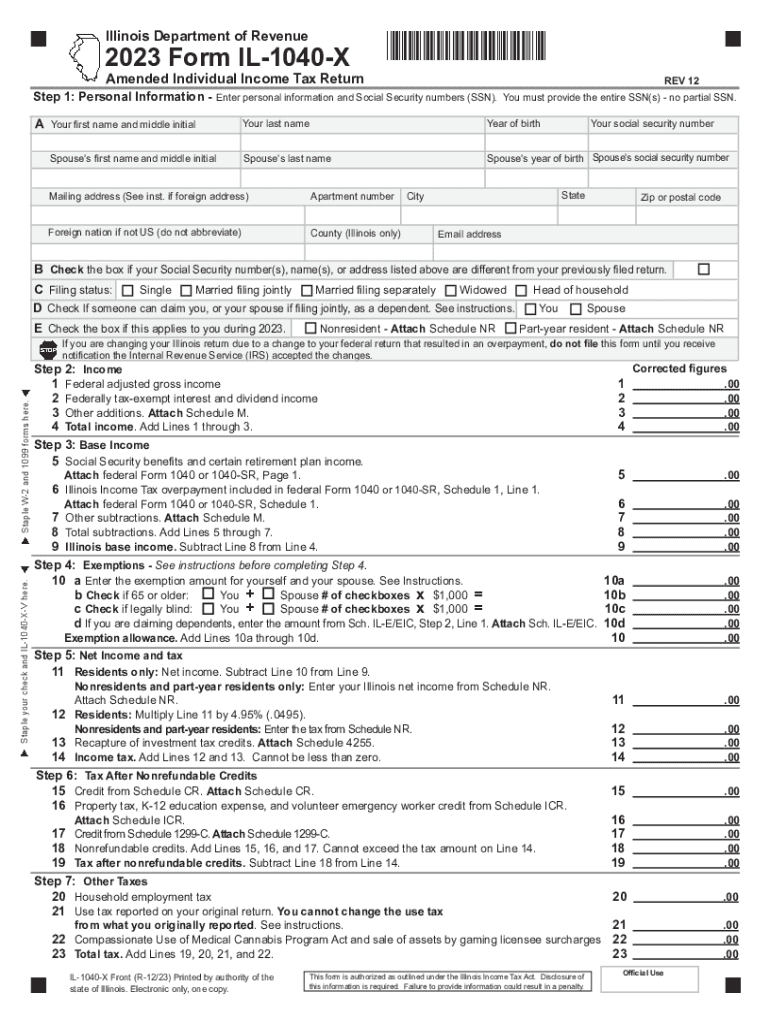

The Form IL 1040 X is used by taxpayers in Illinois to amend their previously filed individual income tax returns. This form allows individuals to correct errors, update information, or claim additional deductions or credits that were not included in the original submission. It is essential for ensuring that tax records are accurate and reflect the taxpayer's true financial situation.

Steps to complete the Form IL 1040 X Amended Individual Income Tax Return

Completing the Form IL 1040 X involves several key steps:

- Obtain a copy of your original Form IL 1040 and the new information you wish to amend.

- Fill out the top section of the form with your personal information, including your name, address, and Social Security number.

- Indicate the tax year you are amending and the reason for the amendment.

- Complete the relevant sections of the form, detailing the changes you are making. Be sure to explain each change clearly.

- Calculate the new tax liability or refund amount based on the amended information.

- Sign and date the form before submitting it.

How to obtain the Form IL 1040 X Amended Individual Income Tax Return

The Form IL 1040 X can be obtained through various methods:

- Visit the Illinois Department of Revenue's website to download a printable version of the form.

- Request a physical copy by contacting the Illinois Department of Revenue directly.

- Access the form through tax preparation software that includes state tax forms.

Filing Deadlines / Important Dates

It is crucial to be aware of the deadlines associated with filing the Form IL 1040 X. Generally, the amended return must be filed within three years from the original due date of the return or within one year from the date you paid the tax, whichever is later. Keeping track of these dates ensures compliance and helps avoid penalties.

