Il 1040 2016

What is the IL 1040?

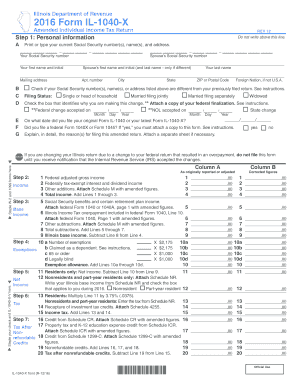

The IL 1040 is the individual income tax return form used by residents of Illinois to report their income and calculate their state tax obligations. This form is essential for ensuring compliance with state tax laws and is typically filed annually. Taxpayers must disclose various sources of income, deductions, and credits applicable to their financial situation. Understanding the IL 1040 is crucial for accurate tax reporting and timely submission.

How to Use the IL 1040

To use the IL 1040 effectively, taxpayers should first gather all necessary documents, including W-2 forms, 1099s, and other income statements. Next, individuals should carefully fill out the form, providing accurate information regarding income, deductions, and credits. After completing the form, taxpayers can sign it electronically using a secure eSignature platform, ensuring compliance with state regulations. Finally, submit the completed IL 1040 either online or by mail, adhering to the filing deadlines.

Steps to Complete the IL 1040

Completing the IL 1040 involves several key steps:

- Gather all relevant income documents, such as W-2s and 1099s.

- Fill out personal information, including name, address, and Social Security number.

- Report all sources of income in the designated sections of the form.

- Claim allowable deductions and credits to reduce taxable income.

- Calculate the total tax owed or refund due based on the provided information.

- Sign the form electronically or manually, ensuring all information is accurate.

- Submit the form by the designated deadline, either online or via postal mail.

Filing Deadlines / Important Dates

Filing deadlines for the IL 1040 are typically aligned with federal tax deadlines. Generally, the deadline for filing individual income tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions that may apply, as well as specific dates for making estimated tax payments throughout the year.

Required Documents

When preparing to complete the IL 1040, taxpayers must gather several key documents, including:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of additional income, such as interest or dividends.

- Documentation for any deductions or credits, such as receipts for charitable contributions.

- Previous tax returns for reference, if needed.

Legal Use of the IL 1040

The IL 1040 must be used in accordance with Illinois tax laws. Taxpayers are legally obligated to report their income accurately and to pay any taxes owed. Failure to comply with these regulations can result in penalties or legal repercussions. Utilizing an eSignature solution can facilitate the legal submission of the form, ensuring that all signatures are valid and compliant with state requirements.

Quick guide on how to complete illinois 1040 2016 form

Your assistance manual on how to prepare your Il 1040

If you’re curious about how to finalize and dispatch your Il 1040, here are some brief instructions on making tax submission less challenging.

To begin, you only need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow offers a highly intuitive and robust document solution that enables you to edit, draft, and complete your tax documents effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures, and revisit to modify responses as necessary. Simplify your tax oversight with advanced PDF editing, eSigning, and seamless sharing.

Follow the instructions below to complete your Il 1040 within a few moments:

- Create your account and start working on PDFs in no time.

- Utilize our directory to find any IRS tax form; peruse through variations and schedules.

- Click Get form to access your Il 1040 in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Use the Sign Tool to affix your legally-binding eSignature (if necessary).

- Examine your document and correct any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that filing on paper can lead to increased errors and delayed refunds. As always, before e-filing your taxes, consult the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct illinois 1040 2016 form

FAQs

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

How do you fill out line 5 on a 1040EZ tax form?

I suspect the question is related to knowing whether someone can claim you as a dependent, because otherwise line 5 itself is pretty clear.General answer: if you are under 19, or a full-time student under the age of 24, your parents can probably claim you as a dependent. If you are living with someone to whom you are not married and who is providing you with more than half of your support, that person can probably claim you as a dependent. If you are married and filing jointly, your spouse needs to answer the same questions.Note that whether those individuals actually do claim you as a dependent doesn't matter; the question is whether they can. It is not a choice.

-

How can I fill up my own 1040 tax forms?

The 1040 Instructions will provide step-by-step instructions on how to prepare the 1040. IRS Publication 17 is also an important resource to use while preparing your 1040 return. You can prepare it online through the IRS website or through a software program. You can also prepare it by hand and mail it in, or you can see a professional tax preparer to assist you with preparing and filing your return.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

How do I understand the 1040 U.S. tax form in terms of an equation instead of a ton of boxes to fill in and instructions to read?

