Illinois Form IL 1040 Individual Income Tax Return 2022

What is the Illinois Form IL 1040 Individual Income Tax Return

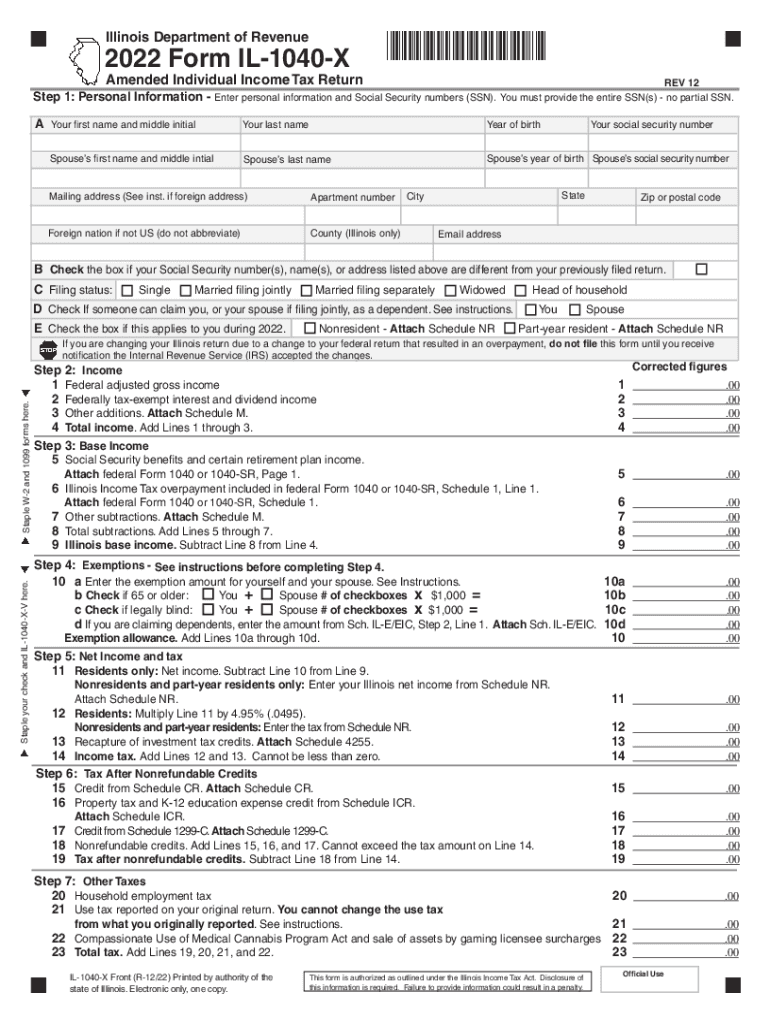

The Illinois Form IL 1040 is the official Individual Income Tax Return used by residents of Illinois to report their income and calculate their state tax liability. This form is essential for individuals who earn income within the state, as it allows them to comply with state tax laws. The form collects information regarding various income sources, deductions, and credits applicable to the taxpayer's situation. Proper completion of the IL 1040 is crucial for accurate tax reporting and compliance with the Illinois Department of Revenue.

Steps to complete the Illinois Form IL 1040 Individual Income Tax Return

Completing the Illinois Form IL 1040 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including W-2s, 1099s, and any other income statements. Next, follow these steps:

- Enter personal information, including name, address, and Social Security number.

- Report total income from all sources, including wages, interest, and dividends.

- Claim any allowable deductions, such as those for education or medical expenses.

- Calculate your tax liability based on the income reported.

- Apply any tax credits for which you qualify.

- Determine whether you owe additional taxes or are entitled to a refund.

After completing the form, review it for accuracy before submission.

How to obtain the Illinois Form IL 1040 Individual Income Tax Return

The Illinois Form IL 1040 can be obtained through several means. Taxpayers can download the form directly from the Illinois Department of Revenue's website. Additionally, physical copies are often available at local libraries, post offices, and tax preparation offices. It is advisable to ensure that you are using the correct version of the form for the tax year you are filing.