Required Documents

When filing the Form IL 1040 X, certain documents may be required to support your amendments:

- A copy of your original Form IL 1040.

- Any supporting documentation for the changes you are making, such as W-2s, 1099s, or receipts for deductions.

- Any correspondence from the Illinois Department of Revenue related to your original return.

Legal use of the Form IL 1040 X Amended Individual Income Tax Return

The Form IL 1040 X must be used in accordance with Illinois tax laws. It is legally binding and should only be used to amend legitimate errors or omissions. Misuse of the form can lead to penalties, including fines and interest on unpaid taxes. It is advisable to consult with a tax professional if you are uncertain about the correct usage of this form.

Quick guide on how to complete form il 1040 x amended individual income tax return

Complete Form IL 1040 X Amended Individual Income Tax Return effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any delays. Handle Form IL 1040 X Amended Individual Income Tax Return on any device with the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to edit and electronically sign Form IL 1040 X Amended Individual Income Tax Return with ease

- Obtain Form IL 1040 X Amended Individual Income Tax Return and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize essential sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Form IL 1040 X Amended Individual Income Tax Return and ensure excellent communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form il 1040 x amended individual income tax return

Create this form in 5 minutes!

How to create an eSignature for the form il 1040 x amended individual income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2019 IL 1040X form and when do I need it?

The 2019 IL 1040X form is used to amend your previously filed Illinois individual income tax return for the year 2019. You need this form if you discover errors or omissions in your original return, such as incorrect income or deductions. Filing an amended return helps ensure that your tax records are accurate and compliant with tax regulations.

-

How can airSlate SignNow assist with the 2019 IL 1040X?

airSlate SignNow simplifies the process of signing and sending your 2019 IL 1040X electronically. With its easy-to-use interface, you can prepare and eSign your amendment in a matter of minutes, ensuring a quick submission to the state. This streamlines your tax filing process and allows for faster handling of your amendments.

-

What are the pricing options for using airSlate SignNow for my 2019 IL 1040X?

AirSlate SignNow offers several pricing plans to accommodate different business needs, starting with a basic plan that is cost-effective for individuals needing to manage their 2019 IL 1040X. Pricing varies based on the features and number of users, so you can choose a plan that fits your requirements. It's a flexible solution that provides value for its ease of use and efficiency.

-

Can I integrate airSlate SignNow with other software for my tax needs?

Yes, airSlate SignNow can integrate with various software tools commonly used for tax preparation and management. This means you can easily use it alongside your accounting software or other financial applications when preparing your 2019 IL 1040X. The integrations enhance your workflow and allow you to manage all your tax documents efficiently.

-

What features does airSlate SignNow provide for signing the 2019 IL 1040X?

AirSlate SignNow offers a range of features designed to facilitate the signing process for documents like the 2019 IL 1040X. This includes customizable templates, secure document storage, and real-time tracking of signatures. These features ensure your amendment is handled safely and efficiently, saving you time and hassle.

-

Is it safe to use airSlate SignNow for my 2019 IL 1040X?

Absolutely! AirSlate SignNow employs industry-leading security measures to ensure your documents, including the 2019 IL 1040X, are protected. With features like data encryption and secure cloud storage, your sensitive information is safeguarded against unauthorized access and bsignNowes.

-

What benefits can I expect from using airSlate SignNow for tax documents like the 2019 IL 1040X?

Using airSlate SignNow for tax documents like the 2019 IL 1040X provides enhanced convenience and efficiency. You can complete the document quickly from anywhere, sign electronically, and reduce the total time spent on paperwork. This not only simplifies the tax filing process but also ensures you stay organized and compliant.

Get more for Form IL 1040 X Amended Individual Income Tax Return

Find out other Form IL 1040 X Amended Individual Income Tax Return

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online