First the 1040 is an exercise in sets:Gross Income - A collection and summation of all your income types.Adjustments - A collection of deductions the tax law allow you to deduct before signNowing AGI. (AGI is used as a threshold for another set of deductions).ExemptionsDeductions - A collection of allowed deductions.Taxes - A Collection of Different collected along with Income TaxesCredits - A collection of allowed reductions in tax owed.Net Tax Owed or Refundable - Hopefully Self Explanatory.Now the formulas:[math]Gross Income - Adjustments = Adjusted Gross Income (AGI)[/math][math]AGI - Exemptions - Deductions = Taxable Income[/math][math]Tax Function (Taxable Income ) = Income Tax[/math][math]Taxes - Credits = Net Tax Owed or Refundable[/math]Please Note each set of lines is meant as a means to make collecting and summing the subsidiary information easier.It would probably be much easier to figure out if everyone wanted to pay more taxes instead of less.

-

Can I file a claim with TurboTax for filing the wrong form for me? Instead of filling the 1040NR form in 2015 and 2016, TurboTax filled 1040 for me instead. Now I need to file for an amendment, which will cost $1200.

Sure you can. Pretty much any one can sue for anything. You have a snowballs chance in hell of winning though. Go back and read the disclaimer-terms of use that you just accepted without reading on installing it.You’ll notice that they bear NO responsibility for incorrect taxes.Besides it was your failure to pick the correct product. Turbo tax does not and has NEVER produced a 1040NR product.As my old Computer Science professors used to say. GIGO - Garbage In Garbage Out.

Create this form in 5 minutes!

How to create an eSignature for the illinois 1040 2016 form

How to create an eSignature for your Illinois 1040 2016 Form in the online mode

How to create an electronic signature for the Illinois 1040 2016 Form in Chrome

How to create an electronic signature for putting it on the Illinois 1040 2016 Form in Gmail

How to make an eSignature for the Illinois 1040 2016 Form straight from your smart phone

How to create an electronic signature for the Illinois 1040 2016 Form on iOS devices

How to create an eSignature for the Illinois 1040 2016 Form on Android devices

People also ask

-

What is Il 1040 and how does it relate to eSigning documents?

Il 1040 refers to the U.S. federal tax return form that individuals use to file their income taxes. With airSlate SignNow, you can easily eSign your Il 1040 documents, ensuring a secure and efficient submission process. Our platform simplifies the eSigning of important forms like Il 1040, making tax season less stressful.

-

How can airSlate SignNow help me with my Il 1040 tax form?

airSlate SignNow provides a streamlined way to fill out and eSign your Il 1040 tax form. You can upload your document, add necessary fields, and send it for eSignature, all within a few clicks. This helps you manage your tax filings effortlessly and ensures that your Il 1040 is submitted on time.

-

What are the pricing options for using airSlate SignNow for Il 1040 eSigning?

AirSlate SignNow offers flexible pricing plans that cater to different business needs, starting from a free trial. This allows you to explore our features suited for eSigning Il 1040 and other documents without any initial investment. Choose a plan that best fits your requirements for eSigning Il 1040 forms and other documents.

-

Is airSlate SignNow secure for signing sensitive documents like Il 1040?

Yes, airSlate SignNow is highly secure and compliant with industry standards for eSigning sensitive documents like Il 1040. We utilize advanced encryption and authentication methods to protect your data, ensuring that your Il 1040 remains confidential and secure during the signing process.

-

Can I integrate airSlate SignNow with other software to manage my Il 1040 documents?

Absolutely! airSlate SignNow integrates seamlessly with popular applications such as Google Drive, Dropbox, and CRMs, allowing you to manage your Il 1040 documents efficiently. These integrations enhance your workflow, making it easier to access and eSign your Il 1040 forms within your preferred software environment.

-

What features does airSlate SignNow offer for managing Il 1040 eSignatures?

airSlate SignNow offers a range of features specifically designed for managing eSignatures on Il 1040 forms, including customizable templates, automated workflows, and real-time tracking. These features help you streamline the eSigning process, ensuring that all parties can sign the Il 1040 quickly and efficiently.

-

How does airSlate SignNow ensure compliance for Il 1040 eSignatures?

airSlate SignNow complies with eSignature laws such as ESIGN and UETA, ensuring that your Il 1040 eSignatures are legally binding. Our platform provides an audit trail and timestamps for each signature, which are crucial for maintaining compliance when filing your Il 1040 tax documents.

Get more for Il 1040

- Kayak rental agreement template form

- Dance audition form template 5593339

- Divemaster candidate information and evaluation form 58685282

- Imgurl pid 3 1 form

- Mv3592 form

- Fce reg 01 application to fell growing trees forestry gov form

- Host home provider application bridges of colorado form

- Application for 60d cila support services dhs state il form

Find out other Il 1040

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online