Legal use of the Illinois Form IL 1040 Individual Income Tax Return

The Illinois Form IL 1040 is legally binding when completed and submitted according to the state's tax regulations. To ensure its legal validity, taxpayers must provide accurate information and sign the form. E-signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). This legal framework ensures that electronically signed documents hold the same weight as traditional paper signatures.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Illinois Form IL 1040 is critical for compliance. Typically, the deadline for filing is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is also important to note any extensions that may be available for filing, which can provide additional time to submit the form without incurring penalties.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Illinois Form IL 1040. The form can be filed online through the Illinois Department of Revenue's e-filing system, which offers a convenient and efficient way to submit your return. Alternatively, taxpayers may choose to mail their completed forms to the appropriate address provided by the state. In-person submissions are also accepted at designated tax offices, allowing for direct interaction with tax officials if needed.

Quick guide on how to complete illinois form il 1040 individual income tax return

Effortlessly Prepare Illinois Form IL 1040 Individual Income Tax Return on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents quickly and without delays. Manage Illinois Form IL 1040 Individual Income Tax Return on any device using the airSlate SignNow applications for Android or iOS and streamline your document processes today.

How to Edit and eSign Illinois Form IL 1040 Individual Income Tax Return with Ease

- Find Illinois Form IL 1040 Individual Income Tax Return and click Get Form to begin.

- Utilize the provided tools to fill out your document.

- Emphasize important parts of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to send the form, via email, text message (SMS), or shareable link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Illinois Form IL 1040 Individual Income Tax Return and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct illinois form il 1040 individual income tax return

Create this form in 5 minutes!

How to create an eSignature for the illinois form il 1040 individual income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Form IL and how do I use it with airSlate SignNow?

The Illinois Form IL is a specific document used for various state-related purposes. With airSlate SignNow, you can easily upload, eSign, and send the Illinois Form IL securely and efficiently. Our platform simplifies the document management process, ensuring you stay compliant with state requirements.

-

Is airSlate SignNow compatible with Illinois Form IL?

Yes, airSlate SignNow is fully compatible with the Illinois Form IL. You can utilize our platform to eSign and share this form without any complications. Our user-friendly interface ensures that completing the Illinois Form IL is a hassle-free experience.

-

What features does airSlate SignNow offer for managing Illinois Form IL?

airSlate SignNow offers several features tailored for managing the Illinois Form IL, including customizable templates and secure eSignature options. You can track document status in real-time and receive notifications when the form is signed. These features enhance your workflow efficiency and document security.

-

Are there any costs associated with using airSlate SignNow for Illinois Form IL?

airSlate SignNow provides flexible pricing plans that cater to various business needs. Whether you're using it for the Illinois Form IL or other documents, our cost-effective solutions ensure you get the most value. You can choose from several subscription options to find the best fit for your business.

-

How does airSlate SignNow enhance collaboration on Illinois Form IL?

With airSlate SignNow, collaboration on the Illinois Form IL is streamlined and efficient. You can invite team members to review and sign the document in real-time, making it easy to gather multiple signatures. Our platform fosters teamwork and ensures everyone stays informed during the process.

-

Can I integrate airSlate SignNow with other tools for processing Illinois Form IL?

Absolutely! airSlate SignNow offers seamless integrations with various applications to enhance how you manage the Illinois Form IL. You can connect with popular CRMs, cloud storage services, and other tools, ensuring your workflows are seamless and efficient.

-

What are the security measures for signing Illinois Form IL with airSlate SignNow?

Security is a top priority at airSlate SignNow. When signing the Illinois Form IL, our platform uses advanced encryption protocols to protect your data. Additionally, we comply with industry standards to ensure that your documents remain secure during the signing process.

Get more for Illinois Form IL 1040 Individual Income Tax Return

- N9a response pack form

- Ntruhs transcript application form mbbs

- Level 1 antiterrorism awareness training answers form

- Ghost hunting paerwork form

- Lee county alarm permit form

- Drawing contour lines worksheet pdf form

- Patient responsibility for payment form

- Protected b when completed page of treaty annuit form

Find out other Illinois Form IL 1040 Individual Income Tax Return

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT