Accessibility Issues of Checkboxes and Radio Buttons Jukka K 2021

IRS Guidelines

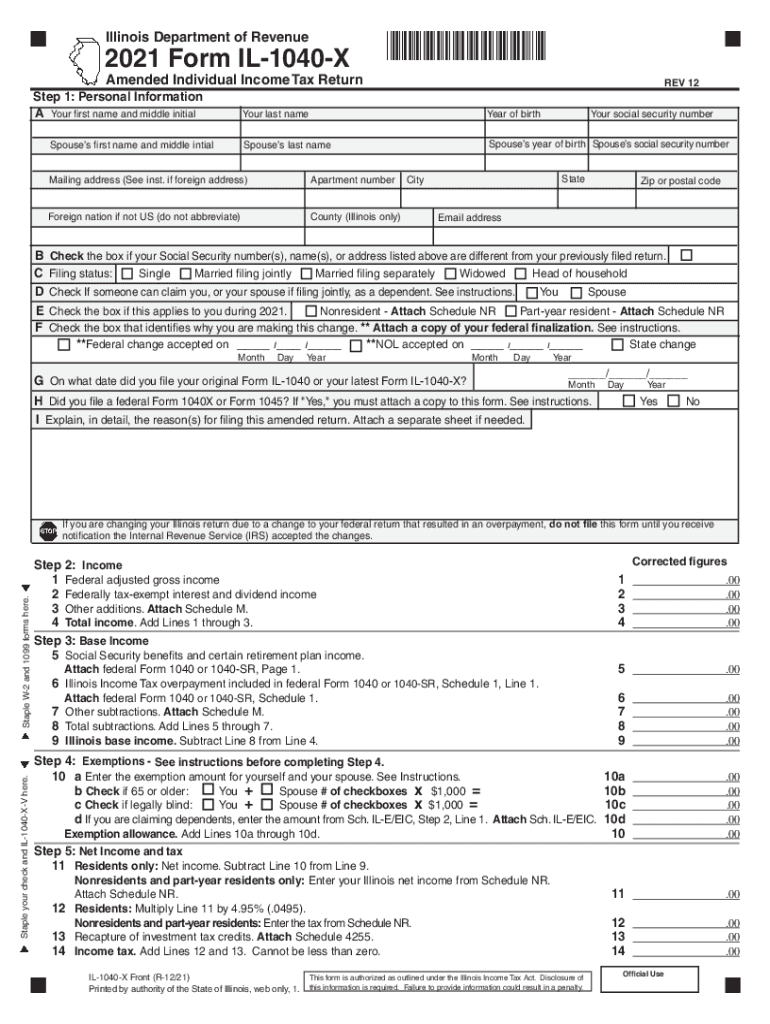

The il 1040 form is a crucial document for individual income tax filing in Illinois. It is essential to adhere to the guidelines set forth by the IRS to ensure compliance and accuracy. The form must be filled out with precise information regarding income, deductions, and credits. Taxpayers should refer to the IRS instructions for the 1040 form to understand the specific requirements for reporting income and claiming deductions. This ensures that all necessary information is included and reduces the risk of errors that could lead to penalties.

Filing Deadlines / Important Dates

Filing deadlines for the il 1040 are typically aligned with federal tax deadlines. For most taxpayers, the deadline to file is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important for taxpayers to be aware of any changes to these dates, as well as any extensions that may apply. Keeping track of these deadlines helps avoid late fees and penalties.

Required Documents

When preparing to file the illinois 1040, certain documents are necessary to ensure accurate reporting. Taxpayers should gather:

- W-2 forms from employers

- 1099 forms for additional income

- Documentation for deductions, such as mortgage interest statements

- Records of any tax credits claimed

- Social Security numbers for dependents

Having these documents ready can streamline the filing process and help ensure that all relevant information is included.

Form Submission Methods (Online / Mail / In-Person)

The il 1040 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers choose to file electronically using tax software. This method is often faster and allows for quicker processing.

- Mail Submission: Taxpayers can also print the completed form and mail it to the appropriate address. It is advisable to use certified mail for tracking purposes.

- In-Person Submission: Some individuals may prefer to file in person at designated tax offices, where assistance is available.

Each method has its own advantages, and taxpayers should select the one that best suits their needs.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the il 1040 can result in significant penalties. Common penalties include:

- Late Filing Penalty: Taxpayers who do not file by the deadline may incur a penalty, which increases the longer the return is overdue.

- Late Payment Penalty: If taxes owed are not paid by the due date, additional penalties and interest may accrue.

- Accuracy-Related Penalties: Errors or omissions on the form can lead to penalties based on the amount of tax understated.

Understanding these penalties emphasizes the importance of timely and accurate filing.

Eligibility Criteria

To file the illinois 1040, taxpayers must meet specific eligibility criteria. Generally, individuals must:

- Be residents of Illinois for the tax year

- Have a certain level of income that meets the filing threshold

- Provide accurate information regarding dependents and tax credits

Meeting these criteria is essential for a valid tax return and to avoid complications with the state tax authority.

Quick guide on how to complete accessibility issues of checkboxes and radio buttons jukka k

Effortlessly prepare Accessibility Issues Of Checkboxes And Radio Buttons Jukka K on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the necessary form and securely retain it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without any hold-ups. Manage Accessibility Issues Of Checkboxes And Radio Buttons Jukka K on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign Accessibility Issues Of Checkboxes And Radio Buttons Jukka K with ease

- Locate Accessibility Issues Of Checkboxes And Radio Buttons Jukka K and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Don't worry about lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Accessibility Issues Of Checkboxes And Radio Buttons Jukka K and ensure clear communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct accessibility issues of checkboxes and radio buttons jukka k

Create this form in 5 minutes!

How to create an eSignature for the accessibility issues of checkboxes and radio buttons jukka k

The way to generate an electronic signature for your PDF document in the online mode

The way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is il 1040 and why is it important?

The il 1040 is a standard tax form used for individual income tax returns in the United States. Understanding how to properly fill out the il 1040 is crucial as it ensures compliance with tax laws and helps avoid potential penalties or audits. Accurate filing can also maximize your tax refund or minimize your tax liability.

-

How can airSlate SignNow simplify the il 1040 signing process?

airSlate SignNow streamlines the signing process for the il 1040 by allowing users to send, receive, and eSign documents electronically. This eliminates the need for printing and mailing physical copies, saving time and enhancing efficiency. With our user-friendly interface, you can ensure that your il 1040 is signed promptly and securely.

-

Is airSlate SignNow cost-effective for handling il 1040 forms?

Yes, airSlate SignNow is a cost-effective solution for managing your il 1040 forms. With various pricing plans tailored to different user needs, you will find options that fit your budget while still accessing powerful features. Our platform helps reduce administrative costs associated with printing and mailing documents.

-

What features does airSlate SignNow offer for il 1040 management?

airSlate SignNow provides features such as document editing, templates for il 1040 forms, and the ability to track the signing status. Additionally, users can integrate their existing systems for seamless workflows. These features ensure that handling il 1040 forms is not only efficient but also easy to manage.

-

Can airSlate SignNow integrate with other tools for processing il 1040?

Absolutely! airSlate SignNow integrates with a variety of popular business tools and software, making it easier to process the il 1040 within your existing workflows. This integration capability allows for smooth data transfer and enhances collaboration with teams during tax preparation seasons.

-

What benefits does airSlate SignNow provide when handling il 1040 documents?

Using airSlate SignNow for your il 1040 documents offers numerous benefits such as enhanced security, faster turnaround times, and improved organization. The platform ensures that your sensitive financial information is protected through advanced encryption methods. Enjoy the convenience of accessing and signing your documents anytime, anywhere.

-

How secure is the airSlate SignNow platform for submitting il 1040 forms?

The airSlate SignNow platform prioritizes security, employing industry-standard encryption to protect your il 1040 forms. We ensure compliance with various data protection regulations, providing users with peace of mind when submitting their sensitive tax information. Your documents are safe from unauthorized access throughout the signing process.

Get more for Accessibility Issues Of Checkboxes And Radio Buttons Jukka K

- Plumbing contractor package minnesota form

- Brick mason contractor package minnesota form

- Roofing contractor package minnesota form

- Electrical contractor package minnesota form

- Sheetrock drywall contractor package minnesota form

- Flooring contractor package minnesota form

- Trim carpentry contractor package minnesota form

- Fencing contractor package minnesota form

Find out other Accessibility Issues Of Checkboxes And Radio Buttons Jukka K

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile